QUOTE(SPHead @ Dec 30 2020, 03:00 AM)

Nowadays, which area is good wt promise investment return? Sifu taiko here can comment a bit? Sincere to learn n listen

10years ago, rental collection can cover instalment n expenses still with xtra passive income, newly vped project recent years hardly heard of this, probly rumawip (price control) or market oversupply (similar products) now?

Klcc area not from one master developer creating everything i can see, how it goes sucess passed years?

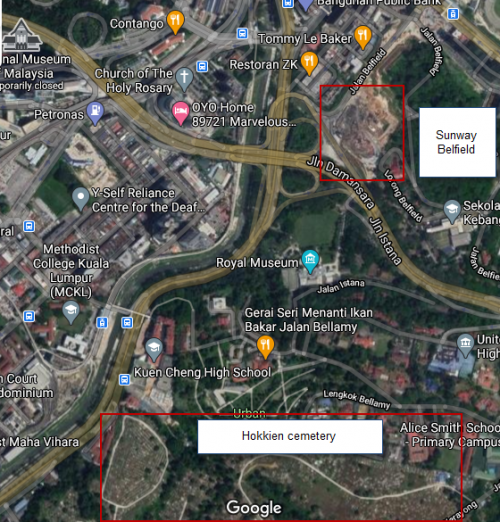

Ekocheras 😁 There are some good deal subsales that I would have considered if I didn’t already hold a unit there (prefer to diversify especially when you have limited funds...). Freehold, direct link to MRT, matured area, good food, shopping mall, cinema etc can’t go too wrong in the long run. I struggled to find another development that is as attractive as EKC in terms of pricing, connectivity, rentability, freehold and most importantly, one that I will be happy to live in, until I came across Sunway Belfield a few months ago and been waiting for its launch since.

But I won’t go as far as saying “promise investment return”. No free lunch in this world. Risk reward system tends to be quite fair, the more risk you take, the higher your potential return but downside risk is greater too. So best not to bite off more than you can chew.

Doom and gloom projections affecting the property market is a cue for taking a position. Would you rather take a position when the market is slow, depressed etc and hence lower pricing or when the market is hot with strong demand pushing the prices up?

If it was me, I’d do the former as long as holding power is there to ride the wave, in case it falls further. In stocks, there’s a saying “don’t try to catch the falling knife” but if you’re confident that the knife is of good quality based on past experience, the demand for good knives will pick up again because who doesn’t like a sharp knife in the kitchen right? Makes cooking so much more pleasurable! 😁 Maybe I’m not making money in stocks because I’m not taking my own advice haha...

In short, buy low sell high and unfortunately, you tend to be able to buy low when the market tanks or when the general market sentiment is low / fear factor is high. As long as you have strong holding power, you control the price and won’t make a loss unless you sell. Whether it’s stocks or properties, the concept can be applied equally. I prefer properties due to benefits of leverage (if understood and used properly), lower volatility, tangible, income producing (hence why location is so important to me) and adjustable (ie. unfurnished / partial furnished / fully furnished / own stay if can’t rent out etc). The one question I always ask myself is whether will I live there? I find that it helps me to decide, along with other factors (freehold, fair pricing, growth potential).

p/s nowhere near a sifu so do your own research as always 🤓

This post has been edited by ekorjiulai: Dec 30 2020, 05:26 PM

Dec 25 2020, 01:42 PM

Dec 25 2020, 01:42 PM

Quote

Quote

0.0272sec

0.0272sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled