QUOTE(yklooi @ Nov 10 2019, 10:42 AM)

good that you are having about 24% of yr income in asb

if you have EPF and with EPF you will have abt 45% saved.

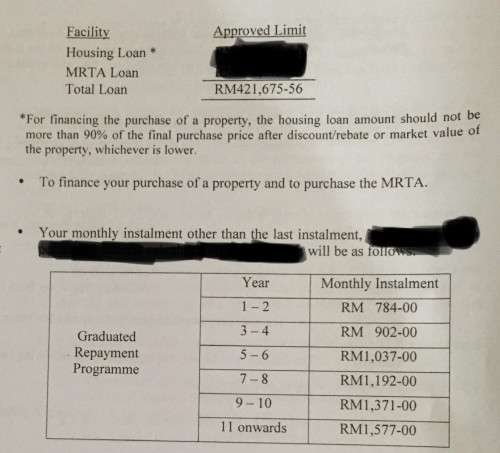

why want to increase rm200 every 2 years, max at rm1600 p.m. for your housing loan?

transferring that to ASB would yield better returns isn't it?

wow, with all that you still have a balance of 640 pm

what about income taxes?

monthly groceries expenses?

any plan to have kid(s) in the next 3~5 yrs?

is yr wife working?

parents having any insurance plans?

tax deduct about RM90 pm but since it will be refunded back, ok lo. 😅

monthly groceries didnt count in yet because long distance rship as at todate.

by next year will have a baby, so surely monthly expenses will .

my wife is working but will resign upon delivery.

parent has no medical plan.

after all, balance of rm640 hopefully enough for the baby and monthly groceries. 😅

my plan, to pay the monthly asb rm1050 using my savings of 70k. rolling that money.

so i will have extra rm1050 from my salary. is it the right thing to do?

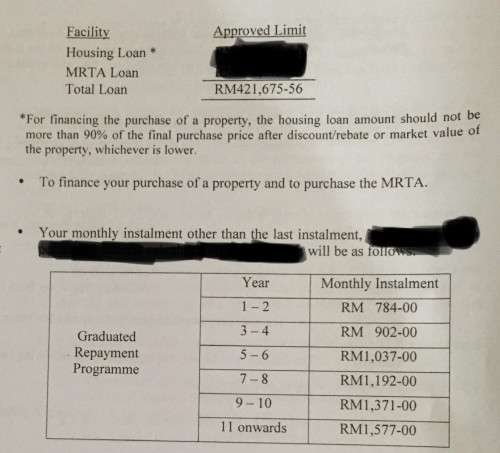

for housing loan, it is due to this.

Nov 10 2019, 04:23 AM

Nov 10 2019, 04:23 AM

Quote

Quote

0.0171sec

0.0171sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled