QUOTE(smsbusiness2u @ Mar 8 2013, 03:12 PM)

what wrong with u? if u open this money box account ..most likely u will open FD together for 12 month with 4%.

U will no close the account either 3 or 6 months later. nobody will go to open account and close account within 3 / 6 months without any reason..

I just want to make it simple, but u go to make it so complicated...

LOLOL. I thought you said not to argue. It looks like you couldn't stop from arguing either ? Since you were the one suggested not to argue, perhaps you should lead by example and stop arguing ?

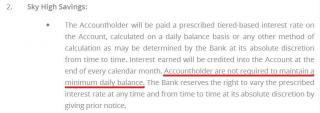

Most likely ? That's an assumption. And don't twist my questions please. There are people here that purposely open a savings/current account from Bank A just so they can enjoy the FD promotion by Bank A. Besides, i already gave the reason why but you don't get it at all, or perhaps like usual you don't bother to read other people's replies ? Besides looking for a firm answer on whether or not there is a fee to pay to close the account, be it within or after a certain period, i was also trying to find out the minimum balance for this Mach Money Box.

QUOTE(MilesAndMore @ Mar 8 2013, 02:21 PM)

The 4% 12-month FD rate offered by Mach by Hong Leong is attractive indeed. However, not everyone will deposit the maximum amount allowed under this promotional rate which is RM250,000. Some may only deposit RM50,000 or lower and all these fees (debit card annual fee, account closure fee

if any) may eat into the profit and there are other better options in the market. I have good intention here but you aren't helping at all!

You also deliberately avoiding answering my questions because you do not have a firm answer. The Mach Money Box Account is giving people the impression that it is a savings account, not a current account. However, from the fee disclosure table, it seems to suggest that it is a current account and to make it worse, it also suggest that there are two types of Mach Money Box Account. But then, from what we all know, there is only one type of Mach Money Box Account, though we are still not sure if it is a savings or current account. That is why i raised my questions here but you weren't supporting what you said with concrete evidence and instead of helping to look for an answer that is 100% reliable, you just wanted to shun people off.

And because you are not sure too, you are saying it is 3 or 6 months now ? But this morning you were confident with 3 months, then later after i raised my doubts, you changed to 6 months, and now it is 3 or 6 months ? What happened to your confidence ?

Bottom line is, i asked all these questions because the fee on account disclosure certainly IS NOT CLEAR and you shouldn't be so confident on something you are not 100% sure. So is this a savings account, basic current account or other current account ?

And for the record, Mach by Hong Leong is giving contradicting information in their Products T&C, FAQ and Products Disclosure Sheet too. In the Products T&C, it stated the minimum account opening deposit is RM200. But in the FAQ page, it stated there the minimum account opening deposit is only RM50. Moreover, up till yesterday, it is stated in the fee disclosure table that we need to pay RM1 for each ATM cash withdrawal using the debit card even it is through HLB/HLIB own ATM. But they amended this already today and it is actually free.

Luckily we have

edwardcgg who is willing to find out and share the information with us!

This post has been edited by MilesAndMore: Mar 8 2013, 05:25 PM

Mar 6 2013, 04:40 PM

Mar 6 2013, 04:40 PM

Quote

Quote

0.0516sec

0.0516sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled