QUOTE(IsaacLiew52 @ Nov 2 2015, 07:17 PM)

Hi guys, I am 25 this year and I am looking for my first insurance. I know that there are many types of insurance, but I am not sure which is the priority insurance for me this range of ages. Also, I heard that a few of my friends said that saving plan is not necessary for me to include in my insurance? Is that truth?

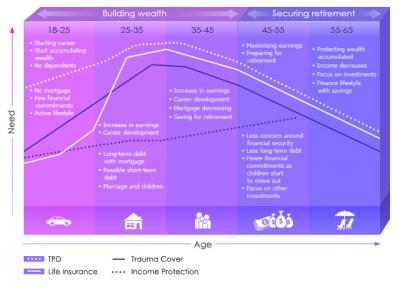

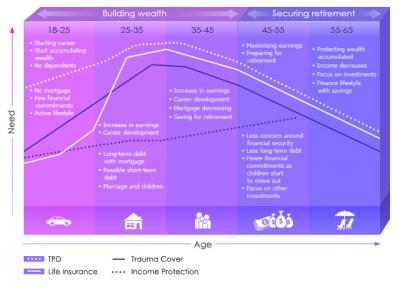

Insurance is part of life commitment and we will have different need during various stage of life.

Here are some life stages to consider:

Young, Single, Recent Graduate – If currently between jobs, or not yet eligible for coverage offered through a job, it is important to consider purchasing a

medical plan as well as disability coverage. In the event an accident leaves you temporarily unable to work, you will still be faced with having to pay bills and student loans. Life insurance is also something to consider –you may not think you need it right now, but it is still worth checking into, as the premiums will be at their lowest for those who are young and generally healthy.

Just Married – If you are thinking about starting a family, you will want to review your

medical plan to be sure you are able to add a new family member to the plan and make sure you have adequate coverage. Also, consider purchasing

life insurance plans at this time. In the event of a spouse’s unforeseen passing, you will want to protect each other financially from having to incur any personal debts and funeral expenses, as well as cover expenses such as the cost of raising a child, college, and a mortgage.

Empty Nesters – With the children off on their own, take time to review your life insurance needs. You may want to adjust the amount of coverage you currently maintain, determining that you may not need as much. Also, consider purchasing Long Term Care coverage, which will cover costs that may arise for elderly services or facilities that may become a necessary part of the care you need as you get older.

Retirement– You will have to maintain your health insurance plan until you reach the age of 65, which is the age you become eligible for Medicare. At that time, you will need to consider purchasing a Supplemental Health Care plan as well as Prescription Drug Coverage, to enhance your Medicare plan and cover the medical expenses that Medicare does not. Travel insurance is also something to consider, as the retired years are when people do the most travelling.

I believe you're still single/not yet married, first thing to consider will be medical insurance and Critical Illness coverage. As these coverage will only available while you still strong and healthy, also it is important to protect ourself from heavy medical bill if anything bad happened.

The main purpose for insurance are protection, if you really looking for saving/investment, perhaps you should look for other investment tools such as Unit Trust, REIT and etc.

Attached thumbnail(s)

Nov 1 2015, 09:11 AM

Nov 1 2015, 09:11 AM

Quote

Quote

0.0444sec

0.0444sec

0.45

0.45

6 queries

6 queries

GZIP Disabled

GZIP Disabled