QUOTE(davinz18 @ Mar 19 2014, 10:19 PM)

that's the risk unit-holders need to face if withdraw. That's the bad thing of c/fwd the income to next financial year

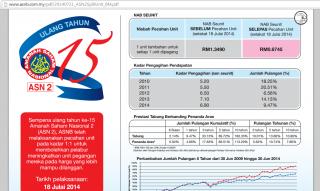

I think people are confused with this carry forward thingy. 2.2 sen carried forward to the next financial year does not translate into an absolute amount. Yes such funds retain its intrinsic RM1 value but every time dividends are disbursed, the unit in circulation "increases" due to the fact that all dividends are reinvested automatically into an account holder's account.

So, 6.6 cents for 2013 may cost PNB/ASNB say 950million but to have the same 6.6 cents for 2014 when the fund has somehow "organically" grown due to dividends/compounding effect may cost more than 1billion. That's why I believe that when say 2.2 cents is carried forward, it does not absolutely translate 1 to 1.

Also, it isn't necessary that when a portion of the returns is carried forward to the following year, it'll be used in that particular year. PNB/ASNB is known for it's so called mantra of "consistent and competitive" returns thingy it may have been allocated to a "pool" that will be used when the next economic cycle comes into play.

Given that economic cycles "seem" to come in 7 to 10 year cycles and the last one was the great financial crisis of 2008, I'm of the opinion that whatever savings brought forward could easily be used up during an economic downturn given the fact that the fund sizes are huge (mostly in billions) and also the fact that whatever happens behind the scenes, PNB/ASNB is required to honour the RM1 valuation even IF the actual NAV for funds during an economic crisis may actually be less than RM1.

Just my 2 cents...

Mar 19 2014, 04:03 PM

Mar 19 2014, 04:03 PM

Quote

Quote

0.0440sec

0.0440sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled