QUOTE(zenwell @ May 18 2021, 09:44 PM)

this is not every type of investment right? where the take into account your 'profit' part as the capital. let's say if i buy stock, unless there's dividend and i reinvest the dividend, otherwise there's no way of achieving so called compounding interest right?

sorry I'm still confused as in like i understand the theory of compounding interest but in actual case, how does it happen? I currently have some funds on hand but i can only see the price of the fund i hold whether it is green/red against the price i buy in. I don't see how it can compound. please teach me sifu

Compounding interest should be more appropriately called "compounding return".

Returns come in two form: capital gain and current income. Capital gain is the price appreciation of the asset you own, current income is the dividend/rent etc, you collect in a certain period of time "explicitly".

If shares are rather abstract, think of buying property, a house for example. You buy today at 500k. 10 years later when you sell it, it won't be 500k. Maybe a few millions. The difference between the selling price of a few millions and your initial purchase price (and minus tax and other transaction cost) is your return over the 10 years.

Apart from buying and owning that house, you can rent it out too. You still own it, but by renting it out, you get some monthly cashflow. This is your rental income. The income is still a "profit" to you. So after 10 years, if you rent out your house, you get returns in the form of capital gain (price appreciation of your house), and rental income over the 10-year period.

Same goes to stock, you buy Microsoft's or Apple's shares, their prices go up over the long run, like your house. Microsoft and Apple pay dividends. That is also part of the profit (like your rental income). But Microsoft and Apple don't distribute all their profits as dividends (they retain some for capital working and investment purposes). So a portion of the profits are retained with the companies. The rest distributed as dividends.

As the years go by, profits grow, and some goes into dividends to you, and some is retained by the company for further investment, and even more profit is generated from those investment, and thus the stock price rises. Thus compounding arises because the profits earned by the company is used to generate future revenue stream/profits on top of the profits earned early. The share price rises automatically as the market (the buyers and sellers) will factor in the rise in profits.

Simple example. You invest 100 dollars in company A at the beginning of year 1. Company A earns 5% per annum (p.a.). Your capital now becomes 105 dollars. Company A does not plan to declare any dividend at the end of year 1 but instead use your money to invest in some projects that generate 5% return p.a. So after another year, (end of years 2) your money is 105*1.05 = 110.25. I can rewrite this as (100+5)*(1.05) = 110.25.

So 2 components of return, your capital of 100 dollars is generating 5% p.a. in the second year 100*1.05 = 105, but so is the 5 dollars you earn in year 1, that gives you 5*1.05 = 5.25. The 5.25 dollars is the compounded return earned from reinvestment of profits a year earlier. (Imagine doing this for 10 years. This is how compounding arises) In this case, the company does it for you, internally.

Alternatively, the company could also distribute the profit of 5 dollars at the end of year 1 to you, but then to let compounding interest to work, you will need to reinvest the 5 dollars into the company yourself. In this case you reinvest the dividends by say, buying more shares of the same company. Both cases lead to compounding via reinvestment of profits, just different methodologies.

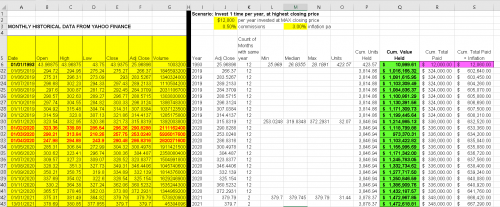

You asked for actual case, so here you go: compounding at work for Microsoft shares since inception in the late 80s.

2 lines appear in the graphs. The upper one which gives 395958.04% as the terminal value is the

total return, while the bottom one whose terminal value is 252005.42% is the

price return. The difference between the two is the dividend return (current income) over time. The astronomical numbers should demonstrate compounding at work, I hope.

An important point to note is compounding is generally a long term process, prices might go up and down because market sentiment changes every second. News, good or bad, appear every now and then. Profits fluctuate throughout the business cycle, but in the long run the trend is up, especially for blue-chip companies. Same applies for funds too, in general.

This post has been edited by TOS: May 18 2021, 10:54 PM

Sep 28 2020, 11:37 PM

Sep 28 2020, 11:37 PM

Quote

Quote

0.0270sec

0.0270sec

0.25

0.25

6 queries

6 queries

GZIP Disabled

GZIP Disabled