For anyone who interested to get the detail quotation, feel free to pm me your basic detail such as Gender, D.O.B, Loan amount, and Loan tenure so that i can get you the personalize quotation base on your need. No obligation ya.

Special rebate / appreciation token will be given for all LYN member who introduce or getting MLTA from me too!!! Please ask for more detail

Some review from some Lowyat member about my service

QUOTE(SalvationArmy @ Dec 23 2014, 01:12 PM)

Just want to say that I am a satisfied customer of onnying88.

I bought MRTA from him recently. Onn is professional, friendly, honest and helpful. Please do not hesitate to contact him if you require anything.

I bought MRTA from him recently. Onn is professional, friendly, honest and helpful. Please do not hesitate to contact him if you require anything.

QUOTE(polarzbearz @ May 6 2015, 09:30 PM)

Bought MLTA insurance policy from onnying88 around January - February 2015 and got to say he's a very honest (and responsive) agent; unlike some others which may not be as honest or as responsive as he does.

Definitely worth to get the policy from him, as he will even go to the extra miles and compare various plans (if you obtained quotation from other providers as well) and highlight the pros & cons of each, for you to choose.

Will definitely look for him for future purchases / upgrades of life / mortgage insurance

Definitely worth to get the policy from him, as he will even go to the extra miles and compare various plans (if you obtained quotation from other providers as well) and highlight the pros & cons of each, for you to choose.

Will definitely look for him for future purchases / upgrades of life / mortgage insurance

QUOTE(kent05 @ May 13 2015, 09:35 PM)

Met onnying88 on march in kulim. He drove all the way from kl just to meet up  He explained very well & in details for the MLTA policy i have requested. I bought the policy on the spot after the meet up & i'm satisfied with his service.

He explained very well & in details for the MLTA policy i have requested. I bought the policy on the spot after the meet up & i'm satisfied with his service.

--------------------------------------------------------------------------------------------------Below is some detail about pros and cons for both MRTA and MLTA for you to have better understanding for the product.

MRTA is stand for Mortgage Reducing Term Assurance.

Some bank is compulsory borrower to take this insurance when applying loan. The main purpose to get MRTA is to cover the loan amount when the borrower passed away. That's why MRTA is only cover for death and TPD (total permanent disability)

Pros of MRTA

- one time payment only (if pay by cash)

- premium can be finance into the loan

Cons of MRTA

- interest count in and your loan commitment become higher thus will lower down your borrowing quota if you finance MRTA premium into loan.

- no cash value at the end of policy

- not transferable (you need to buy again when you refinance in future, and premium will higher when your age higher)

- coverage is reducing year by year until the end (just match the loan balance)

MLTA is stand for Mortgage Level Term Assurance.

Pros of MLTA

- monthly payment

- constant premium whole tenure, if RM150/mth, 30yrs also RM150/mth

- Level coverage, meaning if you cover for RM200k, whole tenure also cover RM200k.

- Fully transferable, you may refinance or change property as much you like

- with cash value (p/s : there are few type of MLTA available that is without cash value, with guaranteed cash value and with non guarantee cash value)

- can shorten your loan tenure using the cash value you have in MLTA

- optional to add critical illness rider, personal accident rider and etc

- premium can be use for tax relief (Max RM6000 per year).

Cons of MLTA

- you have to keep paying to remain covered

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Sample quotation with given scenario as below

House price = RM400K (loan 90%)

House loan tenure = 30 years or 35 years

Property type = sub sale

DOB = 1979

Male and non smoking

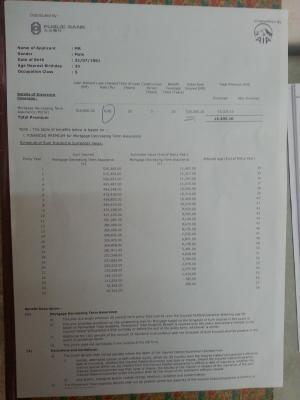

Quotation for MRTA

Age: 35 (1979)

Male / Non-smoker

MRTA cover for Death & TPD (Total Permanent Disability)

MRTA coverage of Rm400k for 30 years,

MRTA premium = RM23,832.00

If you finance the MRTA premium of Rm23,832.00.00 @ BLR-2.4% (effective 4.45%) into the loan, the monthly payment will be Rm120.05 per month. Total cost over 30 years will be Rm43,216.65

---------------------------------------------------------

MRTA coverage of Rm400k for 35 years,

MRTA premium = RM32,016.00

If you finance the MRTA premium of Rm32,016.00.00 @ BLR-2.4% (effective 4.45%) into the loan, the monthly payment will be Rm150.53 per month. Total cost over 35 years will be Rm63,221.77

Do note that if the BLR increase in future, the installment and total cost will increase too.

-----------------------------------------------------------------------------------------------------------------------

Quotation for MLTA

For MLTA type 1 with NO Surrender Value (but will have some value only if you surrender this policy earlier)

Age: 35 (1979)

Male / Non-smoker

MLTA type 1 , Cover Death & TPD (Total Permanent Disability)

MLTA type 1 coverage of Rm400k for 35 years,

Monthly premium = RM290.15

Yearly premium = RM3316.00

MLTA type 1 coverage of Rm400k for 30 years,

Monthly premium = RM237.65

Yearly premium = RM2716.00

MLTA type 1 coverage of Rm400k for 25 years,

Monthly premium = RM194.95

Yearly premium = RM2228.00

MLTA type 1 coverage of Rm400k for 20 years,

Monthly premium = RM156.80

Yearly premium = RM1792.00

--------------------------------------------------------------------------------------------------------------------

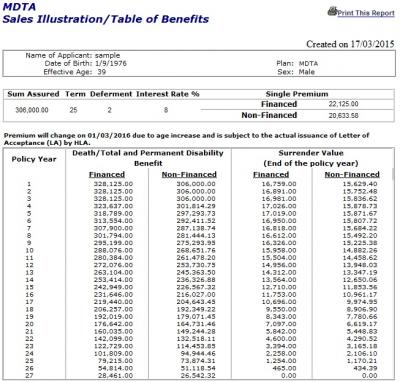

For MLTA type 2 with Guaranteed Surrender Value

Age: 35 (1979)

Male / Non-smoker

MLTA Tenure: There is NO term for this MLTA type 2 so it can be use up to age 100, just surrender this policy at any year you want to terminate or when the loan fully paid.

MLTA coverage type 2 coverage of RM400k, Cover Death & TPD only

Monthly premium = RM465.15

Yearly premium = RM5316.00

GUARANTEED

Surrender value at 40years = RM269,120.00 (total paid only RM212,640.00)

Surrender value at 35years = RM236,696.00 (total paid only RM186,060.00)

Surrender value at 30years = RM199,284.00 (total paid only RM159,480.00)

Surrender value at 25years = RM160,060.00 (total paid only RM132,900.00)

Surrender value at 20years = RM121,268.00 (total paid only RM106,320.00)

Surrender value at 15years = RM82,520.00 (total paid only RM79,740.00) <----- RM5316.00 x 15years = RM79,740.00

This MLTA type 2 surrender value will let you break even at 15 years guaranteed. Meaning you will get back what you've paid at 15 years guaranteed. Let's say if you settle the loan earlier at 15, 25, or at 35 years, you just need to surrender this policy back and you already get back more then you paid for this MLTA thus you can say you are getting FREE MLTA coverage of Rm400k and earning some extra too. And in the middle, you may refinance or change/upgrade to bigger property as you wish without burn the MLTA.

Beside you have the option to continue this MLTA until age 100 and treat this as your saving account with guaranteed return or even a extra life insurance after the loan settle.

---------------------------------------------------------------------------------------------------------------------

For MLTA type 3 with non guaranteed surrender value

(This is an investment link plan which the surrender value will base on investment fund performance thus the surrender value is not guaranteed)

Age: 35 (1979)

Male / Non-smoker

MLTA Tenure: There is NO term for this MLTA type 3 also, so it can be use up to age 100 (If surrender value is sufficient), just surrender this policy at any year you want to terminate or when the loan fully paid.

MLTA type 3, Cover Death & TPD and OAD (old age disability)

MLTA coverage type 3 coverage of RM400k, Cover Death & TPD and OAD only

Monthly premium = RM200.00

Yearly premium = RM2400.00

Projected Surrender value

At 15 years, High = Rm32,371.00, Low = Rm22,801.00

At 20 years, High = Rm48,052.00, Low = Rm28,059.00

At 25 years, High = Rm57,633.00, Low = Rm28,909.00

At 30 years, High = Rm62,970.00, Low = Rm22,879.00

At 35 years, High = Rm57,300.00, Low = Rm2504.00

------------------------------------------------------------------------------------------------------------

My suggestion for you

1) The cheapest and value for money MLTA plan for you would be the MLTA type 3 as the premium is the lowest among all MLTA option which extra benefit as below

-You only pay extra Rm49.47 per month ( MLTA type 3 of Rm200/mth - MRTA of Rm150.53/mth = Rm49.47) compare with MRTA Rm400k coverage for 35 years.

- Level coverage throughout the whole coverage tenure. Mean 35 year also cover Rm400k. (MRTA coverage decreasing each year)

- Option to continue the MLTA for when refinance, upgrade bigger house or use it as extra life coverage.

- Bonus with non guaranteed surrender value, although it's non guaranteed, it's still a bonus and better then MRTA that's guaranteed ZERO surrender value at the end of 35 years.

- Premium does not tide up with BLR so worry free for BLR rise.

- Free up your commitment as finance the MRTA premium into the loan, you are lower down your borrowing quota for future investment.

2) If the commitment is ok for you, then MLTA type 2 will be a good choice too, as you guaranteed can get back all your premium paid as early at 15 years. So you will not lose your money to get the protection of Rm400k right after 15 years. After 15 year, the longer you continue this MLTA type 2, more extra surrender value (beside your total paid) you will get back and it's black and white guaranteed.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

More sample quotation

Scenario 1

Age: 31 (1982)

Male / Non-smoker

Loan: RM250k

MLTA coverage of Rm250k for 35 years.

Sample quotation please refer to post #5

Scenario 2

-Borrower A

Age: 30 (1983)

Female / Non-smoker

-Borrower B

Age: 28 (1985)

Male / Non-smoker

-Loan RM760k

-Loan tenure 35 years

-MLTA cover for 50% or RM380k each

Sample quotation please refer to post #6

Scenario 3

Age: 33 (1981)

Male / Non-smoker

-Loan RM275k

-Loan tenure 15 years

Sample quotation please refer to post #11

Scenario 4

Age: 33 (1981)

Male / Non-smoker

-loan RM420,000 for 30 years

-loan RM480,000 for 30 years

Sample quotation please refer to post #20

Scenario 5

Age: 35 (1979)

Male / Non-smoker

-Loan RM443k

-Loan tenure 30 years

Sample quotation please refer to post #24

Scenario 6

Age: 24

Male / Non-smoker

-Loan RM600k

-Loan tenure 25 years

Sample quotation please refer to post #25

Scenario 7

Age: 27 (1987)

Male / Non-smoker

-Loan RM506,599

-Loan tenure 35 years

Sample quotation please refer to post #27

Scenario 8

Age: 31

Female / Non-smoker

-Loan RM612k

-Loan tenure 35 years

Sample quotation please refer to post #29

Regards,

Onn

017-6100337

This post has been edited by onnying88: Mar 4 2019, 04:58 PM

May 10 2013, 05:52 PM, updated 7y ago

May 10 2013, 05:52 PM, updated 7y ago

Quote

Quote

0.0556sec

0.0556sec

0.40

0.40

6 queries

6 queries

GZIP Disabled

GZIP Disabled