QUOTE(wil-i-am @ Aug 22 2014, 03:52 PM)

QUOTE(davinz18 @ Aug 22 2014, 03:59 PM)

NG as OPR not going to change in Sept.Fixed Deposit Rates in Malaysia V6.1, Please Read Post #1

|

|

Aug 22 2014, 04:05 PM Aug 22 2014, 04:05 PM

|

Senior Member

895 posts Joined: Dec 2013 |

|

|

|

|

|

|

Aug 22 2014, 04:31 PM Aug 22 2014, 04:31 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(BoomChaCha @ Aug 21 2014, 11:44 PM) You are not worried that no more MBSB and no more 4.7% rate if MBSB merge with CIMB before Dec ? QUOTE(BoomChaCha @ Aug 21 2014, 11:44 PM) The contents inside BR hamper are mostly cheap junk food; I do not know it is worth the time and energy to pick-up the hamper or not..? Also, Ah Cha Cha (new name ?), please post more of your posts lah ! This post has been edited by bbgoat: Aug 22 2014, 04:32 PM |

|

|

Aug 22 2014, 04:35 PM Aug 22 2014, 04:35 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

|

|

|

Aug 22 2014, 04:43 PM Aug 22 2014, 04:43 PM

|

Senior Member

7,142 posts Joined: Oct 2008 From: Sin City |

|

|

|

Aug 22 2014, 05:38 PM Aug 22 2014, 05:38 PM

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

Aug 22 2014, 06:01 PM Aug 22 2014, 06:01 PM

|

|

Staff

2,797 posts Joined: Nov 2007 From: On the beach |

|

|

|

|

|

|

Aug 22 2014, 09:00 PM Aug 22 2014, 09:00 PM

|

All Stars

11,954 posts Joined: May 2007 |

bank rakyat so sucks max only 5k online transfer to maybank

|

|

|

Aug 22 2014, 11:16 PM Aug 22 2014, 11:16 PM

|

Senior Member

1,624 posts Joined: Apr 2011 |

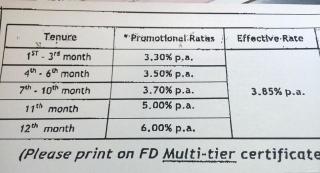

QUOTE(BoomChaCha @ Aug 21 2014, 11:45 PM) Best 1 Month (1) Affin 3.25% - by michaelho (2) CIMB 3.25% - by michaelho (3) Mach 3.15% Mach FD Rates https://www.machbyhongleongbank.com/mach-fixed-deposit Best 3 Months Best 12 Months (1) OCBC Islamic 3.9%, pure FD, valid until 15 Sept or 30 Nov? – by gsc & munkeyflo (2) RHB conventional RHB Islamic 3.88% pure FD – by gsc (3) May Bank 3.85%, promo is tiered rate. Minimum 10k. One cheque one receipt - by munkeyflo [attachmentid=4103593] (4) Affin 4.10%, additional 20% fund in CASA, effective rate up to 3.85%, valid until 31 Dec 2014 (5) RHB (3.48+3.68 + 3.88 + 4.08)/4 = 3.78% with 5% FD in CASA – by gsc (6) Mach 3.6% - by FDInvestor |

|

|

Aug 22 2014, 11:41 PM Aug 22 2014, 11:41 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(munkeyflo @ Aug 22 2014, 08:39 AM) Cool... QUOTE(bbgoat @ Aug 22 2014, 04:31 PM) You are not worried that no more MBSB and no more 4.7% rate if MBSB merge with CIMB before Dec ? Of course I am worried if 4.7% is suddenly no more available.. But I have another issue, I need to take my blood test first then to decide whether if I can last for another 5 more years or not.. And I really want to wait and see the outcome in next 2 Bank Negara meetings QUOTE(bbgoat @ Aug 22 2014, 04:31 PM) Yes, not worth the effort. I only do it on the way going to that location. Ah Cha Cha is okay lah.. as long as don't call me Ah Pek or Ah Beng..Also, Ah Cha Cha (new name ?), please post more of your posts lah ! Quite hate the kids call me Ah Pek but I cannot scold them wor.. QUOTE(bbgoat @ Aug 22 2014, 04:35 PM) Hu.. Newspapers says maybe effective from this Nov, income more than RM 5K will not get petrol subsidized by our government.. |

|

|

Aug 22 2014, 11:53 PM Aug 22 2014, 11:53 PM

|

Senior Member

1,035 posts Joined: May 2010 |

QUOTE(BoomChaCha @ Aug 21 2014, 11:44 PM) Why suddenly will go up in Nov? Even until now, the 4.70% does not advance at all QUOTE(BoomChaCha @ Aug 21 2014, 11:44 PM) Errr...you QUOTE(BoomChaCha @ Aug 22 2014, 01:32 AM) Tomorrow I will make an excuse to deposit RM 200 in my Affin SA, Please post a detailed report of your family adventure as mentioned above and I will pretend to discover this open house accidentally; of course I will ask my whole family to go; otherwise cannot justify my petrol cost, time and energy. I think the best time to go is 12.05pm |

|

|

Aug 22 2014, 11:55 PM Aug 22 2014, 11:55 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(wil-i-am @ Aug 22 2014, 09:15 AM) Thank You QUOTE(gsc @ Aug 22 2014, 11:16 PM) Received sms...bring a family or friend to open Hong Leong Saving account with RM5k deposit, both get gifts. Plus, get 3.85% on 12 months FD. Ends 31 Nov. T & C applies Thank You FD Promos - Please update me if below rates are not updated. Thanks Best 1 Month (1) Affin 3.25% - by michaelho (2) CIMB 3.25% - by michaelho (3) Mach 3.15% Mach FD Rates https://www.machbyhongleongbank.com/mach-fixed-deposit Best 3 Months (1) OCBC, 4.5% + 3.0% (Premier Save Gold) = approximately 3.75% effective rate, valid until 30 Nov (2) OCBC, 4.5% + 2.9% (Smart Saver) = approximately 3.7% effective rate, valid until 30 Nov *ocbc Fd + smart saver applies to new smart saver or dormant account holders only. Those with previous FD + smart saver package when mature are not allowed to take up this package. - by gsc (3) OCBC Islamic 3.55%, valid until 30 Nov (4) Am Bank 3.5%, valid until 19 September (5) Mach 3.3% Best 6 Months (1) May Bank, 3+3, effective rate 3.73%, valid until 16 August. (2) UOB, 3.7% pure FD, valid until 30 August (3) Ambank 3.65%, valid until 19 September (4) Ocbc Mederka promo at 3.75% (was 3.6%), pure FD, valid until 15 Sept - by gsc & munkeyflo (5) RHB (3.48+3.68)/2= 3.58% with 5% FD in CASA – by gsc (6) Mach 3.5% Best 9 Months (1) Am Bank 3.7%, valid until 19 September (2) RHB (3.48+3.68 + 3.88)/3= 3.68% with 5% FD in CASA – by gsc Best 12 Months (1) OCBC Islamic 3.9%, pure FD, valid until 15 Sept or 30 Nov? – by gsc & munkeyflo (2) RHB conventional RHB Islamic 3.88% pure FD – by gsc (3) May Bank 3.85%, promo is tiered rate. Minimum 10k. One cheque one receipt - by munkeyflo

(4) Affin 4.10%, additional 20% fund in CASA, effective rate up to 3.85%, valid until 31 Dec 2014 (5) HLB 3.85%, Ends 31 Nov. T & C applies - by gsc (New added) (6) RHB (3.48+3.68 + 3.88 + 4.08)/4 = 3.78% with 5% FD in CASA – by gsc (7) Mach 3.6% - by FDInvestor Best 13 Months (1) UOB 3.9%, interest paid every 6 months, need RM 20 to open a SA, valid until 30 August - by X_hunter Best 15 Months (1) Affin pure FD, 4.05%, valid until 31 December

(2) RHB (3.48+3.68 + 3.88 + 4.08 + 5.38)/5 = 4.08% with 5% FD in CASA – by gsc Best 24 Months - by munkeyflo (1) OCBC, valid until 30 Nov First 12 months @ 3.8% Next 12 months @ 4.20% (effective rate for 24 months @ 4%) OCBC Existing Funds - valid until 30 Nov - by munkeyflo 3 months @ 3.3% 12 months @ 3.5% Saving Account Promos (1) Hong Leong Bank's Member-Get-Member Programme Received sms...bring a family or friend to open Hong Leong Saving account with RM5k deposit, both get gifts. Valid until 30 June 2015- by gsc & HJebat (New added) (2) Affin's One Million Giveaway "OMG" Campaign - (New added) http://www.affinbank.com.my/General/Whats-...--Campaign.aspx MBSB (No PIDM) Kids Fixed Deposit Promo - Monthly Interest - Valid from 2 June until 2 December 2014 Links: http://www.mbsb.com.my/misc/TnC_KidsFixedDeposit.pdf http://www.mbsb.com.my/misc/Flyer_KidsFixedDeposit.pdf FD Market Reviews Real interest rate ends in positive territory last month - by wil-i-am (New added) http://www.nst.com.my/node/25395 On the back of strong GDP growth, mixed views on rate hike in Malaysia - by wil-i-am http://www.thestar.com.my/Business/Busines...s-on-rate-hike/ Economists divided on next interest rate hike - by gsc http://www.propertyguru.com.my/en/property...m_content=links Thanks so much to below Contributors: munkeyflo McFD2R pinpinmiao gsc cybpscyh kingofong FDInvestor michaelho wil-i-am X_hunter HJebat This post has been edited by BoomChaCha: Aug 23 2014, 12:29 AM |

|

|

Aug 23 2014, 12:08 AM Aug 23 2014, 12:08 AM

|

Senior Member

1,035 posts Joined: May 2010 |

|

|

|

Aug 23 2014, 12:23 AM Aug 23 2014, 12:23 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(HJebat @ Aug 22 2014, 11:53 PM) Why suddenly will go up in Nov? Even until now, the 4.70% does not advance at all Bank Negara Meetings5th --- 18 Sep 2014 (Thursday) 6th --- 06 Nov 2014 (Thursday) 2 more Bank Negara meetings before the Trio merge.. If Sept no raise; then what if it happens in Nov..? And also I want to see how BR will react if OPR goes up..? I am a bit worried if suddenly MBSB's 4.7% is no longer available.. QUOTE(HJebat @ Aug 22 2014, 11:53 PM) Errr...you I see, I really think I have to put some in MBSB..cannot miss this opportunity.. QUOTE(HJebat @ Aug 22 2014, 11:53 PM) No lah.. |

|

|

|

|

|

Aug 23 2014, 12:49 AM Aug 23 2014, 12:49 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(bbgoat @ Aug 19 2014, 06:17 PM) Opened FD and SA in Affin today. 15 mths FD at 4.05%. SA with RM110. But their SA must have activity every 6 mths vs other banks of yearly must have activity ?? Quite fast, all done within 30 minutes Do we have to open a SA when place 15 months FD at 4.05% in Affin..?They also have open house on coming Thursday in their branch. Anyway enough food for me already. Ha ha ha. Why do we need to open a SA? And some more RM 110 to open a SA? How did you use IBG to send your RM 100 out from Affin SA? QUOTE(bbgoat @ Aug 20 2014, 01:27 PM) Next week..?? An exciting moment hah.... Please share with us after you place your FD in MBSB..especially gifts.. Top Goat is really rich hah.. place 2 FD within a month.. |

|

|

Aug 23 2014, 01:01 AM Aug 23 2014, 01:01 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(HJebat @ Aug 23 2014, 12:08 AM) Warrior, if the Trio can negotiate successfully to merge, I think the last opportunity to place 5 years FD in MBSB is December.. On other hand, we also need to keep an eye to see is BR going to revise their rates or not..? |

|

|

Aug 23 2014, 02:03 AM Aug 23 2014, 02:03 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

|

|

|

Aug 23 2014, 08:29 AM Aug 23 2014, 08:29 AM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(BoomChaCha @ Aug 23 2014, 12:49 AM) Do we have to open a SA when place 15 months FD at 4.05% in Affin..? On FD maturity, the interest & principal will be credited to the SA. The FD will not auto roll. So need SA. Reason given by Affin staff.Why do we need to open a SA? And some more RM 110 to open a SA? How did you use IBG to send your RM 100 out from Affin SA? Intend to use online acct to do the IBG. Have not try yet. Save the effort, petrol to go to the branch to withdraw the money. Did not get ATM card which has yearly fees. QUOTE(BoomChaCha @ Aug 23 2014, 12:49 AM) Next week..?? You have made me wonder/hesitate on the MBSB acct, the OPR change in Sept or Nov .....................An exciting moment hah.... Please share with us after you place your FD in MBSB..especially gifts.. Lets see. Small amount for the FD, just like you said, at least put something there before we regret about the 4.7%. QUOTE(BoomChaCha @ Aug 23 2014, 02:03 AM) UOB FD promo bundled with free luggage from Groupon: Counting $$$ again at 2.03am ?? Saw this luggage picture from another forum: Luggage brand is Bayers, hard type luggage: This post has been edited by bbgoat: Aug 23 2014, 08:32 AM |

|

|

Aug 23 2014, 08:46 AM Aug 23 2014, 08:46 AM

|

Senior Member

817 posts Joined: Mar 2014 |

|

|

|

Aug 23 2014, 09:56 AM Aug 23 2014, 09:56 AM

|

Senior Member

1,624 posts Joined: Apr 2011 |

|

|

|

Aug 23 2014, 09:57 AM Aug 23 2014, 09:57 AM

|

Senior Member

817 posts Joined: Mar 2014 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0340sec 0.0340sec

0.26 0.26

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 12:34 PM |