A good article to share , The Millionaire Next Door >

- Millionaires live frugally.

- They drive used cars.

- They buy their (used) car, instead of leasing one.

- They live in “less house” than they can afford, especially while they’re growing their wealth. Most of their neighbors are non-millionaires.

- More than half never received even $1 as an inheritance.

- Almost half never received any money for college tuition from their family.

- Nine out of 10 millionaires never received even $1 worth of ownership in a family business.

- Self-made millionaires have frugal spouses. The authors told one particularly compelling story about a husband who, -- after reviewing his net worth, announced to his wife that they were officially millionaires. The wife nods, then goes back to clipping coupons.

- Millionaires own their own business. Some have full-time jobs plus side businesses, while others are full-time business owners. “Self-employed people make up less than 20 percent of the workers in America but account for two-thirds of the millionaires,” the book says.

- They tend to own “boring,” unglamorous businesses – the type that wouldn’t create interesting cocktail party conversation. The book says: “We are welding contractors, auctioneers, rice farmers, owners of mobile-home parks, pest controllers, coin and stamp dealers, and paving contractors.”

- The one area in which they generously spend money is on their children’s education.

And, of course, my favorite observation:

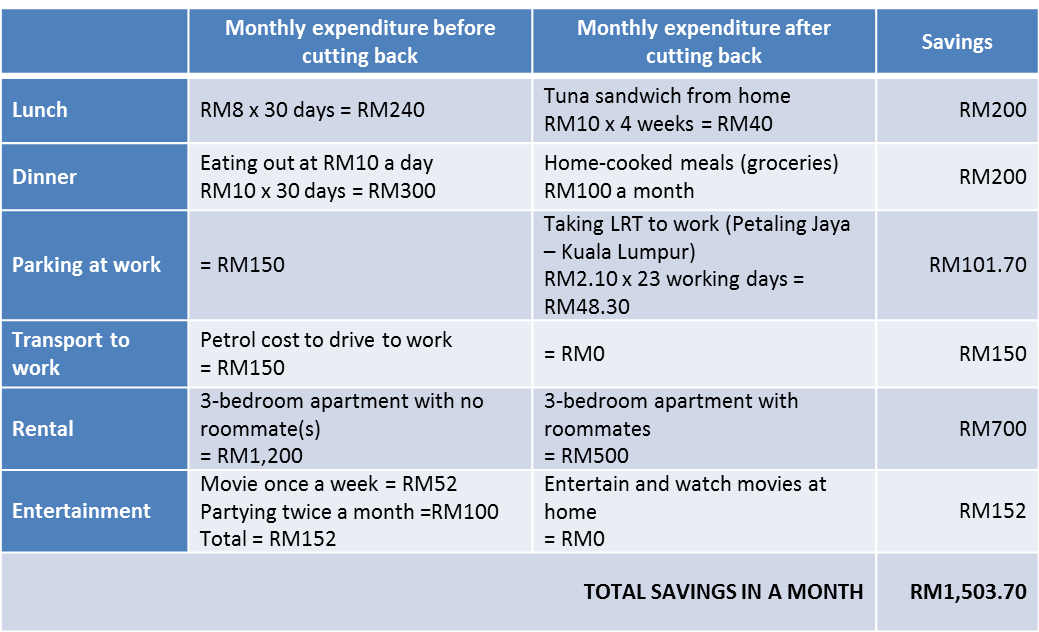

The majority of self-made millionaires budget and track every penny. They know how much they spend on groceries, gas, and every other household line-item.

The authors say:

“Planning and controlling consumption are key factors underlying wealth accumulation … Operating a household without a budget is akin to operating a business without a plan, without goals, and without direction.”

INFO,

http://budgeting.about.com/od/Why_Budget/a...ake-Budgets.htm

This post has been edited by adolph: Apr 10 2014, 06:11 AM

Personal Financial Management V3, It's all about managing your $$$

Apr 10 2014, 06:09 AM

Apr 10 2014, 06:09 AM

Quote

Quote

0.0774sec

0.0774sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled