QUOTE(David83 @ Nov 19 2014, 07:29 AM)

up, up , up too fast and too high in too short a time?

fi,...last 1 month

GTF down slower and abit lesser than GEY

GTF up faster and higher than GEY

now my GTF is + 1.8, GEY is still - 1%

Fundsupermart.com v7, DIY unit trust investing

|

|

Nov 19 2014, 08:42 AM Nov 19 2014, 08:42 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(David83 @ Nov 19 2014, 07:29 AM) up, up , up too fast and too high in too short a time? fi,...last 1 month GTF down slower and abit lesser than GEY GTF up faster and higher than GEY now my GTF is + 1.8, GEY is still - 1% |

|

|

|

|

|

Nov 19 2014, 08:46 AM Nov 19 2014, 08:46 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(yklooi @ Nov 19 2014, 08:42 AM) up, up , up too fast and too high in too short a time? fi,...last 1 month GTF down slower and abit lesser than GEY GTF up faster and higher than GEY now my GTF is + 1.8, GEY is still - 1% CIMB GTF is being dragged down by Eurozone since it has 1/3 allocation there. |

|

|

Nov 19 2014, 09:59 AM Nov 19 2014, 09:59 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(yklooi @ Nov 19 2014, 08:42 AM) up, up , up too fast and too high in too short a time? fi,...last 1 month GTF down slower and abit lesser than GEY GTF up faster and higher than GEY now my GTF is + 1.8, GEY is still - 1% |

|

|

Nov 19 2014, 10:00 AM Nov 19 2014, 10:00 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Nov 19 2014, 10:10 AM Nov 19 2014, 10:10 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Nov 19 2014, 11:30 AM Nov 19 2014, 11:30 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(dasecret @ Nov 19 2014, 09:59 AM) Kan I already named GEY as the 'useless fund'? But okla, no complaints, I finally recouped my losses and sold currently my "worst" performer of about 6 months at YTD is RHBOSK emerging opportunity fund at - 2.9%, but this is just less than 10% of my portfolio allocation...which means it just affected - 0.29% of my portfolio. This post has been edited by yklooi: Nov 19 2014, 11:43 AM |

|

|

|

|

|

Nov 19 2014, 12:13 PM Nov 19 2014, 12:13 PM

Show posts by this member only | IPv6 | Post

#1627

|

Senior Member

808 posts Joined: Apr 2009 |

|

|

|

Nov 19 2014, 12:31 PM Nov 19 2014, 12:31 PM

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Nov 19 2014, 12:35 PM Nov 19 2014, 12:35 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

My Global Titans IRR >10%

|

|

|

Nov 19 2014, 01:14 PM Nov 19 2014, 01:14 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

Nov 19 2014, 01:17 PM Nov 19 2014, 01:17 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Nov 19 2014, 02:57 PM Nov 19 2014, 02:57 PM

Show posts by this member only | IPv6 | Post

#1632

|

Junior Member

567 posts Joined: Mar 2011 |

no action todeiii

|

|

|

Nov 19 2014, 08:27 PM Nov 19 2014, 08:27 PM

|

Junior Member

38 posts Joined: May 2009 |

QUOTE(Pink Spider @ Nov 17 2014, 10:47 AM) Those so-called "experts" like to say things like No pain no gain. now i know "The market WILL collapse" Of course market will experience crashes every now and then But... WHEN? HOW MUCH? 10 year bull run, followed by a crash? Then they will say, "see? I told u so!" But u already made $$$$$$$$$$$$$$ during the 10 years HAD u remain invested. Listen to them and park in cash? Good luck |

|

|

|

|

|

Nov 20 2014, 11:59 AM Nov 20 2014, 11:59 AM

|

Senior Member

1,007 posts Joined: Oct 2006 From: island up north |

QUOTE(yklooi @ Nov 19 2014, 11:30 AM) currently my "worst" performer of about 6 months at YTD is RHBOSK emerging opportunity fund at - 2.9%, but this is just less than 10% of my portfolio allocation...which means it just affected - 0.29% of my portfolio. My RHB emerging opportunity is 11 months old and ROI only 1.76% as of 11/17 NAV price. It is 14% of my FSM portfolio but only 1% of my entire investment portfolio |

|

|

Nov 20 2014, 02:05 PM Nov 20 2014, 02:05 PM

|

All Stars

18,413 posts Joined: Oct 2010 |

This article is saying "what is most important for building wealth is not ‘timing’ the market but rather ‘time in’ the market" and average investors' return is slightly better than the inflation. What is your take on this?

http://www.businessinsider.my/investors-mi...0/#.VG1_zfmUcsA |

|

|

Nov 20 2014, 02:24 PM Nov 20 2014, 02:24 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

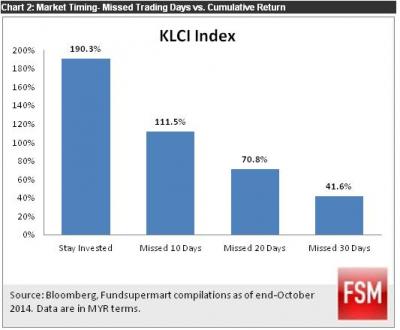

Can You Time The Market?......November 18, 2009

When the market has moved to high levels, predicting its future direction is tricky. Investors are often tempted to time the market - whether it will have further upside or will it consolidate. However, is this the best strategy?....Author : IFAST Research Team * a study of historical returns for the S&P 500 between 1928 and 2009 to test the benefits and detriments of timing the market * Avoiding the ten worst months resulted in an annualised 8.3% return, versus the annualised 5.1% return for remaining invested from 1928 to 2009 * Excluding the ten worst days of performance in eighty-two years, annualised return improved to 6.6% * On the other hand, missing out on the ten best months and ten best days gave annualised returns of 2.5% and 3.7% respectively * Monthly returns were concentrated between -5% and 5% for a majority of the time * The results suggest that market timing can be a risky strategy which may severely impact returns, if one misses out on the best days or months of market performance http://www.fundsupermart.com.my/main/resea...l?articleNo=431 As an example, if investors remained invested in Malaysian market (represented by the KLCI Index) continuously over the last decade, they would have been able to enjoy a cumulative return of 190.3% throughout the 10-year period (Chart 2). However, that may not have been the case if investors performed market timing, and instead of avoiding the worst periods of stock market performance, actually missed out on some of the best periods instead. Over the 10 years, there were approximately 2400 trading days and if investors happened to miss out on just the 10 best trading days (not even 1% of the total trading days), their cumulative returns dropped significantly to 111.5%, about 60% of the return that they would get in the case of staying invested. http://www.fundsupermart.com.my/main/resea...?articleNo=5212 This post has been edited by yklooi: Nov 20 2014, 03:01 PM Attached thumbnail(s)

|

|

|

Nov 20 2014, 03:18 PM Nov 20 2014, 03:18 PM

|

Senior Member

1,007 posts Joined: Oct 2006 From: island up north |

QUOTE(MGM @ Nov 20 2014, 02:05 PM) This article is saying "what is most important for building wealth is not ‘timing’ the market but rather ‘time in’ the market" and average investors' return is slightly better than the inflation. What is your take on this? I believe, very true and I don't have much time left http://www.businessinsider.my/investors-mi...0/#.VG1_zfmUcsA |

|

|

Nov 21 2014, 07:37 AM Nov 21 2014, 07:37 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

S&P500 inches higher to another record at 2052:

U.S. stocks rose to a record, led by energy and small-cap shares, as data showing improvements in the American economy overshadowed concern over weaker growth overseas. URL: http://www.bloomberg.com/news/2014-11-20/u...bal-growth.html |

|

|

Nov 21 2014, 09:19 AM Nov 21 2014, 09:19 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

Those who shied away from US equities becos of the "topping" indices gonna knock wall

Luckily I managed to buy CIMB Global Titans in time before recent spike |

|

|

Nov 21 2014, 09:43 AM Nov 21 2014, 09:43 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(Pink Spider @ Nov 21 2014, 09:19 AM) Those who shied away from US equities becos of the "topping" indices gonna knock wall CIMB GTF cannot really rip the total benefits as it has around 30% allocation in US.Luckily I managed to buy CIMB Global Titans in time before recent spike Unless you have RHB-OSK-GS US Equity Fund. My ROI is 9.23% |

|

Topic ClosedOptions

|

| Change to: |  0.0358sec 0.0358sec

0.45 0.45

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 07:43 AM |