Safe cheque

Guidelines for writing the cheques the right way:

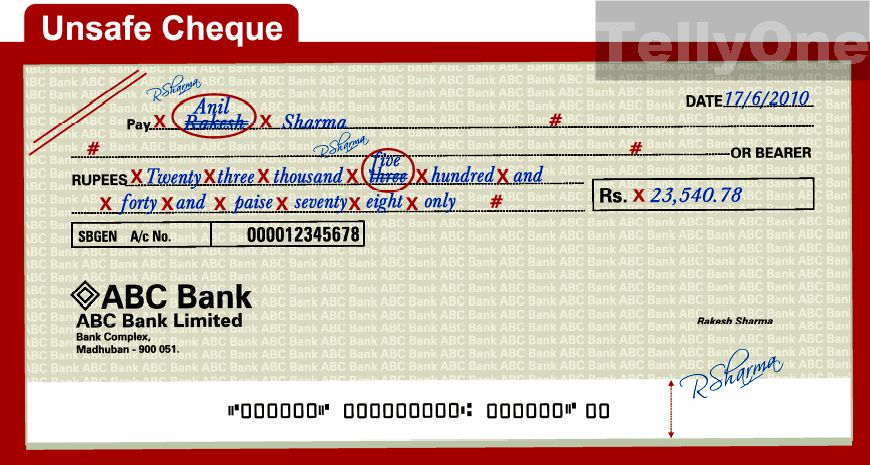

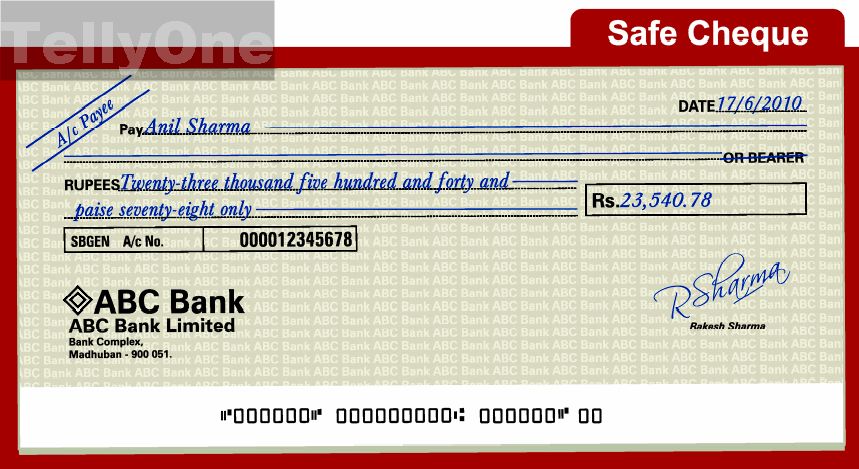

1.Do not leave extra spaces between words or figures

2. Avoid making alterations. Instead write a new cheque.

3. Remember to cross your cheque whenever applicable.

4. Always draw a line through any unused space.

5. Do not write/sign/mark/pin/staple/paste/fold/ on this band

6. Cancel bearer if u don't intended finders of the cheque to cash in.

Different types of cheques based on methods of issuing.

Open cheque or bearer cheque: The issuer of the cheque would just fill the name of the person to whom the cheque is issued, writes the amount and attaches his signature and nothing else. This type of issuing a cheque is also called bearer type cheque also known as open cheque or uncrossed cheque. The cheque is negotiable from the date of issue to three months. The issued cheque turns stale after the completion of three months. It has to be revalidated before presenting to the bank.

A crossed cheque or an account payee cheque: It is written in the same as that of bearer cheque but issuer specifically specifies it as account payee on the left hand top corner or simply crosses it twice with two parallel lines on the right hand top corner. The bearer of the cheque presenting it to the bank should have an account in the branch to which the written sum is deposited. It is safest type of cheques.

A self cheque: A self cheque is written by the account holder as pay self to receive the money in the physical form from the branch where he holds his account.

Pay yourself cheque: The account holder issues this type of crossed cheque to the bank asking the bank deduct money from his account into bank’s own account for the purpose buying banking products like drafts, pay orders, fixed deposit receipts or for depositing money into other accounts held by him like recurring deposits and loan accounts.

Post dated cheque (PDC): A PDC is a form of a crossed or account payee bearer cheque but post dated to meet the said financial obligation at a future date.

Various types of cheques based on their functionality

Local Cheque: A local cheque is a type of cheque which is valid in the given city and a given branch in which the issuer has an account and to which it is connected. The producer of the cheque in whose name it is issued can directly go to the designated bank and receive the money in the physical form. If a given city’s local cheque is presented elsewhere shall attract some fixed banking charges. Although these type of cheques are still prevalent, especially with nationalised banks, it is slowly slated to be removed with at par cheque type.

At par cheque: With the computerisation and networking of bank branches with its headquarters, a variation to the local cheque has become common place in the name of at par cheque. At par cheque is a cheque which is accepted at par at all its branches across the country. Unlike local cheque it can be present across the country without attracting additional banking charges.

Banker’s cheque: It is a kind of cheque issued by the bank itself connected to its own funds. It is a kind of assurance given by the issuer to the client to alley your fears. The personal account connected cheques may bounce for want of funds in his account. To avoid such hurdles, sometimes, the receiver seeks banker’s cheque.

Travelers’ cheques: They are a kind of an open type bearer cheque issued by the bank which can be used by the user for withdrawal of money while touring. It is equivalent to carrying cash but in a safe form without fear of losing it.

Gift cheque: This is another banking instrument introduced for gifting money to the loved ones instead of hard cash.

http://readanddigest.com/what-are-the-diff...pes-of-cheques/

This post has been edited by bananajoe: Jun 11 2014, 02:10 AM

Jun 11 2014, 02:05 AM, updated 12y ago

Jun 11 2014, 02:05 AM, updated 12y ago

Quote

Quote

0.0174sec

0.0174sec

0.77

0.77

5 queries

5 queries

GZIP Disabled

GZIP Disabled