http://www.fundsupermart.com.my/main/resea...?articleNo=3294

Fundsupermart.com v2, Learn about DIY unit trust investing

|

|

Apr 1 2013, 09:55 AM Apr 1 2013, 09:55 AM

Return to original view | Post

#221

|

Senior Member

16,872 posts Joined: Jun 2011 |

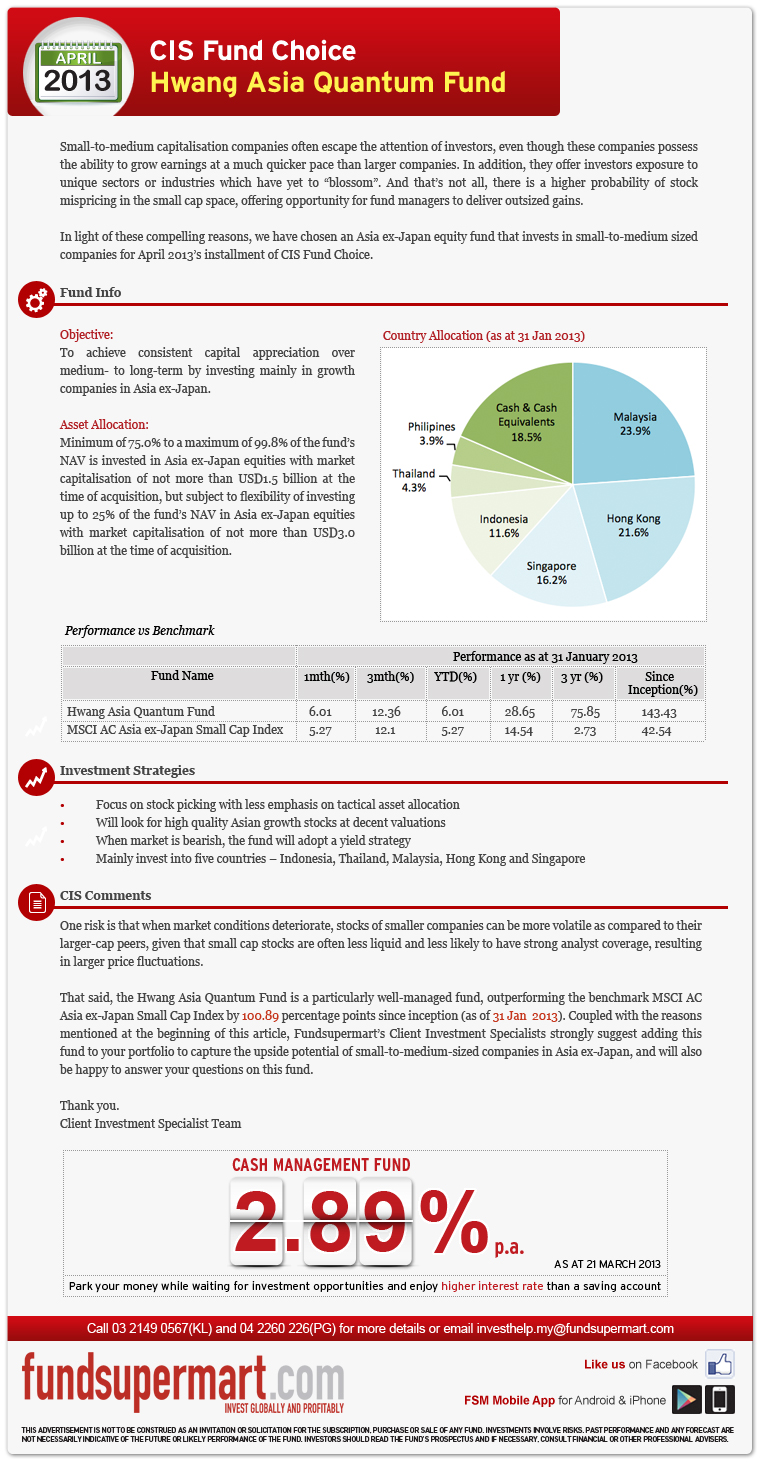

Everyone's favourite is the CIS fund choice of the month

http://www.fundsupermart.com.my/main/resea...?articleNo=3294 |

|

|

|

|

|

Apr 1 2013, 10:47 AM Apr 1 2013, 10:47 AM

Return to original view | Post

#222

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 1 2013, 11:07 AM Apr 1 2013, 11:07 AM

Return to original view | Post

#223

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(Kaka23 @ Apr 1 2013, 11:00 AM) My Hwang AQ stands 5.10% No no no, salah kira bos- Asia ex Jpn equities = 12% - Asia incl Jpn (Only Reits) = 5%% - Malaysia equities + Malaysia funds with max 30% Asia ex Jpn = 22% - Rest MY bonds approx 60% No GEM, no US, yet.. It means Hwang AQ is 5.10/(5.10 + 12 + + 22)=12.5% of your equity allocation Some analysts are bullish on Russian equities, trading at low single-digit PE. GEM exposure is essential This post has been edited by Pink Spider: Apr 1 2013, 11:09 AM |

|

|

Apr 1 2013, 12:03 PM Apr 1 2013, 12:03 PM

Return to original view | Post

#224

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 1 2013, 09:46 PM Apr 1 2013, 09:46 PM

Return to original view | Post

#225

|

Senior Member

16,872 posts Joined: Jun 2011 |

IRR for investment made less than 1 year is not meaningful la...

...and take OSK-UOB CMF out of the equation la This post has been edited by Pink Spider: Apr 1 2013, 09:47 PM |

|

|

Apr 1 2013, 10:05 PM Apr 1 2013, 10:05 PM

Return to original view | Post

#226

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(Kaka23 @ Apr 1 2013, 10:01 PM) Go for what la...macam itu Kaka got go for Lou Sang also don't wanna go find and greet me, busy cuci mata see lenglui FSM only |

|

|

|

|

|

Apr 1 2013, 10:15 PM Apr 1 2013, 10:15 PM

Return to original view | Post

#227

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(Kaka23 @ Apr 1 2013, 10:13 PM) Alamak!! I no cucu mata lei.. just makan makan. Hehe.. If this time go also makan makan! O really So many ppl lei, dont know which is you lei.. nanti greet silap orang pulak. If go, I get your mobile so can whatapp u or sms u la Anyway I'm working on that Saturday, and then doubt that they'd be talking much that we aren't already reading at FSM research articles. Go there bazir petrol and parking money saja |

|

|

Apr 1 2013, 11:30 PM Apr 1 2013, 11:30 PM

Return to original view | Post

#228

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(jerrymax @ Apr 1 2013, 11:15 PM) My equity funds CIMB-Principal Asia Pac Dynamic Income really quite popular among u guys 42.07% CIMB-Principal Asia Pacific Dynamic Income Fund 8.41% Eastspring Investments Equity Income Fund 49.50% Pacific Global Stars Fund Planning on getting other equity fund. CIS april fund choice ok ar? CIMB APDIF and PGSF both also have high % of investment in HK, SG. Getting HAQF means I focus more on HK, SG also? Soli ar, still noobish. Hwang AQF is heavy on ASEAN+HK. Consider having a bit of exposure to Emerging Markets lar. If u takut, just allocate 10% lo. Risk is high, but I believe that it'll be very rewarding. This post has been edited by Pink Spider: Apr 1 2013, 11:30 PM |

|

|

Apr 1 2013, 11:36 PM Apr 1 2013, 11:36 PM

Return to original view | Post

#229

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 2 2013, 11:59 AM Apr 2 2013, 11:59 AM

Return to original view | Post

#230

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 2 2013, 01:48 PM Apr 2 2013, 01:48 PM

Return to original view | Post

#231

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 2 2013, 05:57 PM Apr 2 2013, 05:57 PM

Return to original view | Post

#232

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 2 2013, 06:04 PM Apr 2 2013, 06:04 PM

Return to original view | Post

#233

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(bios @ Apr 2 2013, 05:59 PM) not so sure It's very unusual for a fund (even equity fund) to drop 5% in a day. Unless the fund is a very focused fund with less than 10 underlying stockholding and most of them kaboom-ed. no anouncement being put up so far.... historically the dividend date was on 31 March 2012 hope your point is true.... This post has been edited by Pink Spider: Apr 2 2013, 06:04 PM |

|

|

|

|

|

Apr 2 2013, 09:28 PM Apr 2 2013, 09:28 PM

Return to original view | Post

#234

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(kabal82 @ Apr 2 2013, 08:56 PM) Those 3 -ve funds having distribution pay out... ...the non-sifu mentioned is damn Pinky like previously mention by sifu here, if got distribution better put on hold the tracking of daily NAV value till FSM have updated ur a/c with units reinvested back to ur fund... Just freeze NAV at last day before distribution, i.e. the cum-date. Cum... Let's just say freeze NAV at the day immediately before ex-date This way, the fund having distribution won't mess up your portfolio IRR and ROI while waiting for distribution units to be credited. This post has been edited by Pink Spider: Apr 2 2013, 09:29 PM |

|

|

Apr 2 2013, 10:05 PM Apr 2 2013, 10:05 PM

Return to original view | Post

#235

|

Senior Member

16,872 posts Joined: Jun 2011 |

Chen Fan Fai's 1st blood at Eastspring Investments, a global bond fund

QUOTE KUALA LUMPUR: Eastspring Investments Bhd has launched its latest fixed income product, the Eastspring Investments Bond Plus Fund. The open-ended fixed income fund aims to provide a steady stream of income for investors by investing in a portfolio of local and foreign fixed income securities. The new fund will invest a minimum of 70 per cent of its net asset value (NAV) in fixed income securities and up to 30 per cent of its NAV in foreign fixed income securities, it said in a statement, here, yesterday. "With the prevailing low interest rates, it makes sense for investors to look into a bond fund," said its chief investment officer and country head Chen Fan Fai. He said the fund can provide investors the benefits of diversification and enhanced returns through capitalising on the higher yields available. Eastspring is one of Malaysia's largest fund management companies. It manages about RM22 billion in assets, with bonds making up about 39 per cent of the assets. The latest fund requires a minimum investment of RM1,000 at 50 sen per unit. Read more: 'Bond Plus' fund aims to provide steady income http://www.btimes.com.my/Current_News/BTIM.../#ixzz2PJZy9TSZ This post has been edited by Pink Spider: Apr 2 2013, 10:07 PM |

|

|

Apr 3 2013, 08:14 AM Apr 3 2013, 08:14 AM

Return to original view | Post

#236

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 3 2013, 01:38 PM Apr 3 2013, 01:38 PM

Return to original view | Post

#237

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 4 2013, 07:46 AM Apr 4 2013, 07:46 AM

Return to original view | Post

#238

|

Senior Member

16,872 posts Joined: Jun 2011 |

Portfolio allocation update!

Actual equity exposure should be around 37%, as Hwang Select Income Fund has about 25% exposure to dividend-yielding equities. This post has been edited by Pink Spider: Apr 4 2013, 09:48 AM |

|

|

Apr 4 2013, 07:48 AM Apr 4 2013, 07:48 AM

Return to original view | Post

#239

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 4 2013, 08:21 AM Apr 4 2013, 08:21 AM

Return to original view | Post

#240

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0499sec 0.0499sec

0.86 0.86

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 03:54 PM |