Click here to Fixed Deposit Rates in Malaysia V2 Thread

Click here to Fixed Deposit Rates in Malaysia V3 Thread

Malaysia Major Commercial Banks and Foreign Banks Fixed Deposit / Time Deposit Rates as of 1st March 2013.

Bank - FD rates for 1 month, 3 months, 6 months and 12 months.

Affin Bank - 3.05%, 3.1%, 3.25% and 3.6%

Alliance Bank - 3%, 3%, 3.1% and 3.25%. FD Gold 12 months 3.3% (Interest paid monthly).

AmBank - 2.95%, 3%, 3.1% and 3.15. Am50Plus 12 mths 3.25% (Interest paid monthly, FREE PA).

Citibank - 2.8%, 2.9%, 2.9% and 3.05%

CIMB Bank - 3%, 3.05%, 3.1% and 3.15%

Hong Leong Bank - 2.9%, 2.95%, 2.95% and 3.1%

HSBC Bank - 2.75%, 3%, 3% and 3.15%

Maybank - 3%, 3.05%, 3.1% and 3.15%

OCBC Bank - 2.75%, 2.85%, 2.85% and 3.05%

RHB Bank - 3%, 3.05%, 3.1% and 3.2%.

Public Bank - 3%, 3.05%, 3.1% and 3.15%. PB Golden 50 Plus 12 months 3.25%.

Standard Chartered Bank - 2.75%, 2.9%, 2.9% and 3.05%

UOB Bank - 2.9%, 2.95%, 2.95% and 3.10%

Fixed / Time Deposit and Savings Account Promotions 2013.

Please call the nearest bank to reconfirm the rates (go to the bank website for bank contact number where you can also get the contact number of the branch nearest to you) before going to the bank to check if promotions are still valid.

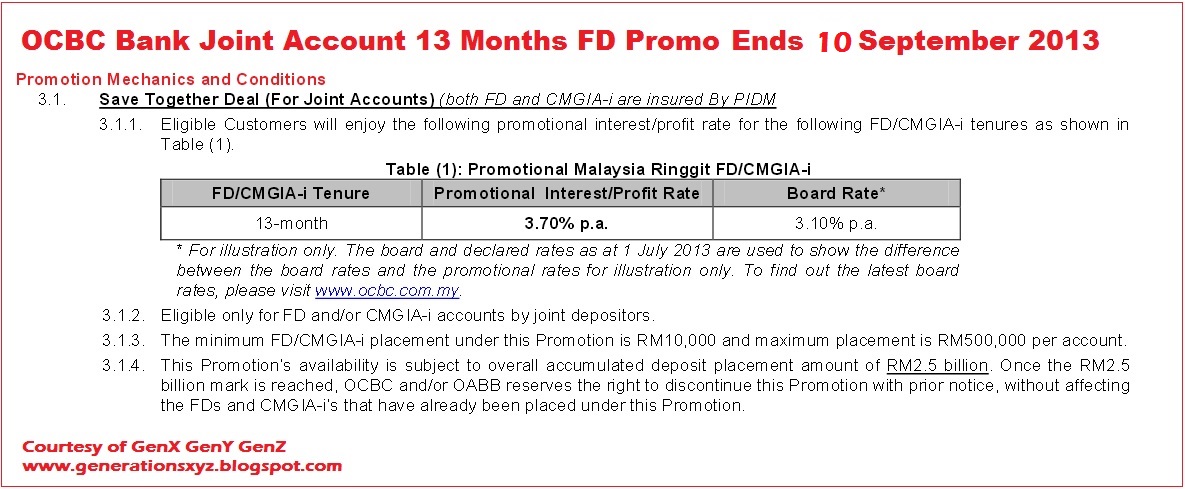

OCBC Bank FD Promo - Note: Promo Ends 10 September instead of 30th Septmeber

(Note: Special thanks to gsc for highlighting promotion date brought forward to 10/9/2013)

OCBC 3.7% 13 months Joint Account Promo

» Click to show Spoiler - click again to hide... «

*

UOB Bank Latest Fixed Deposit Promotion Rates - Minimum RM10K.

QUOTE(BoomChaCha @ Sep 2 2013, 11:25 AM)

UOB FD 3 Months Promo - Effective from 2 September to 30 September 2013

3.3% for 3 months tenure

95% of fund put in FD, 5% of fund put in CASA

Minimum deposit: RM 10K

*3.3% for 3 months tenure

95% of fund put in FD, 5% of fund put in CASA

Minimum deposit: RM 10K

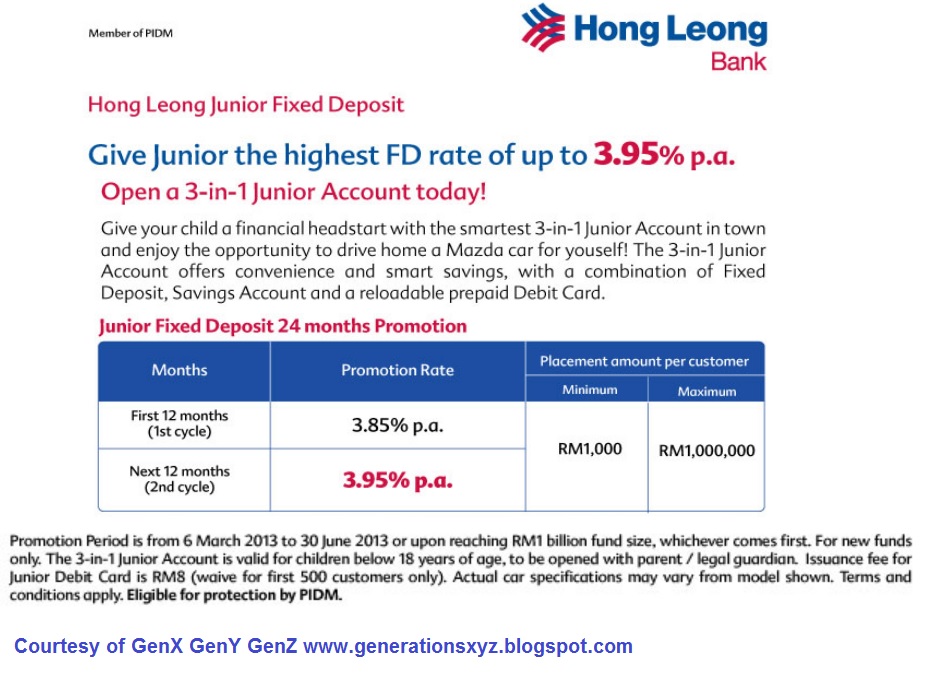

Hong Leong Bank

Note: This promo suppose to end 31 October 2013 but can't seem to find it in HLB website.

3.3% for 3 Months but 5% equivalent to FD Amount to be earmarked 3 months in CASA.

MACH by Hong Leong Bank (Online Banking) - up to 3.4% for 12 months FD. Contributed by BoomChaCha

Special Promo for Gurney MACH contributed by gsc

QUOTE(gsc @ Sep 3 2013, 06:55 PM)

Hong Leong Islamic Bank Promotion until 31 October 20136 Months - 3.3%

9 Months - 3.4%

12 Months - 3.5%

*

Kuwait Finance House -

And if you got children below age 18, you are eligible for their 3.98% "FD" Promo called Junior International Murabahah Deposit i. You will need to open a CASA account to deposit the "profit" (interest). Call them on what documents (e.g. birth cert) to bring before going to the branch. (Note: Special thanks to bbgoat for re-highlighting this promo during discussions)

Public Bank Super FD - Go read post#790 onwards or else you'll might regret once you deposit with this so call Super FD.

AMBANK 9 Months FD Promo - 3.55% - Ends 30 September 2013. Contributed by many regulars here.

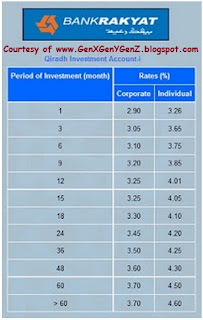

Other Similar FD Accounts - Bank Rakyat Qiradh General Investment Account-i. For those who want "interest rates" that are higher than FD Promo interest rates offered by commercial banks.

To read my comments and see more FD promos click >>> Malaysia Latest Fixed Deposit Board and Promotion Interest Rates by Major Commercial and Foreign Banks.

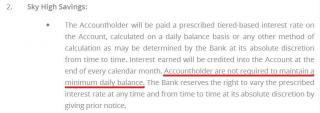

To learn more on The Best and Highest Paying Savings Account in Malaysia for Adult, Kid, Parent and Grandpa click >> The Best Savings Accounts in Malaysia

Click here to read my article titled Australia Education, Term Deposit, Savings Account and Credit Card Interest Rates In this article I have tables of interest rates from several banks in Australia and also a Table for UOB, OCBC and RHB Foreign Currecny Time Deposit Interest Rates.

Click here to read my article Premier Priority Privilege Banking Accounts. This updated revised article now include comments for OCBC Premier and StanChart Priority Banking Account.

Banker's Cheque Fee purely for FD Upliftment/Withdrawal (Do not combine with other accounts, i.e. Savings Account)

Affin - FREE

Alliance - FREE

AmBank - RM2.15

Bank Rakyat - FREE

CIMB - FREE

Citibank - RM0.15

HLB - RM5.15 (PB Customers RM0.15)

HSBC - RM5 same day or RM2 next day (no RM0.15 Stamp Duty??)

Maybank - RM5 or RM5.15?

MBSB - FREE

OCBC - FREE

PBB - RM2.15

RHB - RM5.15

SCB - RM2.15

UOB - RM0.15 (in Penang) or RM2.15 (in Klang Valley!!!???) Conflicting reports.

This post has been edited by Gen-X: Sep 4 2013, 12:38 PM

Mar 3 2013, 06:18 PM, updated 13y ago

Mar 3 2013, 06:18 PM, updated 13y ago

Quote

Quote

0.2412sec

0.2412sec

0.98

0.98

6 queries

6 queries

GZIP Disabled

GZIP Disabled