Candy Crush King IPO listing = down > 10% in openning ..

Nobody interested to buy gaming company, as hard to make profit and growth ??

USA Stock Discussion v5, Investment,Trader,Financial Ratios,HUAT?

USA Stock Discussion v5, Investment,Trader,Financial Ratios,HUAT?

|

|

Mar 26 2014, 10:06 PM Mar 26 2014, 10:06 PM

Return to original view | Post

#41

|

Validating

1,525 posts Joined: Oct 2012 |

Candy Crush King IPO listing = down > 10% in openning ..

Nobody interested to buy gaming company, as hard to make profit and growth ?? |

|

|

|

|

|

Mar 27 2014, 09:35 AM Mar 27 2014, 09:35 AM

Return to original view | Post

#42

|

Validating

1,525 posts Joined: Oct 2012 |

QUOTE(danmooncake @ Mar 27 2014, 04:25 AM) Look at all the old gaming stocks... LVS, MPEL, MGM, WYNN, .... all kena whacked! IMHO, if Japan legalize the casino licenses in Apr-June , these counters will uptrend again..Any ticker with a name like KING, will be "undressed" immediately. Aim to add more banks portfolio like LYG and NBG or Home contruction BZH if there is a correction period. Already got big allocation in gaming stocks in NYSE/HK.. |

|

|

Mar 31 2014, 11:33 PM Mar 31 2014, 11:33 PM

Return to original view | Post

#43

|

Validating

1,525 posts Joined: Oct 2012 |

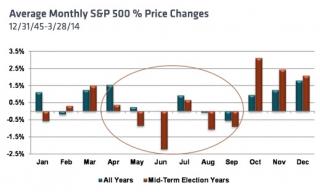

Sell in April and buy in October strategy still workable?? But the CLSA Feng Shui Index 2014 tell

a better prospects coming summer 2014.. Market trend going better before Good Friday and Easter Day, trading resume usually yield a better gain?? Historical Data still a good reference and will repeat again and again? |

|

|

Apr 4 2014, 11:39 PM Apr 4 2014, 11:39 PM

Return to original view | Post

#44

|

Validating

1,525 posts Joined: Oct 2012 |

Why do Foreigners Invest in the United States?

"If China's bond market were as well developed as the cross-country average - about the level of development in South Korea -- then China's predicted holdings of U.S. bonds would be about $200 billion below their current level." One of today's most contentious economic debates is whether the current system of large global imbalances can continue. Some researchers suggest that this system will not persist because the United States must stabilize its external debt ratios, and part of that adjustment will involve a large depreciation of the dollar (even more than has occurred so far). Others argue that global imbalances could continue for an extended period because of factors that make U.S. assets more attractive and the persistent return differential between U.S. and foreign asset holdings. Most researchers agree that the greatest short-term vulnerability to the current system is the willingness of foreigners to continue to invest almost $2 trillion per year into the United States at existing exchange rates and interest rates. Over the five years from 2002 through 2006, gross capital flows into the United States totaled $6.2 trillion. Foreigners invested an average of over $5 billion in the United States every day, despite relatively low returns compared to investments in other countries and the widespread expectation of continued dollar depreciation. Moreover, over two-thirds of U.S. external liabilities were held by the private sector by the end of 2006. What motivates the individual decisions that drive these capital inflows, and can this massive net transfer of capital into the United States last? In Why Do Foreigners Invest in the United States? (NBER Working Paper No. 13908), Kristin Forbes notes that foreigners have earned substantially lower returns on their U.S. investments over the past five years than U.S. investors have earned abroad, even after removing the effects of exchange rate movements and government investments. This return differential exists even within individual asset classes (equities, foreign direct investment, and to a lesser extent, bonds) and after making rough adjustments for risk. Still, foreign investors might choose to continue investing in the United States and financing the large U.S. current account deficit for several reasons. Indeed, they may choose to purchase U.S. portfolio investments in order to benefit from the highly developed, liquid, and efficient U.S. financial markets, and from the strong corporate governance and institutions in the United States -- although both of these perceived strengths of the United States have shown some vulnerabilities during the recent financial market turmoil. Foreigners also may invest in the United States in order to diversify risk, especially if returns in U.S. financial markets have little correlation with returns in their own country's domestic financial markets. Or, investors outside the United States may put their money here because of their strong linkages with the United States, through trade flows or such measures of "closeness" as distance, inexpensive communications, or sharing a common language. Forbes asks which of these factors are actually significant in determining foreign investment in the United States. She finds that a country's financial development is consistently an important factor that affects its investment in both U.S. equity and debt markets. Specifically, countries with less developed financial markets invest a larger share of their portfolios in the United States and the magnitude of this effect decreases with income per capita. Her estimates suggest that if China's bond market were as well developed as the cross-country average - about the level of development in South Korea ---then China's predicted holdings of U.S. bonds would be about $200 billion below their current level. Countries with fewer controls on capital flows and larger trade flows with the United States also invest more in U.S. equity and debt markets. And, return differentials are important in predicting U.S. equity (but not bond) investments, because foreigners invest more in U.S. equities if they have had relatively lower returns in their own equity markets. Finally, despite strong theoretical support, it appears that diversification motives have little impact on patterns of foreign investment in the United States. Forbes notes that these results -- and especially the primary role of a country's financial market development in determining its investment in the United States -- have three important implications. First, the results support the theoretical literature on global imbalances that emphasizes the role of U.S. financial markets. Although the exact mechanism varies across models, one key theme in recent research is that lower levels of financial market development in other countries will continue to support capital flows into the United States, thereby supporting the U.S. current account deficit and large global imbalances without major changes in asset prices. A second, related, implication is that as countries around the world continue to develop and strengthen their own financial markets, this will gradually reduce this important driver of capital flows into United States. These adjustments would likely occur slowly, though, because the development of financial markets, especially in low-income countries, is a long process. Finally, and potentially more worrisome, because the liquid and efficient financial markets of the United States are a major impetus behind U.S. capital inflows, anything that undermines the perceived advantages of U.S. equity and bond markets could present a serious risk to the sustainability of U.S. capital inflows. The U.S. sub-prime crisis and continued turmoil in U.S. financial markets already may have undermined this perceived "gold standard" of financial markets, and the risk of a sudden increase in poorly thought-out regulation may aggravate these concerns. If countries with less developed financial markets begin to question the relative advantages of U.S. financial markets, this could lead to a more rapid adjustment in U.S. capital inflows, global imbalances, and asset prices. |

|

|

Apr 13 2014, 02:27 PM Apr 13 2014, 02:27 PM

Return to original view | Post

#45

|

Validating

1,525 posts Joined: Oct 2012 |

QUOTE(ichigo_6091 @ Apr 13 2014, 12:54 PM) Hey guys,I just started reading and learning about the US stock market. Great Start.. If got time, learn on the CBOE VIX (Fear Index /Gauge) too.. So far,I've read that Japan might legalise gambling in a few months time. Is it a good time to invest in resorts such as MGM,Vegas sands? And,will the bear go to full mauling-mode this week? S&P 500 1800 this week? Usually, If VIX > 25 pts, ppls will put 30% of their cash and BUY some stocks. If VIX > 30 pts, ppls will put another 30% of their cash and BUY some stocks too. If VIX > 35 pts, based on own judgment on the remaining 40% CASH reserves. Casinos stocks like MGM, LVS, MPEL, WYNN(NYSE/Nasdaq) or 0027,1928, 1128, 0880, 2282 (HKSE) were flying very high since year 2009 .. I got feeling the legalization will happen just b4 parliament end in June.. Prediction of bull/bear direction?? You may get right or wrong move too. IMHO, better put yr money to work even harder for you (ROI %) in small-cap and medium-cap stocks (Russell 2000) with great ROI in currency exchg rate too in investment(long-term). Ordinary usual day, ppls continue with day-to-day job/career/business, save the cash in term FD and collect dividend(if got any) plus view their porfolios in trust / trading acct whenever in their free time. This post has been edited by netmask8: Apr 14 2014, 12:37 PM |

|

|

Apr 15 2014, 09:00 AM Apr 15 2014, 09:00 AM

Return to original view | Post

#46

|

Validating

1,525 posts Joined: Oct 2012 |

QUOTE(jasontoh @ Apr 15 2014, 08:02 AM) Per famous Trader's Almanac, ppls sell in month of May, as historical recordsshown seasonal month of decline.. Sell in May and Go Away(click me) Sell in May and Buy in October?? (click me)

May not applicable for investment(long term) plan, as investment is not a seasonal period/trend.. |

|

|

|

|

|

Apr 15 2014, 11:27 PM Apr 15 2014, 11:27 PM

Return to original view | Post

#47

|

Validating

1,525 posts Joined: Oct 2012 |

CBOE VIX values greater than 30 are generally associated with a large amount of volatility

as a result of investor fear or uncertainty, while values below 20 generally correspond to less stressful, even complacent, times in the markets. Is CBOE VIX is still relevant? More Info abt CBOE VIX ==>> Volatility Index (VIX) and Wikipedia VIX |

|

|

Apr 23 2014, 01:49 PM Apr 23 2014, 01:49 PM

Return to original view | Post

#48

|

Validating

1,525 posts Joined: Oct 2012 |

QUOTE(jerrychoo2004 @ Apr 23 2014, 10:04 AM) 4 of my top holding stocks will post their quarterly report these few days Earnings period is usually bullish, with continue of money printing, low borrowing interest rate and bond purchase..FB, AAPL, WYNN, LVS......hope they no bring me go Holland >.< very tension hahahha as all come at almost same time As long as these companies make profit and growth, it would not bring you to Holland but instead go to Disneyland for vacation.. For LVS, the major shareholder control more than 51%, authorizes usd 2B share buyback/repurchase program, less common shares floating in market, qrtrly dividend of usd 50 cents, good qrtrly cashflow to expand to new market segment in Vietnam, S.Korea + Jpn.. Target Price Aim = 180 - 200 in 3 - 4 years.. |

|

|

Apr 24 2014, 09:58 AM Apr 24 2014, 09:58 AM

Return to original view | Post

#49

|

Validating

1,525 posts Joined: Oct 2012 |

QUOTE(danmooncake @ Apr 24 2014, 06:13 AM) Halted and opened up $40+ to $565... dang.. market loves the news, not only beat estimates but $30 bln stock buyback and 7-1 splits in June. Definitely going for the moon now. Stay long, don't sell now. Agreed. Good prospects for AAPL share price appreciation with 30B share buyback.7-1 split will makes the share price "cheaper" and affordable for many investors .. Good + Huge cashflow too. |

|

|

Apr 24 2014, 10:12 AM Apr 24 2014, 10:12 AM

Return to original view | Post

#50

|

Validating

1,525 posts Joined: Oct 2012 |

QUOTE(danmooncake @ Apr 24 2014, 09:58 AM) Both AAPL and MSFT are still in Nasdaq .. Dow tracks 30 companies while Nasdaq tracks 4k companies..DJIA is composed mainly of companies found on the NYSE, with only a couple of Nasdaq-listed stocks. Why the main reason AAPL need to move to DJIA ? |

|

|

Apr 25 2014, 01:51 PM Apr 25 2014, 01:51 PM

Return to original view | Post

#51

|

Validating

1,525 posts Joined: Oct 2012 |

LVS Q1 2014 earning, sales revenue usd 4.01B , net profit usd 776M,

EPS 95 cents (an increased of 36% per Q1 2013).. Qrtrly dividend 50 cents for every qrtr in 2014. Returned $810.0 Million of Capital to Shareholders through its Stock Repurchase Program. LVS Q1 2014 Details This post has been edited by netmask8: Apr 25 2014, 01:54 PM |

|

|

Apr 29 2014, 09:06 AM Apr 29 2014, 09:06 AM

Return to original view | Post

#52

|

Validating

1,525 posts Joined: Oct 2012 |

Trader Almanac formula = Sell in May and go away..

Market will be stagnant/down in May-Sept, buy back in Oct for trader when VIX is > 30pts..For investors, holding power is the key. Fifa World Cup, Summer Holiday, Russia/Ukraine conflicts may bring more down? Bull markets lasted 20 mths.. Time for at least 10% correction? When is the last MARKET correction? Are you a trader or an investor? This post has been edited by netmask8: Apr 29 2014, 09:09 AM |

|

|

Apr 30 2014, 12:01 AM Apr 30 2014, 12:01 AM

Return to original view | Post

#53

|

Validating

1,525 posts Joined: Oct 2012 |

Continuous record low interest rate is awesome for equities.. Hardly see a correction for the past 2 years.

MGM is up more than 6% . Expects Q1 2014 good Earnings today? |

|

|

|

|

|

Apr 30 2014, 09:06 AM Apr 30 2014, 09:06 AM

Return to original view | Post

#54

|

Validating

1,525 posts Joined: Oct 2012 |

MGM up more than 8.5%.

MGM Q1 2014 Earnings, Revenue Sales 2.63B (grew 11.8% yr-to-yr), net profit 108M, property EBITDA 682M ( grew 19% yr-to-yr) and EPS 21 cents. |

|

|

Apr 30 2014, 10:52 PM Apr 30 2014, 10:52 PM

Return to original view | Post

#55

|

Validating

1,525 posts Joined: Oct 2012 |

QUOTE(danmooncake @ Apr 30 2014, 10:37 PM) With low interest rate and usa economy is in gradual recovery state, I'm looking for long term share holding power.Cash portion is increasing monthly thru career savings, dividend collection + little passive income.Will add more portfolios when VIX in fear mode.Perhaps during low volume FIFA summer football world cup? |

|

|

May 1 2014, 03:59 PM May 1 2014, 03:59 PM

Return to original view | Post

#56

|

Validating

1,525 posts Joined: Oct 2012 |

Lloyds Q1 2014 earnings posted pre tax profit roses 22% to 1.8B pounds.Common Equity

Tier 1 ratio and leverage ratio increased to 10.7% and 4.5% respectively under Basel committee on banking supervision. Expects to list child TSB Bank operation IPO by end of June and apply to regulators to resume dividend payment too.. |

|

|

May 1 2014, 08:57 PM May 1 2014, 08:57 PM

Return to original view | Post

#57

|

Validating

1,525 posts Joined: Oct 2012 |

QUOTE(mikehwy @ May 1 2014, 05:42 PM) wow. into ftse? i got my ipo for british gas but sold it after 1 month. omg, it was such a long time ago...me getting v old. Lloyds(Main) in ftse, in nyse listed as LYG.Followed LYG for few years back when it just traded below usd2 and when company need bailouts. I bought Aig / Bac / Citi / NBG too.For trader, hard to get right timing/signal ..etc . i Buy shares during crisis or when got special good discount. Portfolios = 50% Gaming/Leisure, btw, is trustee savings bank TSB still in existence? i thot it was merged like many building society bankers long long time ago. gosh 40% Bank/Finance/Insurance and 10% Home Constructions (BZH). Not sure abt existence / building society in UK.. This post has been edited by netmask8: May 1 2014, 09:09 PM |

|

|

May 2 2014, 01:19 PM May 2 2014, 01:19 PM

Return to original view | Post

#58

|

Validating

1,525 posts Joined: Oct 2012 |

Do you know why FED continue to taper its massive bond-buying stimulus from usd85B to usd40B per month

without hike/increase interest rate? Without taper, cheap money printing continue to push equities uptrend. With taper, USA economy is able to growth without any help/life supporting oksigen. Conclusion: Taper or not, both also helping USA economy gradually with economic datas like GDP, inflation, job, housing, consumer confidence, ISM ..etc.etc. Are these economic datas reflect of the underlying real strength in the USA economy? 10% correction or more? |

|

|

May 12 2014, 10:50 AM May 12 2014, 10:50 AM

Return to original view | Post

#59

|

Validating

1,525 posts Joined: Oct 2012 |

QUOTE(yok70 @ May 10 2014, 03:09 AM) True. China/HK consumer stocks already puke heavily about 30-40% down from recent peak. My HK stocks kena too. HK casino stocks are in great discount and happy to top up some, as Jpn expected to legalize casino soonfor Olympic Summer 2020.. For USA stocks, plan to top up during FIFA World Cup Summer ( after 2nd Round/Qtr Finals ), as historical shown volume is thin.. Plan to HOLD it long term. HOLDING POWER is the key, with 1) qtrly dividend, 2) monthly share reinvest/stock repurchase to make 3) reasonable valuation, 4) PE Ratio/other financial ratios = in great cashflow, and finally, 5) the major key shareholder earned > 51% stake in the company. If you are the major shareholder with > 51% , how to make yr company in great healthy mode? Per above? Presently term FD need put for another 1mth in bank? This post has been edited by netmask8: May 12 2014, 10:55 AM |

|

|

May 12 2014, 10:33 PM May 12 2014, 10:33 PM

Return to original view | Post

#60

|

Validating

1,525 posts Joined: Oct 2012 |

QUOTE(NicJolin @ May 12 2014, 02:06 PM) What's the good place to start buying US stocks? Good place to buy USA Stocks? You mean online broker service like TradeKing, Etrade, UBS ..etc? Any of u guys ever heard of Hirsche Private Asset Mgmt? what about online broker like just2trade? Consumer Products / Health Care / Technology counters? News CNBC, Bloomberg, Google Finance, cnn money ..etc? |

|

Topic ClosedOptions

|

| Change to: |  0.0625sec 0.0625sec

0.34 0.34

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 03:11 AM |