QUOTE(icemanfx @ Sep 11 2013, 03:56 PM)

AyeThe Fed is like a drug pusher feeding the addicts with the drugs.

If they remove the drug, the druggie will go into CONVULSIONS and DEath.

Cant stop or else

Gold Investment Corner V7, all about gold

|

|

Sep 12 2013, 07:18 AM Sep 12 2013, 07:18 AM

Return to original view | Post

#21

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

|

|

|

Sep 12 2013, 01:54 PM Sep 12 2013, 01:54 PM

Return to original view | Post

#22

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(icemanfx @ Sep 12 2013, 12:24 PM) At the beginning of QE, gold hoarders believe the end of fiat money was in sight and now believe tapering will bring the end of economy Even at the beginning of QE, many gold bugs believe that there was NO solution to Greenspook's financial crisis.Its a case of kicking the can down the road by Bernanke. That's why they said QE to infinity. Delaying of the inevitable. I believe that they did not think fiat will end. All will be re-setted. It will just be in a different form. |

|

|

Sep 16 2013, 11:09 AM Sep 16 2013, 11:09 AM

Return to original view | Post

#23

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(icemanfx @ Sep 16 2013, 10:59 AM) Gold may drop below $1,000 for the first time since October 2009 as the Fed withdraws stimulus and the economy improves, Jeffrey Currie, Goldman’s head of commodities research, said in a Bloomberg Television interview Sept. 13. Currie issued a sell recommendation for bullion on April 10, before prices plunged 13 percent in a two-session slump ended April 15 that sent the metal into a bear market. CON-spiracy?http://www.bloomberg.com/news/2013-09-15/g...ommodities.html Home Guess Which "Bearish" Bank Bought A Record Amount Of GLD In Q2 Tyler Durden's pictureSubmitted by Tyler Durden on 08/30/2013 21:32 -0400 . In early April, the status quo was exuberant when none other than Goldman Sachs issued a "sell" on the barbarous relic that has become so indicative of the exuberance of central planning. At the time, we were skeptical (to say the least) and, just for extra Muppetting, the bank also suggested its clients buy Treasuries. Well, now that the full details of holdings changes have been released for Q2, it is perhaps clearer than ever before that as the bank was telling its clients to "sell, sell, sell" it was itself "buy, buy, buy"-ing the Gold ETF (GLD) with both arms and feet. In Q2, Goldman Sachs added a stunning (and record) 3.7 million 'shares' of GLD. As Paulson dumped his GLD, Goldman lapped it up to become the ETF's 7th largest holder.  buying what its clients were selling in size...  http://www.zerohedge.com/news/2013-08-30/g...d-amount-gld-q2 |

|

|

Sep 17 2013, 07:40 AM Sep 17 2013, 07:40 AM

Return to original view | Post

#24

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Sep 17 2013, 04:35 PM Sep 17 2013, 04:35 PM

Return to original view | Post

#25

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Sep 17 2013, 04:46 PM Sep 17 2013, 04:46 PM

Return to original view | Post

#26

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(lamode @ Sep 17 2013, 04:41 PM) holy cow... that was even before i started to trading.. No.congratz n this is so far the longest holding trade i heard of. do u have any target price in mind to let go at all? Just as when I bought, I had no target. It was the numbers and situation of the financial outlook which prompted me to go in....and that was after I started studying gold in 1999 and first bought in 2002. The present numbers and world financial situation do not prompt me to sell, just yet. |

|

|

|

|

|

Sep 17 2013, 05:08 PM Sep 17 2013, 05:08 PM

Return to original view | Post

#27

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Sep 17 2013, 05:39 PM Sep 17 2013, 05:39 PM

Return to original view | Post

#28

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Sep 18 2013, 07:19 AM Sep 18 2013, 07:19 AM

Return to original view | Post

#29

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Sep 18 2013, 07:47 AM Sep 18 2013, 07:47 AM

Return to original view | Post

#30

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(yan7 @ Sep 18 2013, 07:39 AM) hey, can i ask, how is FOMC meeting related to gold price, how to detect raise or fall for gold price if the news tell something? You are too late. They already priced in tapering in the gold price. It has already retreated $100.Next, IF you believe tapering you would have shorted gold. BUT WHOS to believe? The FEDS? The unemployment is still HIGH and the economic recovery is is.....chugging along for the last 5 years. Like Sri at CNBC said: " The Feds have put themselves into a tight corner by pre announcing Tapering" How now, brown cow Berny? They will beat gold up. |

|

|

Sep 18 2013, 10:36 AM Sep 18 2013, 10:36 AM

Return to original view | Post

#31

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(hey_there @ Sep 18 2013, 10:33 AM) where did u usually buy them? as a physical gold investor, will u afraid of the problems in selling them? does looking for buyer is a problem in liquidating ur gold? The Kijang gold coin...........no problem selling bk to Maybankbtw, 1294/oz now |

|

|

Sep 18 2013, 10:40 AM Sep 18 2013, 10:40 AM

Return to original view | Post

#32

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Sep 19 2013, 07:31 AM Sep 19 2013, 07:31 AM

Return to original view | Post

#33

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(Flex @ Sep 19 2013, 03:45 AM) No Taper. Now was that a real surprise?The Federal Reserve's September FOMC statement is out. The Federal Reserve decided to refrain from tapering quantitative easing this month, saying it wanted to see more evidence of the economic growth process before beginning a reduction in bond buying. The FOMC said tightening of financial conditions from rising rates could slow growth, and reminded everyone that "asset purchases are not on a preset course." Right now, stocks, bonds, and gold are surging, and the dollar is tanking. Excerpts taken from : http://www.businessinsider.com/september-fomc-statement-2013-9 Price of gold is currently USD1362/oz and still rising .... Economic growth indeed.......... Raise the rate and U.S will spiral into DEPRESSion.............simple as that |

|

|

|

|

|

Sep 20 2013, 08:16 AM Sep 20 2013, 08:16 AM

Return to original view | Post

#34

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(davinz18 @ Sep 19 2013, 10:16 PM) Gold Rallies to One-Week High Gold hit a one-week high on Thursday as the dollar fell after the U.S. Federal Reserve stunned markets by choosing not to cut back on its asset-buying programme for now. "If people have a view that this is a game changer for the Fed, then that may change their perception of what's good value for gold," Standard Chartered analyst Dan Smith said. "(We) are seeing that the Fed will only start tapering in March 2014 because of the change in emphasis from the labour market to inflation." Higher prices kept buyers away in Asian markets, with China closed for the Mid-Autumn Festival holiday and demand in India curbed by official restrictions on imports. India's central bank and government have taken several steps this year to curb bullion imports in an effort to reduce its record trade deficit. |

|

|

Nov 29 2013, 07:28 AM Nov 29 2013, 07:28 AM

Return to original view | Post

#35

|

All Stars

12,268 posts Joined: Oct 2010 |

The Chinese buying sooooo much gold!

October Chinese gold imports from HK massive 131 tonnes Net Chinese gold imports through Hong Kong in October exceeded 130 tonnes – the second highest figure on record and showing that Chinese demand is still rising. Author: Lawrence Williams Posted: Wednesday , 27 Nov 2013 LONDON - Far from slowing down, net Chinese gold imports through Hong Kong accelerated in October to 131.2 tonnes according to figures sent to Reuters today - the seventh month this year that China has imported over 100 tonnes of gold and the sixth in a row. Imports appear once again to be being stimulated by the lower gold prices currently prevailing. A Bloomberg comment suggests the figure was slightly lower at 129.9 tonnes and that this demand strength is also due to jewellers and retailers purchasing gold to build up stocks ahead of what is usually the peak demand season for gold purchases on the Chinese mainland and in Hong Kong itself. China net gold imports from Hong Kong 2013 to date Month (tonnes) January 20 February 61 March 136 April 77 May 106 June 102 July 113 August 110 September 111 October 131 Total year to date 967 Again this increased volume of imports through the former British Crown Colony highlights how conservative the estimated figure for Chinese gold imports via this route of 1,000 tonnes, so frequently quoted by most media, was when it was made by the World Gold Council, using GFMS figures, much earlier in the year. The statistics now show that the 1,000 tonne figure has probably been reached comfortably already now we are almost at the end of November and the likely figure for imports through Hong Kong alone this year will be more like 1,200 tonnes. This ties in strongly with the recent report from China’s biggest jewellery company Chow Tai Fook of almost doubled sales through the first half of the current year as the Chinese continue to buy gold in volume. But, as we have said before – and there is an increasing amount of evidence to support this – that China also imports gold through other routes, notably Shanghai – and that total import figures now look likely to be nearer 2,000 tonnes - some analysts put them even higher - rather than those shown by the Hong Kong figures alone. Together with China’s likely domestic gold production this year of 420-430 tonnes, Chinese annual consumption this year, on the more conservative estimates, now looks like being in the order of 2,400-2,500 tonnes, or well over 80% of the latest estimates of world new gold output this year of an increased 2,900 tonnes – the rise in global production over last year largely being because of high grading by the world’s major producers to compensate for lower gold prices. Thus gold continues to move from West to East, seemingly at an accelerating rate with China being fed by the gold bleeding from the big gold ETFs as well as from global new mined production. When are investors in the West going to wake up to the fact that if China carries on buying at current rates – and there’s no sign of any slowdown – there soon won’t be any physical gold left to trade in the traditional markets – it will all be being swallowed up by China and the other eastern consumers. If anything points to a massive price squeeze ahead this has to be it! http://www.mineweb.com/mineweb/content/en/...19660&sn=Detail |

|

|

Dec 17 2013, 02:41 PM Dec 17 2013, 02:41 PM

Return to original view | Post

#36

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Dec 20 2013, 10:00 AM Dec 20 2013, 10:00 AM

Return to original view | Post

#37

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Dec 20 2013, 10:19 AM Dec 20 2013, 10:19 AM

Return to original view | Post

#38

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(cherroy @ Dec 20 2013, 10:08 AM) Yes, QE may be tapered or end one day. YesBut it may start again in the one day in the future. Same with gold, it has its glory day from 2000 to 2013. But it has its darker day from 1980 to 2000. There is nothing or any trend last forever. Forever QE? If forever, then all the treasuries , mortgages securities in the financial market ended up in the hand of Fed. I do not fear gold price dropping, as gold has its "floor price" (just like any other commodities), the most fear is gold repeating its history, whereby I don't know have the time to wait again another 20+ years. Taper may come. It may come because a) US treasuries become junk and US blows up b) US economy licks up, jobless claims goes down' Just as the sun will rise and fall So why? This is your taper 'Taper' is the FED printing $75 Billion per month, instead of $85 Billion per month. They will create $900 Billion instead of $1,020 Billion 'thin air' US Dollars. So, at the end of 2014, the FED's balance sheet will be $4.9 Trillion instead of over $5 Trillion. OR Yellen may increase QE? and QR for ever........why should she stop and cause Deflation and Depression? WHO wants to be remembered for that? |

|

|

Jan 13 2014, 09:08 AM Jan 13 2014, 09:08 AM

Return to original view | Post

#39

|

All Stars

12,268 posts Joined: Oct 2010 |

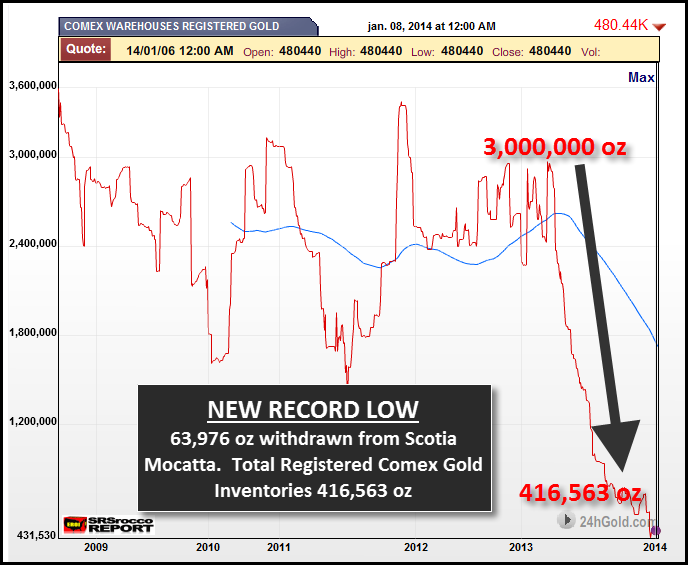

Very soon PHYSICAL gold in Comes warehouses will be a FAT ZERO!

|

|

|

Jan 13 2014, 09:26 AM Jan 13 2014, 09:26 AM

Return to original view | Post

#40

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0589sec 0.0589sec

0.35 0.35

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 03:36 PM |