Mortgage Loan Package Inquiries v2, Loan agents pls read the 1st post!

Mortgage Loan Package Inquiries v2, Loan agents pls read the 1st post!

|

|

Feb 24 2021, 07:29 PM Feb 24 2021, 07:29 PM

Return to original view | Post

#1

|

All Stars

14,227 posts Joined: Jan 2011 |

|

|

|

|

|

|

Feb 28 2021, 01:14 AM Feb 28 2021, 01:14 AM

Return to original view | Post

#2

|

All Stars

14,227 posts Joined: Jan 2011 |

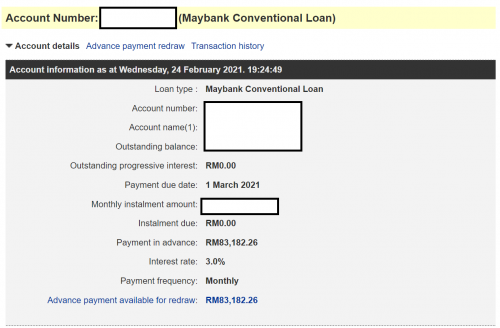

QUOTE(propusers @ Feb 27 2021, 10:49 PM) mine is also semi flexi home loan at maybank... Yes just make the payment to ur home loan account and any excess payment will be counted as advanced payment.may I know how do you do advance payment? is it normal transaction like transfer amount from saving account to the loan account via m2u website? your screenshot looks like old m2u website? Yes I am using classic m2u website. |

|

|

Mar 20 2021, 02:47 AM Mar 20 2021, 02:47 AM

Return to original view | Post

#3

|

All Stars

14,227 posts Joined: Jan 2011 |

|

|

|

Mar 20 2021, 03:00 AM Mar 20 2021, 03:00 AM

Return to original view | Post

#4

|

All Stars

14,227 posts Joined: Jan 2011 |

if my current home loan installment is around rm3k for another 32 more years to clear the loan and I can afford to pay rm6k per month for my home loan.

which ONE of the options below will help me to save the most interest? 1) refinance to a shorter tenure - says 32 - x years for a monthly installment of rm6k 2) just simply pay extra than the initial monthly installment for the amount of rm6k to reduce the interest? |

|

|

Mar 20 2021, 03:06 AM Mar 20 2021, 03:06 AM

Return to original view | Post

#5

|

All Stars

14,227 posts Joined: Jan 2011 |

if refinance with another bank vs refinance within the same bank (such as to lower the loan tenure), does refinance with the same bank will have less legal fee to pay?

|

| Change to: |  0.0232sec 0.0232sec

0.95 0.95

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 02:55 PM |