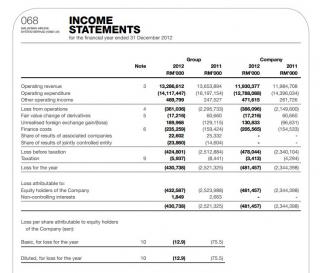

I got a question to ask all master, MAS had suffer from negative income in year 2011 and year 2012. Why still got Taxation on negative profit?? If a company losses money from operating, they still has to pay tax??

That mean they take all their available cash to cover up the tax??

PE ratio will become negative with negative earning per share(negative income from income statement) right? So, can we conclude this kind of company is not feasible to invest because it losing money from it operating.

Jun 15 2013, 12:42 AM

Jun 15 2013, 12:42 AM

Quote

Quote 0.0371sec

0.0371sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled