Hi.

1. Yes, the new rule is

applicable if you want to refinance from bank A to bank B

2. The GOOD news is that, you can still choose so the the repayment of the refinancing portion to be at 35-years (maximum tenure for housing loan). So that means if you have an outstanding balance of RM300k, and you need another 100k, the new loan of RM400k CAN be repaid in 35 years.

The BAD news is that, the 100k (the cash-out portion) will be

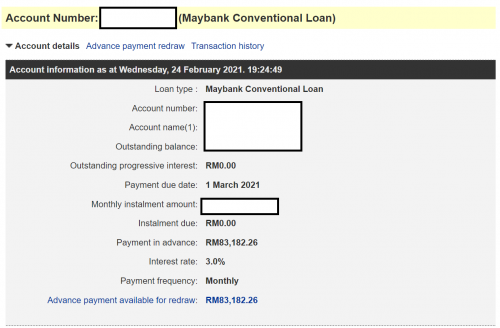

calculated by the banks as if you are going to repay it in 10 years. What does this mean? Illustration below. From the bank's view, your monthly commitment would jump from RM460 a month to RM1026 a month! This would burst your Debt-service-ratio (DSR) for most people!

However, if you do get your loan approved,

the repayment schedule for the loan will still based on the 35years tenure, for this example, your repayment for the RM100,000 cash-out portion would remain at RM460 a month and not RM1026 a month.

10-year tenure calculation

35-year tenure calculation

3. So if I get you right, your would be okay with this since the repayment would still be low, whether or not your loan would be approved is a whole different story.

Hi, nice to see your detail explaination...

I have questions here.

Let say I refinance 100k (cash out portion) in House A. All agreement signed and done case. And I need to pay RM460 monthly for House A cash out portion.

Then I wanna refinance 100k (cash out portion) in another House B. Bank will view my monthly commitment of A is RM460 or RM1026 since it was a cash out portion?

Sep 13 2013, 02:25 PM

Sep 13 2013, 02:25 PM

Quote

Quote

0.0262sec

0.0262sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled