QUOTE(dasecret @ Jan 26 2022, 02:04 PM)

This is going to be unpopular opinion in this forum, because I'm on the same page with the Edge's Cindy and the previous Mr Thomas.

People tend to react negatively to this sort of suggestion for a simple reason, all private sectors employees are vested in EPF. As soon as they hear their returns will be lower, they just shut off their mind and insists it's a terrible terrible idea. So I understand where you came from. But maybe you have not understood where the likes of Cindy and Thomas are thinking.

Well, before you start bashing me, I want you to do one thing - Pretend this is not EPF for a moment, it's a pension fund in another country with similar income disparity and aging population. Pretend you are running that pension fund, or running that country. What is best for the country, not what is best for an individual depositor.

Not every forummer would be able to do that, I've accepted the fact. But I hope you rise up to the challenge, and really use an objective mind to look at what I have to say

My suggestion would be taking some ideas from Cindy and Thomas, and added my own twist to it.

1. There would be a "bonus" dividend for those depositors having less than basic savings set by EPF at their age - This is a concept borrowed from Tabung Haji dividend distribution. It could be 3-5% and will give a boost to those who are not earning as much, and the power of compounding is going to work to the advantage of the younger population who are not making as much as they are expected to be able to have sufficient retirement savings. It also reduces the low income earners' urge to withdraw from EPF at every chance they have.

2. How to fund the extra dividend for (1)? For every RM above RM1million savings per depositors, they will get 1% less dividend than the dividend rate declared for that year. These people have the ability to withdraw at anytime, they are basically treating EPF as their personal investment manager without having to pay for it. This is the best risk free capital guaranteed, min 2.5% guaranteed return product you would ever find in Malaysia. Sure, the rich put their money elsewhere, but they also put some of their money in EPF as a replacement of FD. Remember - they can withdraw these savings ANYTIME, EPF had to keep buffer in cash because of these people and dragging down the returns. So it's not to OUR advantage that the rich keep a lot of money in EPF

3. You may ask, how can that 1% reduction in the rich's returns give 3-5% extra returns to those with less than basic savings? Well, because the rich are keeping so much money in EPF currently; and I dare say, even if this is implemented, most will still keep their money there as it's still higher than commercial banks. currently EPF targets inflation rate + 3% returns on 3 years rolling and it's really good for almost risk free investment

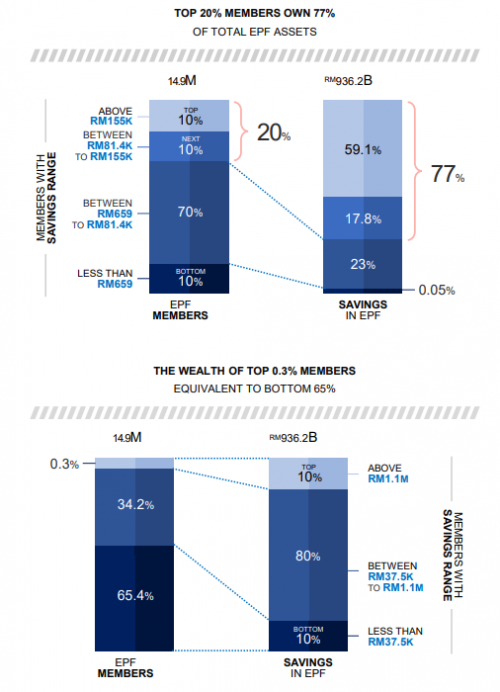

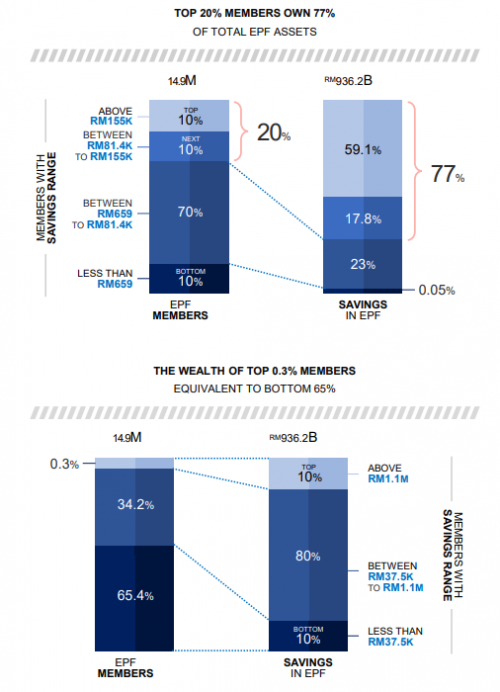

Only 0.3% of the depositors need to take this 1% hit actually and benefit more than 70% of the depositors. Sounds like a good impact to a country, no? Fairer distribution of income.

4. Many of you felt that these low deposit balance people "deserved being poor", or "did it to themselves". I tend to disagree, but I do feel that there need to be better social safety net to "help people help themselves"

How about this? In conjunction with the implementation of (1), which adds money to their account, it comes with a condition that at the retirement age, the amount below basic savings are retained to be put into annuity scheme, where they get paid an income on monthly basis, it's probably very little, like RM2000 or so with RM240,000 basic income at 55 yo. This is similar to what CPF had implemented a few years ago and it's again a necessary but unpopular move that EPF had shy away due to public negative reactions.

Why is this annuity scheme important? Obviously too many people spend the retirement savings soon after they took all of it, and research shows that poor people make poor decisions because of their circumstances, sometimes they couldn't help it, so it's necessary for policy making to take that into consideration.

Now, back to you as one of EPF depositor, why should you not react negatively to EPF giving more returns to the poor than the rich when you belong in the "rich group"?

Because, believe it or not, we pay for these poor people who have not enough retirement savings one way or another. If we don't pay for it in the form of lower EPF returns, we will pay for it in taxes (could be inheritance tax, capital gain tax, GST etc), or our future generation will pay for it, in both $$ and doomed future because the country is no longer competitive

For anyone who read all the way here, thank you

You can now start bashing me

Such tiering policy is unfair if no taking into age and employment status of EPF members. How do you address the situation below:

P1 - Age 30 with active annual income 84K, EPF below 50K.

P2 - Age 45, jobless for years, retrenchment due to severe impact of covid, EPF with 1mil (likely proceed for withdraw >1mil, pose higher risk if not well versed in investment)

P3 - Age 55, retired, EPF with 1mil (likely withdraw tiering introduced, subjected to higher risk if not well versed in investment, or placing into FD for meager 2% return, retirement plan affected)

Is tiering dividend is really helping those needs or causing more problem to savers (P2, P3)?

Beside, all these policy shall inform upfront and allow impacted members hv flexibility to withdraw the exceed. If introduced it abruptly, it going to be a mess.

However, if tiering start let says at 500K, such system will double tax the saver (income tax + indirect tax on EPF), more trying to withdraw money when they meet eligible criteria for education, housing, health issue etc.

All in, once more ppl losing faith on EPF, it trigger much higher withdrawal, it causing more long term damage to EPF investment strategy as they need cashing out at much higher rate.

Who going to absorbs government bond, main GLC linked company share like TNB, banks etc in short period of time? Try to see the bigger picture, don't try to save some trees but end up losing a forest without understand full spectrum of problems, but rush into decision.

edited: p/s: Pls be reminded those with higher contribution in EPF are faithful taxpayers (regardless like it or not as its trackable). Many real rich are outside of EPF system (fancy biz accounting with help of tax accountants).

This post has been edited by return78: Jan 28 2022, 11:19 AM

Jan 29 2018, 02:53 PM

Jan 29 2018, 02:53 PM

Quote

Quote

0.0425sec

0.0425sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled