Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

soul78

|

Nov 9 2020, 10:32 AM Nov 9 2020, 10:32 AM

|

|

Is it because they dont take into account money which is taken out from Acct1 for investment. Maybe majority of the money is taken out from EPF for investment and they only see what is left inside EPF only thats why so little..

|

|

|

|

|

|

soul78

|

Feb 25 2021, 08:44 AM Feb 25 2021, 08:44 AM

|

|

QUOTE(prophetjul @ Feb 25 2021, 08:05 AM) BAD OMEN for the new CEO incoming.  EPF will be run by something akin to our monthly electricity bills from now on??... inconsistencies here and there... gone lorr.. |

|

|

|

|

|

soul78

|

Jan 26 2022, 05:35 PM Jan 26 2022, 05:35 PM

|

|

By another few years epf would be irrelevant as inflation would wipe up whatever interest rates its gives. We are already at inflation of double digits. No one country will tell your their real inflation numbers. Even US officially stated inflation at 7pct, whereas othera who are on the ground are saying its more than double digit inflation.

Energy sector especially petrol/diesel are expected to grow to 3 digits this year. Do you still think our inflation is at 2-3 pct officially now?. People are already complaining about chicken and vege price. Soon they will atart complain about the most basic flour/ wheat price which is already starting to go up in other countries due to crop failuires from climate changes.

Sorry to burst the bubble but water, energy and food shortage is just around the corner. Inflation will be worst than any taxes imposed by gomens that will wipe all your wealth away.

Things we eat now for granted will be a delicacy in future.

This years EPF if its not above 5.5 or more than 6 pct or shows at least its going up, it just tells me we are heading into a big mess in future.

Furthermore since when EPF is a government charitable society?. It just feels like we have taken over Petronas role to solve some of our big countries issue with EPF. Why is that so ?.. Coz big fat cow now is skinny one, we need new fresh blood to feed on.

I for one use to have high hopes with EPF, but now with the many stupid ideas they are dishing out to test people sentiment on tiered dividends and other silly ideas. I will only keep a minimum 1mil and take out the rest before retirement.

And once retired, depending on situation , I'll remove all and place it in steady no crap/bullshit investments that deals steady safe growth.

Yes i support kitajagakita. But not sacrificing my ownself and family to be part of the statistics to be saved when I'm old later on. You should be in a position to save yourself before you save others and not go in blindly saving others without understanding the long term impacts it has on you.

|

|

|

|

|

|

soul78

|

Feb 5 2022, 03:17 PM Feb 5 2022, 03:17 PM

|

|

QUOTE(brando_w @ Feb 5 2022, 01:01 PM) EPF is the last bastion that has not been ‘raided’ . Am not too sure if it would be the same after the next GE. By this year we will know whether they wanna fark up EPF for everyone or not. |

|

|

|

|

|

soul78

|

Mar 1 2022, 11:36 PM Mar 1 2022, 11:36 PM

|

|

QUOTE(annoymous1234 @ Mar 1 2022, 11:31 PM) Removed d. What is this la. Really got something to hide i take it not good news for EPF... expecting low returns.. in contrary to what others were expecting i guess.. |

|

|

|

|

|

soul78

|

Mar 4 2022, 08:52 AM Mar 4 2022, 08:52 AM

|

|

what if due to hyperinflation, gomens decided not to allow those with excess of 1mil to withdraw, rather now you need to be 2mil for you to be able to take out the cash.

And recommend income raised to 500k min for epf.

|

|

|

|

|

|

soul78

|

Oct 13 2022, 10:03 AM Oct 13 2022, 10:03 AM

|

|

QUOTE(MGM @ Oct 13 2022, 09:53 AM) Read somewhere it is holding bonds of Credit Suisse or Deutsch Bank which are in trouble. UK pension funds take a leverage position on 30yr old Bonds in order to get higher yields.. As pension funds they should not be leveraging... pension funds should be stable and least risky investment but Nooooooo... they want more mullahs on their monies... |

|

|

|

|

|

soul78

|

Dec 25 2022, 11:01 AM Dec 25 2022, 11:01 AM

|

|

Teka teki :

At 25, someone can already have 1.35 mil in their accounts.

How much were they being paid to be able to achieve this as such short time?.. and how early did they come out working?

|

|

|

|

|

|

soul78

|

Feb 12 2023, 02:01 PM Feb 12 2023, 02:01 PM

|

|

QUOTE(Wedchar2912 @ Feb 12 2023, 01:57 PM) why same and why diff? different managers and different mandates rite? EPF should be different..coz it has HARAMz division... if u compare with syariah compliant, mebe more of less.. but for tabung haji..err... » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

soul78

|

Feb 16 2023, 09:32 AM Feb 16 2023, 09:32 AM

|

|

after taking the above and minus some skewed data.... then 18 value points...

it came to 5.53%

let's see ktard's "wisdom of the crowd" hods up or not...

|

|

|

|

|

|

soul78

|

Feb 17 2023, 05:19 PM Feb 17 2023, 05:19 PM

|

|

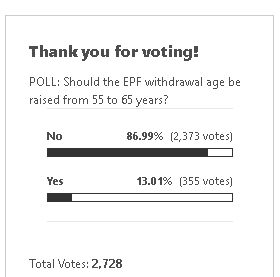

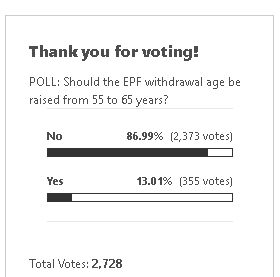

Star pool on voting age :  |

|

|

|

|

|

soul78

|

Feb 17 2023, 05:25 PM Feb 17 2023, 05:25 PM

|

|

QUOTE(Wolves @ Feb 17 2023, 05:21 PM) Waaa... Don't raise retirement age la. This is exactly what i scare lo. I already plan to withdraw one time at 50 leh. Then 55 can use kwsp as monthly living expenses. Now raise to 65 my money get stucked inside not good lo. This is why i say i scare they do this and that. Unless they let you choose then different story. That is why until now don't dare deposit in unless hit 48/49 years old.. so many ppl touch kwsp.. not good.. mebe by age 55 if no 250k min... then can't take out and work tilll 65?... if age 65 still no 500k min.... then can't take out and work till 75?... then if age 75 no 1mil.... then can't take out and work till 100?. since 250k is min amount needed to retire according to kwsp. |

|

|

|

|

|

soul78

|

Feb 22 2023, 02:11 PM Feb 22 2023, 02:11 PM

|

|

QUOTE(Human Nature @ Feb 22 2023, 01:47 PM) What is the purpose of using the term monopolizing? It is also misleading to use the term T20 in EPF context. Term monopolizing needed to be used when one feel jeles and tercabai'ed that others has more in EPF savings than others... |

|

|

|

|

|

soul78

|

Feb 25 2023, 03:13 PM Feb 25 2023, 03:13 PM

|

|

Getting stable income is not a race, it's a Marathon.

Hence final T20, M40 or B40 should not be based on current "working" household income BUT should be BASED on retirement income.

You are a true T20 , if after retirement you still have earnings be it through dividends or passive incomes of more than 10k per month.

If you hit retirement age from T20 with 1mil in EPF and your only source of income is that . it boils down to rm4.4k per month which makes you a B40!.

|

|

|

|

|

|

soul78

|

Mar 3 2023, 12:03 PM Mar 3 2023, 12:03 PM

|

|

ayam sure after 5pm announcement... so dun spook da markets... kekk

|

|

|

|

|

|

soul78

|

Apr 13 2023, 05:45 PM Apr 13 2023, 05:45 PM

|

|

Next FOMC US will hike 25 basiis points... putting the probability of that happening at 74%.

So linggit will fall?

|

|

|

|

|

|

soul78

|

Jun 8 2023, 05:38 PM Jun 8 2023, 05:38 PM

|

|

who had recently 100k lump sum into EPF?..

how was the experience?.. any issue?...

|

|

|

|

|

|

soul78

|

Jun 8 2023, 05:45 PM Jun 8 2023, 05:45 PM

|

|

QUOTE(nexona88 @ Jun 8 2023, 05:41 PM) What issues u thinking about?? Same thing only... Only difference is the limit Same style same route to self contribute.... Same timing for credit into account Issues like suddenly bank or epf call... say where money coming from? also 100k can go through FPX?. |

|

|

|

|

|

soul78

|

Sep 12 2023, 09:11 PM Sep 12 2023, 09:11 PM

|

|

Do you think they will deem dividends from retirement account as income and hence subject to income tax?... in US .... QUOTE The IRS considers retirement accounts assets, but the most common types of retirement accounts don't incur capital gains taxes. Withdrawals from IRA and 401(k) accounts get taxed at your ordinary income tax level, not as capital gains. |

|

|

|

|

|

soul78

|

Oct 13 2023, 01:59 PM Oct 13 2023, 01:59 PM

|

|

QUOTE(virtualgay @ Oct 13 2023, 01:53 PM) this is malaysia bolehland - you can join the tongkat group if you want just drop yourself to B40... i have another 10 more years before reach 60 i wanted to know if i retire and no income but i have dividend from my EPF, ASM and FD, do i consider B40 and will be given tongkat? are you saying that the moment you retire... You would need tongkat? then why wanna save in the first place if guarantee gomen will provide tongkat??... |

|

|

|

|

Nov 9 2020, 10:32 AM

Nov 9 2020, 10:32 AM

Quote

Quote

0.0502sec

0.0502sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled