Summary of RHB Full Flexi Account from ExperienceYou can open either current account or savings account, it doesn't matter. The main purpose of the account is to allow redraw facility (Principle Pre-payment) from your loan account into this account.

You can opt for accounts which doesn't require ANY monthly/annual fees (RM 0), however there're are limitations such as limited debit card ATM withdrawals etc.

I choose this option as I use other banks to withdraw money from ATM, so I can avoid any fees.

There are 2 payment types:

1. Regular / Advance Payment - Your monthly repayment amount

2. Principle Prepayment - Extra payment that you wish to pay to offset interest (Only in multiples of RM1000)

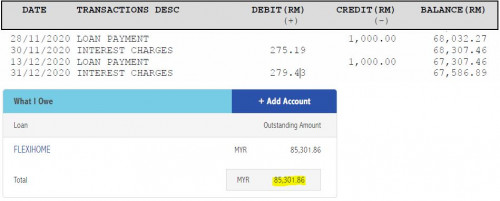

Don't worry about the multiples of RM1000 limit set by RHB bank, as this is just useless. Why do I say so? Initially, I tried doing extra payment using principle payment (RM 50,000) and the additional prepayment also reflected in the redraw bucket. (Available to redraw: RM50,000). The interest also reduced for this effect. I compare my loan outstanding with before additional prepayment and after additional prepayment. I also confirmed with RHB officer that the interest amount is calculated daily at 12:00am.

Here comes the funny part, after the additional prepayment, my monthly repayment was reduced to reflect the additional prepayment. (Say initially I need to pay RM 2000 monthly, now it is RM 1725). As it is a odd number, I decided to do my monthly payment in RM 1800 every month. (Doesn't matter from RHB current account or other banks). Surprisingly, the additional RM 75 (RM 1800-RM1725) is also reflected in the redraw bucket! From this I conclude that RHB only take your monthly payment amount and additional always put back into your redraw bucket to offset the interest. Now, whether this RM 75 does offset the interest I'm not sure because it's too small of a amount for me to notice the difference.

Hope this helps

Nov 18 2020, 02:31 PM

Nov 18 2020, 02:31 PM

Quote

Quote

0.0330sec

0.0330sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled