QUOTE(TakoC @ Oct 18 2013, 01:35 PM)

I was a bit confused with that too. Unker Looi got global exposure too I reckon, just that portfolio a little red.

cos he lump sum dump in at market top Fundsupermart.com v4, Manage your own unit trust portfolio

|

|

Oct 18 2013, 01:45 PM Oct 18 2013, 01:45 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

|

|

|

Oct 18 2013, 01:49 PM Oct 18 2013, 01:49 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(TakoC @ Oct 18 2013, 01:35 PM) I was a bit confused with that too. Unker Looi got global exposure too I reckon, just that portfolio a little red. currently i am M'sia too HEAVY EQ 34%balance funds is 30% of portfolio......needed to shift out...to US and north asia, out of Balance to EQ This post has been edited by yklooi: Oct 18 2013, 01:52 PM |

|

|

Oct 18 2013, 01:50 PM Oct 18 2013, 01:50 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Oct 18 2013, 02:09 PM Oct 18 2013, 02:09 PM

|

Senior Member

628 posts Joined: Oct 2005 |

For the current PRS promotion by FSM, if I just put a one-time lump sum of RM3000 for any of the PRS Fund, do I still need to periodically top it up, or I can just leave the RM3000 until I reach 55, irrespective of whether it is a profit or loss.

For the RM3000 income tax relief, is it only for the 1st year, or as long as the RM3000 is in PRS, I can keep claiming RM3000 every year? |

|

|

Oct 18 2013, 02:17 PM Oct 18 2013, 02:17 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(stacko @ Oct 18 2013, 02:09 PM) For the current PRS promotion by FSM, if I just put a one-time lump sum of RM3000 for any of the PRS Fund, do I still need to periodically top it up, or I can just leave the RM3000 until I reach 55, irrespective of whether it is a profit or loss. PRS is a voluntary scheme for individuals who are 18 years old and above. Under the PRS, a contributor can contribute any amount as and when he or she is able to do so, subject to a minimum initial contribution of RM100.For the RM3000 income tax relief, is it only for the 1st year, or as long as the RM3000 is in PRS, I can keep claiming RM3000 every year? tax relief is for yr 2012 to 2021, if you want to claim 3000 every year, you need to contribute 3000 yearly. http://www.fundsupermart.com.my/main/resea...?articleNo=2965 This post has been edited by yklooi: Oct 18 2013, 02:21 PM |

|

|

Oct 18 2013, 02:43 PM Oct 18 2013, 02:43 PM

|

Senior Member

628 posts Joined: Oct 2005 |

QUOTE(yklooi @ Oct 18 2013, 02:17 PM) PRS is a voluntary scheme for individuals who are 18 years old and above. Under the PRS, a contributor can contribute any amount as and when he or she is able to do so, subject to a minimum initial contribution of RM100. OK, got it. I already have EPF, so just giving PRS a thought due to the RM3000 tax relief.tax relief is for yr 2012 to 2021, if you want to claim 3000 every year, you need to contribute 3000 yearly. http://www.fundsupermart.com.my/main/resea...?articleNo=2965 |

|

|

|

|

|

Oct 18 2013, 03:03 PM Oct 18 2013, 03:03 PM

|

All Stars

10,859 posts Joined: Jan 2003 From: Sarawak |

i think no harm to put money at PRS.. i will put mine before next april

|

|

|

Oct 18 2013, 03:55 PM Oct 18 2013, 03:55 PM

|

Senior Member

1,591 posts Joined: Feb 2007 From: Auckland, NZ |

A noob question, if there is a market dip (say minus 100 points) in the market my fund has greatest exposure to, how soon will this drop reflected in unit price? T+1 ?

|

|

|

Oct 18 2013, 03:59 PM Oct 18 2013, 03:59 PM

|

Senior Member

2,081 posts Joined: Mar 2012 |

QUOTE(maldiniho @ Oct 18 2013, 03:55 PM) A noob question, if there is a market dip (say minus 100 points) in the market my fund has greatest exposure to, how soon will this drop reflected in unit price? T+1 ? NAV price on that day, which will only reflect the next 1 or at most 2 days.But the question you asked is quite subjective. A 100 points difference may not fluctuate your NAV price a lot. Unless of course the exposure of the fund is a certain region is HUGE! This post has been edited by TakoC: Oct 18 2013, 04:02 PM |

|

|

Oct 18 2013, 04:06 PM Oct 18 2013, 04:06 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

Furthermore, u also have forex to take account into.

Let's say Dow fell 2% But Ringgit weakened against USD U might even have a gain in NAV! This post has been edited by Pink Spider: Oct 18 2013, 04:06 PM |

|

|

Oct 18 2013, 11:46 PM Oct 18 2013, 11:46 PM

|

Senior Member

2,525 posts Joined: Sep 2013 |

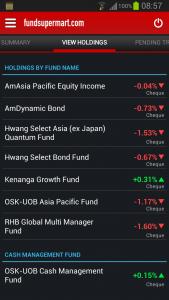

My allocation is as attached...is that healthy?

Most of the time red red..but looking long term hopefully will turn green haha All almost same distribution compared to I have a colleague who just focus on reit only...I'm using fsm.whereas he is using some osk platform he said no sales charge? This post has been edited by kkk8787: Oct 18 2013, 11:48 PM Attached thumbnail(s)

|

|

|

Oct 19 2013, 09:29 AM Oct 19 2013, 09:29 AM

|

Senior Member

3,968 posts Joined: Nov 2007 |

QUOTE(kkk8787 @ Oct 18 2013, 11:46 PM) My allocation is as attached...is that healthy? i think your colleague mean REIT stocks? as in buy from bursa?Most of the time red red..but looking long term hopefully will turn green haha All almost same distribution compared to I have a colleague who just focus on reit only...I'm using fsm.whereas he is using some osk platform he said no sales charge? |

|

|

Oct 19 2013, 10:01 AM Oct 19 2013, 10:01 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(kkk8787 @ Oct 18 2013, 11:46 PM) My allocation is as attached...is that healthy? Correct buying REIT got no sales charge .....Most of the time red red..but looking long term hopefully will turn green haha All almost same distribution compared to I have a colleague who just focus on reit only...I'm using fsm.whereas he is using some osk platform he said no sales charge? but... have to pay brokerage fee, clearing fee and stamp duty. Your friend is misleading or delusional..and IF he solely concentrate on REIT, I cannot imagine he is doing well lately. BTW Most REIT in Malaysia HAVE management fee like UT... about 0.5%-1.0% p.a. This post has been edited by gark: Oct 19 2013, 10:04 AM |

|

|

|

|

|

Oct 19 2013, 10:03 AM Oct 19 2013, 10:03 AM

|

Senior Member

1,591 posts Joined: Feb 2007 From: Auckland, NZ |

|

|

|

Oct 19 2013, 10:05 AM Oct 19 2013, 10:05 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Pink Spider @ Oct 18 2013, 04:06 PM) Furthermore, u also have forex to take account into. The storm clouds are brewing... too much bullishness in the market. Let's say Dow fell 2% But Ringgit weakened against USD U might even have a gain in NAV! "The cat has bounced high enough"... This post has been edited by gark: Oct 19 2013, 10:06 AM |

|

|

Oct 19 2013, 10:11 AM Oct 19 2013, 10:11 AM

|

Junior Member

28 posts Joined: Mar 2010 |

QUOTE(TakoC @ Oct 18 2013, 04:59 PM) NAV price on that day, which will only reflect the next 1 or at most 2 days. Yup. I agree with TakoC. Unless the fund focus highly on that particular area, otherwise the fund NAV will not have much impact. But the question you asked is quite subjective. A 100 points difference may not fluctuate your NAV price a lot. Unless of course the exposure of the fund is a certain region is HUGE! |

|

|

Oct 19 2013, 10:16 AM Oct 19 2013, 10:16 AM

|

Senior Member

1,591 posts Joined: Feb 2007 From: Auckland, NZ |

QUOTE(jasonlet5203 @ Oct 19 2013, 10:11 AM) Yup. I agree with TakoC. Unless the fund focus highly on that particular area, otherwise the fund NAV will not have much impact. Thanks all. My only fund KEnanga growth does have big exposure to Malaysia equity. Risky I think. Thanks for pink gor advice to put some in other market |

|

|

Oct 19 2013, 10:30 AM Oct 19 2013, 10:30 AM

|

Senior Member

2,525 posts Joined: Sep 2013 |

QUOTE(gark @ Oct 19 2013, 10:01 AM) Correct buying REIT got no sales charge ..... I think he said full reits...apparently safer bet he said...whereas mine higher risk.. red more than green avday. .. hopefully in long term can turn green....amdynamic not doing well Huhbut... have to pay brokerage fee, clearing fee and stamp duty. Your friend is misleading or delusional..and IF he solely concentrate on REIT, I cannot imagine he is doing well lately. BTW Most REIT in Malaysia HAVE management fee like UT... about 0.5%-1.0% p.a. |

|

|

Oct 19 2013, 10:36 AM Oct 19 2013, 10:36 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(kkk8787 @ Oct 19 2013, 10:30 AM) I think he said full reits...apparently safer bet he said...whereas mine higher risk.. red more than green avday. .. hopefully in long term can turn green....amdynamic not doing well Huh He said REIT safer bet? REIT moves up like bond during good times, fall like equities during bad times... remember this. The best risk adjusted portfolio is having a combination of equities, bonds, reits and commodities. Having only 1 type will put all your eggs in 1 basket. This post has been edited by gark: Oct 19 2013, 10:37 AM |

|

|

Oct 19 2013, 10:52 AM Oct 19 2013, 10:52 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0306sec 0.0306sec

0.64 0.64

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 05:06 AM |