QUOTE(stephdreamcloud @ May 15 2020, 10:13 AM)

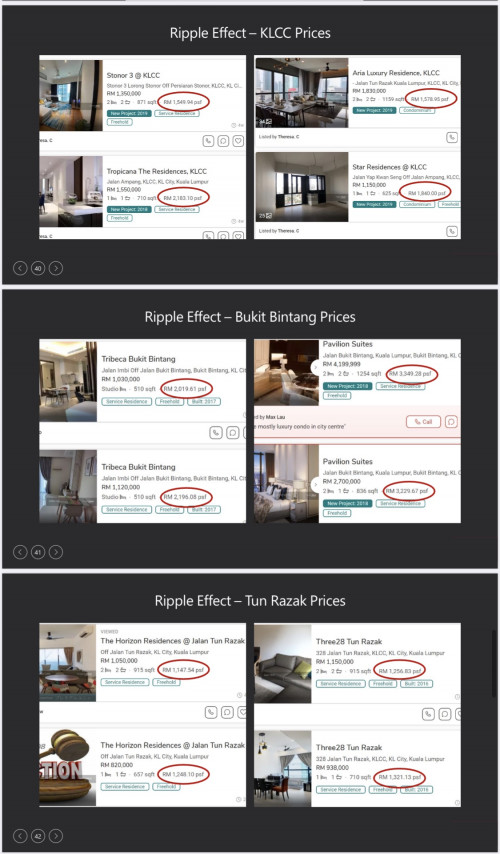

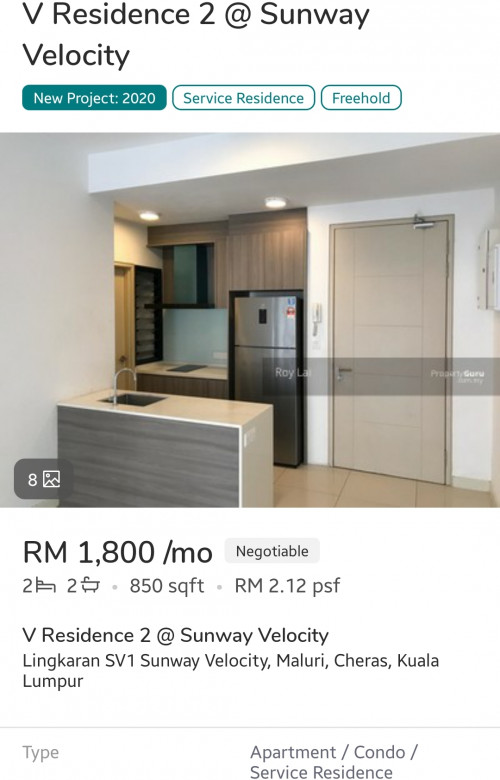

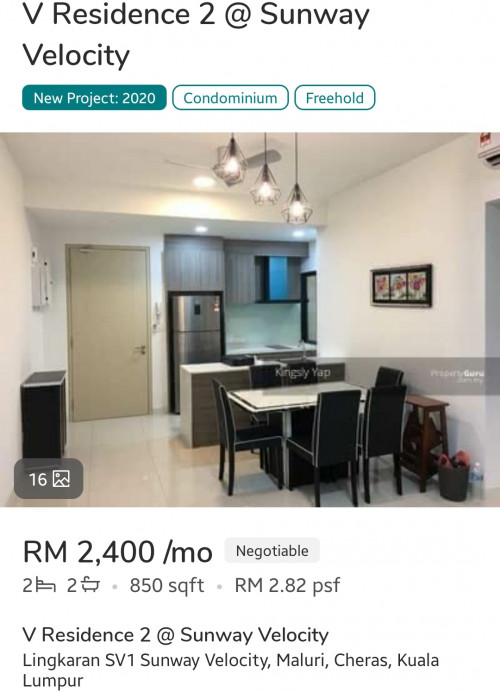

if can survey the area rental online, it's 3K+

advantage of OC is low density.

but like any good projects that's selling at fair price/below market price, it's fully booked already.

good thing is, can still join waiting list la.

advantage of OC is low density.

but like any good projects that's selling at fair price/below market price, it's fully booked already.

good thing is, can still join waiting list la.

QUOTE(stephdreamcloud @ May 23 2020, 08:52 AM)

Exaggerated1) I live near this area and it’s hard to get rent even past RM3k in current situation.

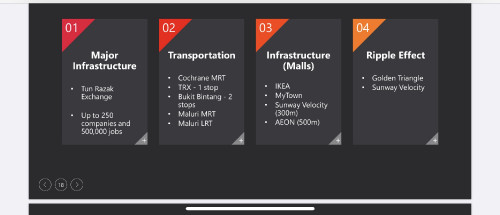

2) Why would anyone go for One Cochrane when you can have relatively better developments in Maluri like Velocity, UNA, Laville, Mira just one stop away?

3) One Cochrane isn’t pedestrian friendly. Distance to walk to MRT is relatively far (non-covered for now) and you’re risking getting

a worse deal since there’s a plot right next to it which might be phase 2 AND is nearer to MRT.

4) Maintenance fee last I checked was prohibitive. Have they revised it downwards from RM0.55 psf yet?

5) I don’t like the developer profile and backers at all. The main con is a Boustead subsidiary which is majority owned by LTAT. You can google LTAT or Boustead to know what kind of position they’re at.

May 23 2020, 01:01 PM

May 23 2020, 01:01 PM

Quote

Quote

0.0268sec

0.0268sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled