QUOTE(peri peri @ Nov 15 2013, 11:53 AM)

Care to elaborate further ? seen this phenomena in a few area.Investment 4 Critical Signs of a Bubble Market, Property Investment

Investment 4 Critical Signs of a Bubble Market, Property Investment

|

|

Nov 15 2013, 11:59 AM Nov 15 2013, 11:59 AM

|

Senior Member

3,274 posts Joined: May 2013 |

|

|

|

|

|

|

Nov 15 2013, 12:24 PM Nov 15 2013, 12:24 PM

|

Senior Member

717 posts Joined: Jun 2011 |

QUOTE(cybermaster98 @ Nov 15 2013, 11:34 AM) I think the bubble is already here. Its just a matter of when and how bad the burst is gonna be. Some areas may experience major drops in prices while others may only experience stagnation. i guess mature areas e.g. BU or Damansara shouldn't be affected that much but i suspect Greater KL especially will have a very major impact, especially on high-rise or office investments. |

|

|

Nov 15 2013, 12:30 PM Nov 15 2013, 12:30 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

cyber kor,

another doomsday thread? anyway, generally the article is alright. but it also clearly clarifies exemption to the yield rule eg low yield acceptable in high growth/infrastructure area. but do you also notice that some of these low yield areas are usually the ones that has the highest cap app? take landed in general, yields of 2-3% is quite norm. some even lower. ttdi landed, rental vs price? bu landed, rental vs price? if one purely looks at yield, then one can totally forget about commies as well. personally i tend to look for 4-6% yield props and 'hope' that the yield trends down to 2-3% over the years. 4-6% would suggest mature neighbourhood ;p |

|

|

Nov 15 2013, 12:31 PM Nov 15 2013, 12:31 PM

|

Junior Member

175 posts Joined: Mar 2012 |

Great but a few comments as below

•Price to Rent Ratio (or Yield) the yield has taken US as a yardstick in which current yield is extremely high after the collapse of the housing bubble. In malaysia yield is dropping. in fact it is hard to find a property in which rental can cover monthly installment. i would say 5-6% yield is reasonable based on the nett mortgage interest of 4.2%. •Relative Prices This is again has taken US as a yardstick. Generally i would have agreed to this but in malaysia property isn't just a normal roof over the head. Lifestyle property with unique selling point has been a great hit. So while i agree to take this relative prices approach, i would still consider premium price to be paid for unique product. Otherwise, there is nothing to judge the price of fernel which has been a great hit. •Affordability Totally agree with this. but affordability has also been boosted due to low interest rate in our country. It is not just depend on the GDP/ house price •Price of new builds Agree, however information is not available to us. |

|

|

Nov 15 2013, 12:48 PM Nov 15 2013, 12:48 PM

|

Junior Member

79 posts Joined: Aug 2013 |

Another sign - People queue up overnight to buy property in area they never been to... and the MRT station isn't even confirmed yet.

|

|

|

Nov 15 2013, 12:50 PM Nov 15 2013, 12:50 PM

|

Junior Member

194 posts Joined: Apr 2007 |

Not to forget about the following that add burden

1) increasing BLR (increase blr 0.50 up soon) 2) increasing Electricity (in talking to increase of 19% next year) 3) Increasing petrol (propose to uplift subsidy and free float base on market price). 4) Increasing Assesment ( in progress already) 5) Difficult to get loan 6) GST 7) Housing loan have to paid up by 10 years This post has been edited by mlpk: Nov 15 2013, 12:53 PM |

|

|

|

|

|

Nov 15 2013, 01:00 PM Nov 15 2013, 01:00 PM

|

Senior Member

1,091 posts Joined: Sep 2012 |

QUOTE(ProPStaR @ Nov 15 2013, 12:31 PM) Great but a few comments as below Interest rate can be changed at any time.•Price to Rent Ratio (or Yield) the yield has taken US as a yardstick in which current yield is extremely high after the collapse of the housing bubble. In malaysia yield is dropping. in fact it is hard to find a property in which rental can cover monthly installment. i would say 5-6% yield is reasonable based on the nett mortgage interest of 4.2%. •Relative Prices This is again has taken US as a yardstick. Generally i would have agreed to this but in malaysia property isn't just a normal roof over the head. Lifestyle property with unique selling point has been a great hit. So while i agree to take this relative prices approach, i would still consider premium price to be paid for unique product. Otherwise, there is nothing to judge the price of fernel which has been a great hit. •Affordability Totally agree with this. but affordability has also been boosted due to low interest rate in our country. It is not just depend on the GDP/ house price •Price of new builds Agree, however information is not available to us. In fact, given that it is in record lows - I (in agreement with most experts) only see it going up soon. |

|

|

Nov 15 2013, 01:20 PM Nov 15 2013, 01:20 PM

|

Junior Member

133 posts Joined: Jul 2006 |

People will always complain the high price of property. In fact, people never stop complaining about high prices. They all regret ten year later that they did not buy. This story repeats and repeats. Study the history, learn from the history.

For own stay, ability to hold is the key because the value of the house will remain unlock unless you sell the house. People are getting wiser. Gone is the low share prices during economic meltdown. |

|

|

Nov 15 2013, 01:32 PM Nov 15 2013, 01:32 PM

|

Senior Member

3,333 posts Joined: Mar 2011 |

QUOTE(mlpk @ Nov 15 2013, 12:50 PM) Not to forget about the following that add burden why housing loan need to be pay up in 10 years?1) increasing BLR (increase blr 0.50 up soon) 2) increasing Electricity (in talking to increase of 19% next year) 3) Increasing petrol (propose to uplift subsidy and free float base on market price). 4) Increasing Assesment ( in progress already) 5) Difficult to get loan 6) GST 7) Housing loan have to paid up by 10 years |

|

|

Nov 15 2013, 01:37 PM Nov 15 2013, 01:37 PM

|

Senior Member

3,274 posts Joined: May 2013 |

QUOTE(limch @ Nov 15 2013, 01:20 PM) People will always complain the high price of property. In fact, people never stop complaining about high prices. They all regret ten year later that they did not buy. This story repeats and repeats. Study the history, learn from the history. Share price would "Never" go down even during[ economic meltdown, I like that ...lolFor own stay, ability to hold is the key because the value of the house will remain unlock unless you sell the house. People are getting wiser. Gone is the low share prices during economic meltdown. Those senior & record that show KLSE is at 300++ point during late 90's must be fake, it was actually 1300 point...lol Eh.. isn't back then 1 SGD were like 1.3 something while today ehh.. 2.5 something, so share price err up or down ah? I also donno. 1300 x 2 = 1800 I supposed. |

|

|

Nov 15 2013, 01:46 PM Nov 15 2013, 01:46 PM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(ProPStaR @ Nov 15 2013, 12:31 PM) Great but a few comments as below Bro, im sure you know that sales of new launches are never a yardstick of the future capital appreciation rite? That's just the herd mentality. Sometimes the herd is right but sometimes the herd can be dead wrong. Watch National Geographic and ull see some resemblance. Fennel is a good product if investors have the holding power to go beyond 2017. If not, they are treading on dangerous water. Same as those who rushed to buy Tropicana Gardens in Kota Damansara. Many of them are very happy with their paper gains. But will these paper gains translate into actual subsale upon VP? We'll have to wait and see.•Price to Rent Ratio (or Yield) the yield has taken US as a yardstick in which current yield is extremely high after the collapse of the housing bubble. In malaysia yield is dropping. in fact it is hard to find a property in which rental can cover monthly installment. i would say 5-6% yield is reasonable based on the nett mortgage interest of 4.2%. •Relative Prices This is again has taken US as a yardstick. Generally i would have agreed to this but in malaysia property isn't just a normal roof over the head. Lifestyle property with unique selling point has been a great hit. So while i agree to take this relative prices approach, i would still consider premium price to be paid for unique product. Otherwise, there is nothing to judge the price of fernel which has been a great hit. •Affordability Totally agree with this. but affordability has also been boosted due to low interest rate in our country. It is not just depend on the GDP/ house price •Price of new builds Agree, however information is not available to us. |

|

|

Nov 15 2013, 01:47 PM Nov 15 2013, 01:47 PM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(joeblows @ Nov 15 2013, 01:00 PM) Interest rate can be changed at any time. Havent seen you around for some time. How have u been? its been a while eh? In fact, given that it is in record lows - I (in agreement with most experts) only see it going up soon. |

|

|

Nov 15 2013, 01:50 PM Nov 15 2013, 01:50 PM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(limch @ Nov 15 2013, 01:20 PM) People will always complain the high price of property. In fact, people never stop complaining about high prices. They all regret ten year later that they did not buy. This story repeats and repeats. Study the history, learn from the history. I don't see anybody complaining about high property prices (at least not on this thread). High property prices is not an issue compared to high and unsustainable prices. You need to know the difference. For own stay, ability to hold is the key because the value of the house will remain unlock unless you sell the house. People are getting wiser. Gone is the low share prices during economic meltdown. Besides, im also a property investor but a very prudent one. I was looking to purchase my 5th before end of this year but with the latest news, ive adopted a wait and see approach. |

|

|

|

|

|

Nov 15 2013, 01:52 PM Nov 15 2013, 01:52 PM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(mlpk @ Nov 15 2013, 12:50 PM) Not to forget about the following that add burden No housing loans need to be paid up in 10 years. This clause is only for the refinanced amount that's greater than the original loan amount.1) increasing BLR (increase blr 0.50 up soon) 2) increasing Electricity (in talking to increase of 19% next year) 3) Increasing petrol (propose to uplift subsidy and free float base on market price). 4) Increasing Assesment ( in progress already) 5) Difficult to get loan 6) GST 7) Housing loan have to paid up by 10 years |

|

|

Nov 15 2013, 02:35 PM Nov 15 2013, 02:35 PM

|

Senior Member

2,294 posts Joined: Sep 2011 |

i dunno but almost everyone is buying property for "investment" ... a sign?

|

|

|

Nov 15 2013, 03:28 PM Nov 15 2013, 03:28 PM

|

Senior Member

1,091 posts Joined: Sep 2012 |

QUOTE(cybermaster98 @ Nov 15 2013, 01:47 PM) Good, my friend. Btw, since you are another TTDI kaki, you may be interested: Since I informed my agent contacts that I'm looking for good-value props around TTDI, phone has been ringing non-stop with news of 2 auction units in TTDI. 1 unit 2000sf TTDI Plaza 910k 1 unit 1700sf Sinaran TTDI 950k Both non-bumi, agents desperate to do a deal. Seems like subsales is plenty slow. Those prices are close to 2010 prices IIRC..... Already viewed the sinaran one. Just next to LRT but again next to LRT track too! LOL....so got pros and cons. This post has been edited by joeblows: Nov 15 2013, 03:29 PM |

|

|

Nov 15 2013, 03:38 PM Nov 15 2013, 03:38 PM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(joeblows @ Nov 15 2013, 03:28 PM) Good, my friend. Aiyo! Not these 2 condo's la. Very poor sales / capital appreciation. Hold many years also not sure if can make any profit. These 2 condo's good for own stay only. TTDI Plaza is the worst. Bad feng shui. None of the retail outlets there are doing well. So many change of owners. Dunno what's wrong with that place. Btw, since you are another TTDI kaki, you may be interested: Since I informed my agent contacts that I'm looking for good-value props around TTDI, phone has been ringing non-stop with news of 2 auction units in TTDI. 1 unit 2000sf TTDI Plaza 910k 1 unit 1700sf Sinaran TTDI 950k Both non-bumi, agents desperate to do a deal. Seems like subsales is plenty slow. Those prices are close to 2010 prices IIRC..... Already viewed the sinaran one. Just next to LRT but again next to LRT track too! LOL....so got pros and cons. Anyway, those prices are the starting auction prices rite? Furnished or bare? This post has been edited by cybermaster98: Nov 15 2013, 03:42 PM |

|

|

Nov 15 2013, 03:57 PM Nov 15 2013, 03:57 PM

|

Senior Member

1,091 posts Joined: Sep 2012 |

QUOTE(cybermaster98 @ Nov 15 2013, 03:38 PM) Aiyo! Not these 2 condo's la. Very poor sales / capital appreciation. Hold many years also not sure if can make any profit. These 2 condo's good for own stay only. TTDI Plaza is the worst. Bad feng shui. None of the retail outlets there are doing well. So many change of owners. Dunno what's wrong with that place. Actually, not really.Anyway, those prices are the starting auction prices rite? Furnished or bare? TTDI Plaza would be my choice out of the two units (although just barely lah). With Hero Market opening up downstairs, plus general upkeep of facilities, it is really not a bad place to live for self-stay or even expat rental. The only (major) downside would be shitty parking (only 1 car park lot IIRC) and horrendous access going in and out (congested roads, bad road condition due to contstruction and idiots parking haphazardly along the road). I know as my parents own a unit there jointly with my aunt (a retiree) who lives there. Auction price is starting price, yes, but according to agent they don't expect the price to be bid up a lot due to low interest. I think the Sinaran unit could be bid up to above 1mil if you're unlucky (cos got more rental potential) but the Plaza one should not go above 950k - general consensus from agents. |

|

|

Nov 15 2013, 04:17 PM Nov 15 2013, 04:17 PM

|

Senior Member

2,347 posts Joined: Jan 2003 From: in town |

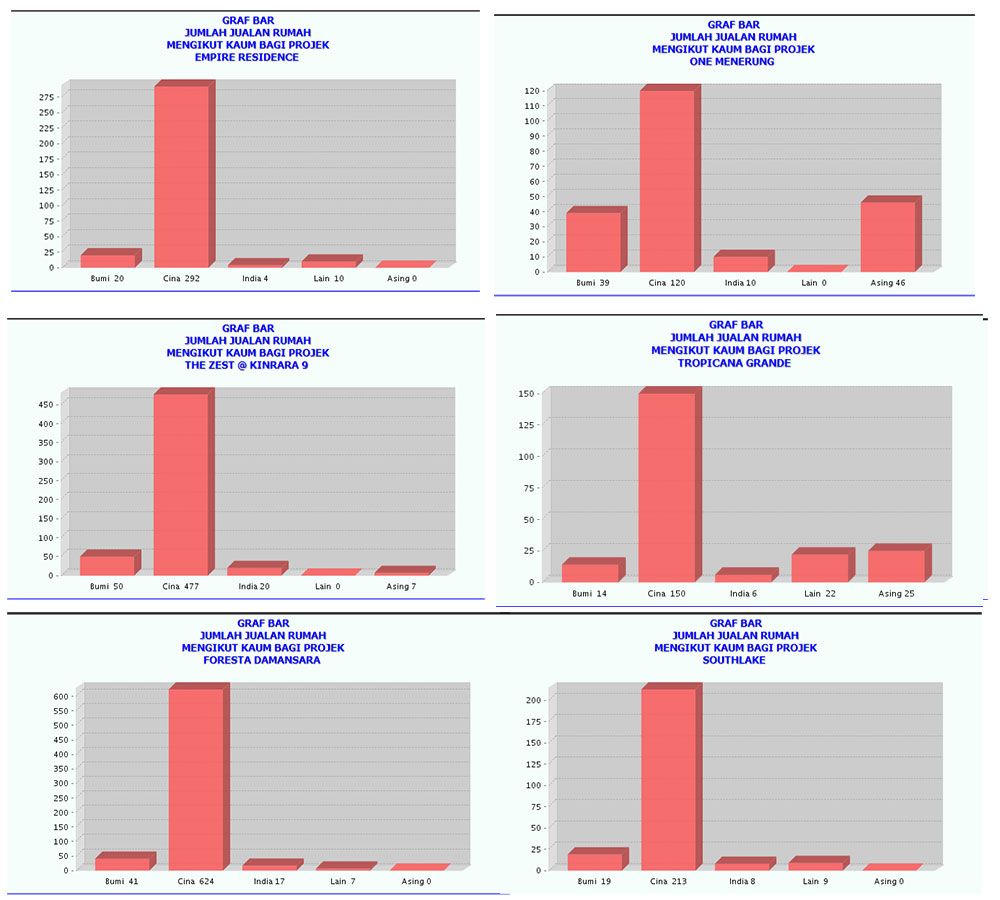

Bubble? only when Chinese run out of bullets

|

|

|

Nov 15 2013, 04:24 PM Nov 15 2013, 04:24 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

Where are the foreigners who came in by bus load? |

|

Topic ClosedOptions

|

| Change to: |  0.0255sec 0.0255sec

0.63 0.63

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 07:51 AM |