QUOTE(polarzbearz @ Sep 2 2015, 10:39 PM)

[attachmentid=4873152]

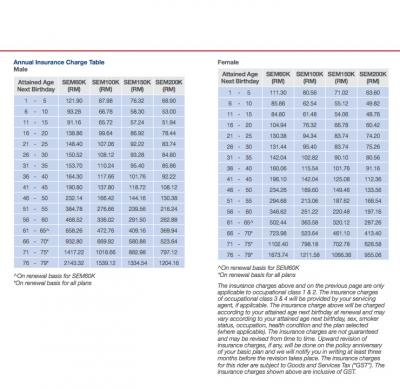

Anyone can comment on this plan?

Insurance Talk V2, Anything and everything about insurance

|

|

Sep 3 2015, 01:21 AM Sep 3 2015, 01:21 AM

|

Senior Member

3,567 posts Joined: Jan 2003 From: Paradise |

QUOTE(polarzbearz @ Sep 2 2015, 10:39 PM) [attachmentid=4873152] Anyone can comment on this plan? |

|

|

|

|

|

Sep 3 2015, 09:41 AM Sep 3 2015, 09:41 AM

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(basSist @ Sep 3 2015, 01:21 AM) Yup my company group plan is under AIA. Is it OK compared to, say, the tokio marine you shared earlier? The TM ones looks like similar benefits but cheaper as age grows |

|

|

Sep 3 2015, 06:49 PM Sep 3 2015, 06:49 PM

|

Senior Member

1,522 posts Joined: Mar 2007 From: Kuala Lumpur |

QUOTE(nujikabane @ Aug 30 2015, 07:13 PM) Can I get a confirmation that only ILP-linked insurance have the flexibility to add/remove riders ? Traditional policy able to add rider as well. However, it do not have the flexibility like investment linked to add/remove after the policy inforce.Other types of insurance e.g. life insurance, term insurance do not have such flexibility ? QUOTE(nujikabane @ Aug 31 2015, 08:28 PM) How is Takaful different from other conventional insurance? Yes, Takaful do have investment linked insurance. It's similar to Conventional however, there are a numbers of principle difference between takaful and conventional.e.g. price coverage & does takaful also have investment-linked insurance ? Takaful 1)Takaful is based on mutual cooperation. 2)Takaful is free from interest (Riba), gambling, (Maysir), and uncertainty (Gharar). 3)All or part of the contribution paid by the Participant is a donation to the Takaful Fund, which helps other Participants by providing protection against potential risks. 4)Takaful companies are subject to the governing law as well as a Shari’a Supervisory Board. 5)There is a full segregation between the Participants Takaful Fund account and the shareholders' accounts. 6)Any surplus in the Takaful Fund is shared among Participants only, and the investment profits are distributed among Participants and shareholders on the basis of Mudaraba or Wakala models. 7)In case of the deficit of a Participants’ Takaful Fund, the Takaful operator (Wakeel) provides free interest loan (Qard Hasan) to the Participants. 8)The Plan Owners’ and shareholders’ capital is invested in investment funds that are Shari’a compliant. 9)Takaful companies have re-insurance with Re-Takaful companies or with conventional re-insurance companies that adhere to certain conditions of Shari’a. Conventional 1)Conventional insurance is based solely on commercial factors. 2)Conventional insurance includes elements of interest, gambling, and uncertainty. 3)The premium is paid to conventional insurance companies and is owned by them in exchange for bearing all expected risks. 4)Conventional companies are only subject to the governing laws. 5)Premium paid by the Policyholder is considered as income to the company, belonging to the shareholders. 6)All surpluses and profits belong to the shareholders only. 7)In case of deficit, the conventional insurance company covers the risks. 8)The capital of the premium is invested in funds and investment channels that are not necessarily Shari’a compliant. 9)Conventional insurance companies do not necessarily have re-insurance with re-insurance companies that abide by Shari’a principles. https://www.tazur.com/takaful-vs-conventional.html QUOTE(frosteer @ Sep 1 2015, 09:47 PM) Quick Question =)) As pointed out by @adele123 , it's not covering the cost of organ. Most of the medical cards are not covering the surgical cost of removing the organ from donor, but some of the premium medical card does. Example: Great Eastern's Smart Premier Health.Medical card usually cover organ transplant (kidney, lung, liver, heart, pancreas & bone marrow) However, it only covers the surgery cost but does not cover the organ. Is this correct? Please advise, thanks =) By the way, is there any AIA agent here can help too? I heard the latest AIA medical card (sample: R&B200, annual limit 1.375 million, lifetime no limit) covers both the organ transplant surgery cost and also the cost of the organ. Is this true? QUOTE(polarzbearz @ Sep 1 2015, 10:50 PM) Hi all, thinking to get my first personal medical insurance as currently I only have the company benefits' one. Anyone have any good recommendation of product or is there any agent here that can PM me? pm-ed you.I'm mostly keen on non ILP-linked medical insurance (traditional type), but I'm open to suggestions. Thanks in advance! QUOTE(kutitata @ Sep 2 2015, 09:55 AM) Guys, On the admission to hospital, if Guaranteed Letter is granted by Great Eastern, full hospitalization bill will be paid instead of paying the initial amount only. This procedure is same across the insurance industry.I am looking to buy medical insurance for my wife and young daughter, I am deciding between AIA and GE... Both are for Room rate of either 200 or 300 and 1m yearly and no lifetime limit. However was advised to check the details of GE as they said for GE only the initial amount is paid directly and the balance you have to pay first and claim from GE. Another concern is that GE has payor benefit for both wife and baby plan but AIA has payor benefit only for baby and not for wife plan. Can anyone clarify? I need some honest opinion on a good medical plan for my small family. As for the payor benefit, it's depends on the attachable rider from the quotation system. AIA are unable to attach payor benefit maybe due to low budget or high insurance chargers from other riders. QUOTE(polarzbearz @ Sep 2 2015, 10:39 PM) [attachmentid=4873152] Anyone can comment on this plan? QUOTE(polarzbearz @ Sep 3 2015, 09:41 AM) Yup my company group plan is under AIA. If you are going for deductible plan, why not Smart Extender Max, the price is more affordable, refer to the attachment below.Is it OK compared to, say, the tokio marine you shared earlier? The TM ones looks like similar benefits but cheaper as age grows

However I wouldn't advise you to go for deductible plan if you are able to afford at least RM200/month. The reason because 1)The price is not too big different RM100 vs RM200 2)You are taking the deductible risk. 3)Deductible plan might not too suitable for retirement purpose when you are retired without company medical coverage. 4)It's extremely hard for you to get a standard medical card if you are planning to get on your retirement which is age 55. 5)If you are able to get one, high blood pressure/ blood sugar/ cholesterol might made you paying 100% or higher premium rate than normal person. Example: If a healthy age 55 person are paying RM300/month, you might be paying RM600/month due to loading. |

|

|

Sep 4 2015, 12:53 AM Sep 4 2015, 12:53 AM

|

Senior Member

3,567 posts Joined: Jan 2003 From: Paradise |

QUOTE(polarzbearz @ Sep 3 2015, 09:41 AM) Yup my company group plan is under AIA. yeah because TM's deductible is RM10k, and the AIA's is RM30k. once you passed age of 60, there won't be deductible option for you hence the premium increases.Is it OK compared to, say, the tokio marine you shared earlier? The TM ones looks like similar benefits but cheaper as age grows TM deductible plan is fixed at RM10k for all plans, and AIA's deductible plan is fixed at respective plan. Try AXA SCO, you can adjust your deductible amount, from RM7.5k to RM20k for each plan. if you are concerned that QUOTE 2)You are taking the deductible risk. 3)Deductible plan might not too suitable for retirement purpose when you are retired without company medical coverage. 4)It's extremely hard for you to get a standard medical card if you are planning to get on your retirement which is age 55. 5)If you are able to get one, high blood pressure/ blood sugar/ cholesterol might made you paying 100% or higher premium rate than normal person. Example: If a healthy age 55 person are paying RM300/month, you might be paying RM600/month due to loading. you can always look for AXA SCO because their deductible plan can be converted to non-deductible plan once in a life time by age of 59. the Insured Person will not be required to provide health declaration to the Company. and the last thing, i'm a consumer. i'm not a insurance salesman. |

|

|

Sep 4 2015, 09:22 AM Sep 4 2015, 09:22 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(basSist @ Sep 4 2015, 12:53 AM) yeah because TM's deductible is RM10k, and the AIA's is RM30k. once you passed age of 60, there won't be deductible option for you hence the premium increases. The concept is still the same.TM deductible plan is fixed at RM10k for all plans, and AIA's deductible plan is fixed at respective plan. Try AXA SCO, you can adjust your deductible amount, from RM7.5k to RM20k for each plan. if you are concerned that you can always look for AXA SCO because their deductible plan can be converted to non-deductible plan once in a life time by age of 59. the Insured Person will not be required to provide health declaration to the Company. and the last thing, i'm a consumer. i'm not a insurance salesman. If you're on a budget and don't have a choice, get those with deductible, atleast part of the risk is covered. However, if you can afford a full plan with no co-insurance today with a better benefit. Why not ? Is it worth saving a few extra ringgit worth the long run ? |

|

|

Sep 4 2015, 03:46 PM Sep 4 2015, 03:46 PM

|

Senior Member

1,522 posts Joined: Mar 2007 From: Kuala Lumpur |

QUOTE(basSist @ Sep 4 2015, 12:53 AM) yeah because TM's deductible is RM10k, and the AIA's is RM30k. once you passed age of 60, there won't be deductible option for you hence the premium increases. Thanks for the information TM deductible plan is fixed at RM10k for all plans, and AIA's deductible plan is fixed at respective plan. Try AXA SCO, you can adjust your deductible amount, from RM7.5k to RM20k for each plan. if you are concerned that you can always look for AXA SCO because their deductible plan can be converted to non-deductible plan once in a life time by age of 59. the Insured Person will not be required to provide health declaration to the Company. and the last thing, i'm a consumer. i'm not a insurance salesman. |

|

|

|

|

|

Sep 4 2015, 11:10 PM Sep 4 2015, 11:10 PM

|

Senior Member

1,128 posts Joined: Nov 2008 |

If you have RM500 to invest on insurance ( include medical card, 36 critical illness).

Would you put all in 1 insurance company or split to 2 company (250 each)? Can we claim daily cash allowance from both insurance company if got 2 medical card? This post has been edited by doraemonkiller: Sep 4 2015, 11:12 PM |

|

|

Sep 5 2015, 12:45 AM Sep 5 2015, 12:45 AM

|

Senior Member

3,567 posts Joined: Jan 2003 From: Paradise |

QUOTE(lifebalance @ Sep 4 2015, 09:22 AM) The concept is still the same. it is definitely worth it if u know how to manage your own money, financial planning. If you're on a budget and don't have a choice, get those with deductible, atleast part of the risk is covered. However, if you can afford a full plan with no co-insurance today with a better benefit. Why not ? Is it worth saving a few extra ringgit worth the long run ? if i have company medical benefit, why not i choose a deductible option plan to complement it? it saves alot. if i decide to change job, and the new company doesn't provide any medical benefit, i can convert the deductible plan to a full plan (AXA SCO). QUOTE(ExpZero @ Sep 4 2015, 03:46 PM) no worry QUOTE(doraemonkiller @ Sep 4 2015, 11:10 PM) If you have RM500 to invest on insurance ( include medical card, 36 critical illness). insurance 101. Would you put all in 1 insurance company or split to 2 company (250 each)? Can we claim daily cash allowance from both insurance company if got 2 medical card? insurance is meant to be protection, not investment. better focus in 1 insurance company (easier management), but if u want to use the 2nd plan to complement the 1st plan, it works as well. about the daily cash allowance, should be able to claim from 1 insurance company iianm. pls correct me if i was wrong. |

|

|

Sep 6 2015, 11:47 AM Sep 6 2015, 11:47 AM

|

Senior Member

4,816 posts Joined: Apr 2007 |

After comparing all that plans (thank you to all that have helped providing advice / quotation / explanations!), I have decided to go with the Deductible option for now mainly because:

1) I'm paying 1/3 of the cost to get slightly better benefit, compared with Traditional plans, with exception that it requires deductible amount (which is covered by company's group policy) 2) The benefits definitely are way lesser as compared to ILP products currently in the market (especially for some insurance company with attractive offering up to 900k annual with no lifetime limit) 3) However, at this stage, since my main objective is to extend my protection (beyond what the standard company's 30k offering) as a protection to myself, deductible plans worked just nice for me with 1/3 the cost of traditional (or 1/10 the cost of ILP) with similar protections. 4) Lastly, it is also easier for me when group policy + deductible plan comes from a single insurance provider, easier to manage and still maintain the Cashless Admission. With these, I'm able to extend my protection with minimal cost, while still being able to mitigate the risk (should anything happen). |

|

|

Sep 6 2015, 01:20 PM Sep 6 2015, 01:20 PM

|

Senior Member

4,726 posts Joined: Jul 2013 |

QUOTE(polarzbearz @ Sep 6 2015, 11:47 AM) After comparing all that plans (thank you to all that have helped providing advice / quotation / explanations!), I have decided to go with the Deductible option for now mainly because: I agree with your analysis. cost saving. but do bear in mind what are your insurance planning for your own in future, once you retire, but still have time to plan that later. on1) I'm paying 1/3 of the cost to get slightly better benefit, compared with Traditional plans, with exception that it requires deductible amount (which is covered by company's group policy) 2) The benefits definitely are way lesser as compared to ILP products currently in the market (especially for some insurance company with attractive offering up to 900k annual with no lifetime limit) 3) However, at this stage, since my main objective is to extend my protection (beyond what the standard company's 30k offering) as a protection to myself, deductible plans worked just nice for me with 1/3 the cost of traditional (or 1/10 the cost of ILP) with similar protections. 4) Lastly, it is also easier for me when group policy + deductible plan comes from a single insurance provider, easier to manage and still maintain the Cashless Admission. With these, I'm able to extend my protection with minimal cost, while still being able to mitigate the risk (should anything happen). also i don't think getting the deductible plan coming from single insurance provider will necessary mean be able to maintain cashless admission if say you exceeded your company's limit. you should be wary of this. after all, to the 3rd party administrator, it's still two different insurance policy. |

|

|

Sep 6 2015, 11:59 PM Sep 6 2015, 11:59 PM

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(adele123 @ Sep 6 2015, 01:20 PM) I agree with your analysis. cost saving. but do bear in mind what are your insurance planning for your own in future, once you retire, but still have time to plan that later. on Yup, long term wise (most likely before age of 30) I'll look for & get a proper insurance, but for now I believe the deductible option is sufficient for me. also i don't think getting the deductible plan coming from single insurance provider will necessary mean be able to maintain cashless admission if say you exceeded your company's limit. you should be wary of this. after all, to the 3rd party administrator, it's still two different insurance policy. For the cashless admission, we have checked with the insurance provider when our company invited them for a briefing session last week. So long as the group policy is sufficient to cover the deductible amount, it will be a cashless admission. |

|

|

Sep 11 2015, 02:49 PM Sep 11 2015, 02:49 PM

|

Junior Member

51 posts Joined: Aug 2010 From: Sarawak |

Greetings,

I'm currently holding Public Mutual Life Plus 2 ( Plan 1 ) by GE and Prudential Enhanced Hospital Income Plus Plan ( Plan 1 ). I am thinking of getting another insurance for protection purposes, or a standalone medical card. Can any agents advise me? I'm 36. non smoker, Occupation Class 1. Thanks! |

|

|

Sep 13 2015, 08:40 PM Sep 13 2015, 08:40 PM

|

Senior Member

892 posts Joined: Oct 2007 From: Penang |

My current gross salary is RM4200 and from Penang. Currently I'm using the medical card from Allianz with the following details:

1. Month premium: RM200 2. Annual limit: RM100k 3. Lifetime limit: RM1mil Recently, someone from AXA Affin suggest me to change to their package with the following details: 1. Month premium: RM333 2. Annual limit: RM1.6mil 3. Lifetime limit: No limit He told me that with the current annual limit of 100k is not sufficient for any dread disease. What do you guys think? Do you think it's necessary? |

|

|

|

|

|

Sep 13 2015, 09:09 PM Sep 13 2015, 09:09 PM

|

All Stars

11,954 posts Joined: May 2007 |

yep 100k is too less nowdays

|

|

|

Sep 13 2015, 10:51 PM Sep 13 2015, 10:51 PM

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(prescott2006 @ Sep 13 2015, 08:40 PM) My current gross salary is RM4200 and from Penang. Currently I'm using the medical card from Allianz with the following details: Your best option right now is to talk to Allianz and inquire whether you are able to upgrade on your existing medical card and _NOT_ replace it with another medical card.1. Month premium: RM200 2. Annual limit: RM100k 3. Lifetime limit: RM1mil Recently, someone from AXA Affin suggest me to change to their package with the following details: 1. Month premium: RM333 2. Annual limit: RM1.6mil 3. Lifetime limit: No limit He told me that with the current annual limit of 100k is not sufficient for any dread disease. What do you guys think? Do you think it's necessary? You may check out my blog << HERE >> on why you should not cancel your existing policy just to get a new one. |

|

|

Sep 14 2015, 09:06 AM Sep 14 2015, 09:06 AM

|

Senior Member

4,726 posts Joined: Jul 2013 |

QUOTE(prescott2006 @ Sep 13 2015, 08:40 PM) My current gross salary is RM4200 and from Penang. Currently I'm using the medical card from Allianz with the following details: As someone highlighted, do not cancel existing insurance policy. 1. Month premium: RM200 2. Annual limit: RM100k 3. Lifetime limit: RM1mil Recently, someone from AXA Affin suggest me to change to their package with the following details: 1. Month premium: RM333 2. Annual limit: RM1.6mil 3. Lifetime limit: No limit He told me that with the current annual limit of 100k is not sufficient for any dread disease. What do you guys think? Do you think it's necessary? another point, 100k is really a lot of money for most common in-patient procedures. as for dread disease coverage, you can get a separate coverage on that which will provide a lump sum amount which is payable upon diagnosis if you worry your medical card is not sufficient. another point to note, AXA Affin has a fixed separate lifetime limit on out-patient dialysis and cancer. do take note of that. |

|

|

Sep 14 2015, 10:45 AM Sep 14 2015, 10:45 AM

|

Senior Member

892 posts Joined: Oct 2007 From: Penang |

QUOTE(roystevenung @ Sep 13 2015, 10:51 PM) Your best option right now is to talk to Allianz and inquire whether you are able to upgrade on your existing medical card and _NOT_ replace it with another medical card. I 've gone through your blog post. Some of my replies:You may check out my blog << HERE >> on why you should not cancel your existing policy just to get a new one. 1. For the waiting period, he said will help me settle the AXA policy before surrender the Allianz policy, so there is no gap between them. 2. Can you explain more about incontestability? Not very understand about this term. 3. I've never claim since I took the policy in 2011. Based on my income, do you think RM333 is too much for an ILP medical insurance? |

|

|

Sep 14 2015, 10:45 AM Sep 14 2015, 10:45 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(prescott2006 @ Sep 13 2015, 08:40 PM) My current gross salary is RM4200 and from Penang. Currently I'm using the medical card from Allianz with the following details: 100k might be sufficient for most lower end surgeries, but definitely not enough for more expensive and complicated surgeries.1. Month premium: RM200 2. Annual limit: RM100k 3. Lifetime limit: RM1mil Recently, someone from AXA Affin suggest me to change to their package with the following details: 1. Month premium: RM333 2. Annual limit: RM1.6mil 3. Lifetime limit: No limit He told me that with the current annual limit of 100k is not sufficient for any dread disease. What do you guys think? Do you think it's necessary? |

|

|

Sep 14 2015, 10:47 AM Sep 14 2015, 10:47 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(prescott2006 @ Sep 14 2015, 10:45 AM) I 've gone through your blog post. Some of my replies: There is a minimum 4 months waiting period. Meaning you will need to in-force your new policy under AXA for 4 months before surrendering the Allianz policy. Else in between you can't perform any claim if you cancel Allianz.1. For the waiting period, he said will help me settle the AXA policy before surrender the Allianz policy, so there is no gap between them. 2. Can you explain more about incontestability? Not very understand about this term. 3. I've never claim since I took the policy in 2011. Based on my income, do you think RM333 is too much for an ILP medical insurance? The budget depends on your wallet. Do you need that RM1.6m coverage in the near future ? Are you willing to pay RM333/month now for the benefit ? If yes, then go ahead. |

|

|

Sep 14 2015, 11:47 AM Sep 14 2015, 11:47 AM

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(prescott2006 @ Sep 14 2015, 10:45 AM) I 've gone through your blog post. Some of my replies: 1. Please ask the AXA agent to explain how he will "settle" the bill if within two months of replacing the policy you need to claim for kidney stones which costs Rm30k.1. For the waiting period, he said will help me settle the AXA policy before surrender the Allianz policy, so there is no gap between them. 2. Can you explain more about incontestability? Not very understand about this term. 3. I've never claim since I took the policy in 2011. Based on my income, do you think RM333 is too much for an ILP medical insurance? Please get him to write a letter stating that he will "settle" the bill if that happens. If it was an offer by AXA to waive the waiting period, then please get an official letter. Everything has to be in black and white. In addition, since you have been paying for 4 years, starting a new policy all over will mean that the units allocation (to accumulate cash values) and the agents commission will start a new. Agent's commission is only up to six years. Suppose you were to choose the upgrade option in Allianz, the allocation period will only start anew for the upgraded portion and not the entire policy itself. Ps. The only way to pass the waiting period is to maintain both policy running concurrently. The claims is paid by the insurer, not the agent. Therefore when in doubt, it is best to get a black and white from the insurer, not the agent. 2. You may google "incontestibility period" for a better understanding. In layman terms, provided there is no fraud (during health declaration to get the policy), and the policy is over 2 years, most insurer will just pay the claim. Suppose you were to get a policy and immediately after the waiting period is over the claim starts, it will definitely raise suspicion that it could be a pre existing health problem prior to the inception of the policy. 3. Whether or not you did any claim before is irrelevant. Getting extra coverage means adding more risk to the insurer, therefore the insurer will have to scrutinize all applications. I am just curious as to why you are reluctant to look at upgrading in Allianz instead of insisting to replace the policy with AXA? |

|

Topic ClosedOptions

|

| Change to: |  0.0367sec 0.0367sec

0.65 0.65

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 01:24 PM |