QUOTE(AccO2324 @ Oct 9 2016, 07:03 PM)

Hi sifu..

Today I went to a completed condo project and there are still developer units available.

Loan amount after developer discount will be approximately RM550k (85% of selling price).

The sales agent mentioned that the gross salary needed is approximately RM8k to have the loan approved.

My current details are as follow, please guide me on the max. loan amount I will be able to undertake:

Age : 29

Job : Sales Exec with commission

Gross pay : RM4700 (Basic Salary RM3700 & Transport Allowance RM1k)

Nett pay : RM4100 without commission (Avg commission/mth = RM2000 - Based on 9 months data)

Rental income : None

Asb : None

Bonus 2 years total : None

Commitment : Insurance : RM500

House : None

Car : RM750

Personal loan : None

Credit card outstanding : None

Ptptn : RM300

Thank you!!

Hi there!

Based on your details provided you can loan up to 820k so purchase of 550k should be okay

Loan eligibility will varies from different banks depending on your salary

Interest rates will varies from bank to bank also depending on your loan amount.

a. If your loan amount is 400k, the current interest is 4.35%.

b. If above 500k, you're entitled to the lowest 4.3%.

Things you need to consider when buying a property

1. You need to consider legal fee cost and stamp duty to be paid when you purchase a property. Which is normally about 5% of the purchase price.

a. Determine who to include in Sales and Purchase Agreement and Loan Agreement.

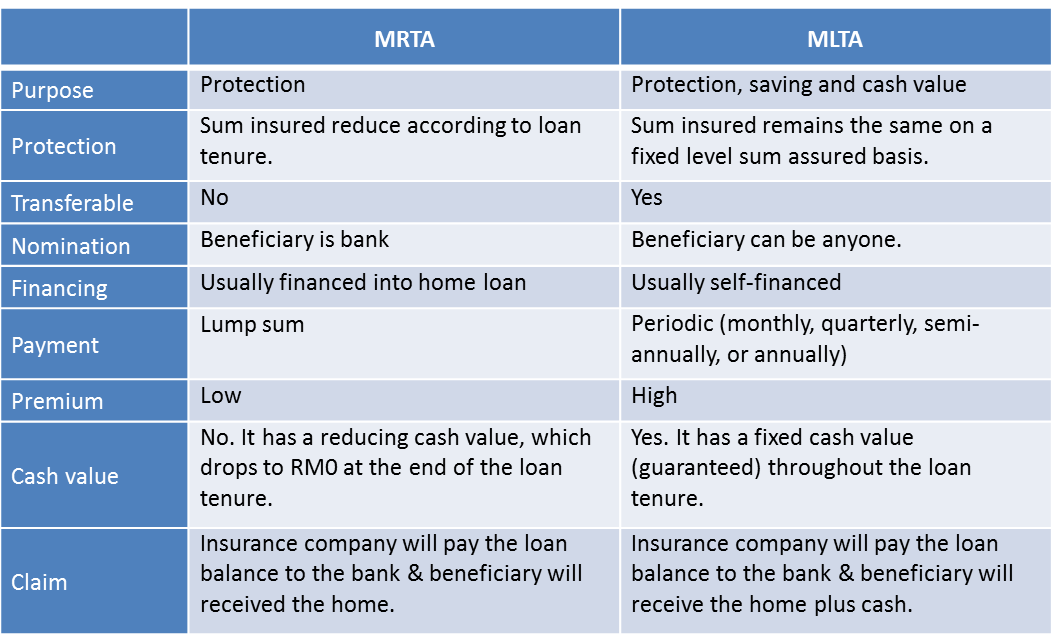

2. You need to consider mortgage insurance when you obtain your loan to secure your property in the event you are no longer around or fallen critically ill. Your mortgage insurance will pay off your loan. There is MLTA and MRTA in the market.

» Click to show Spoiler - click again to hide... «

- source from iMoney

3. I will need to analyse your personal document and check on your CCRIS and CTOS to make sure that your loan will not encounter any issue such as late payment, special attention account and bad repayment history.

4. Feel free to let me know if you have any further questions.

Sep 24 2016, 09:47 PM

Sep 24 2016, 09:47 PM

Quote

Quote

0.0277sec

0.0277sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled