Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

pearl_white

|

Jan 27 2016, 03:08 PM Jan 27 2016, 03:08 PM

|

Getting Started

|

Don't speculate and make conjectures without supporting data. The very least, you have some past data to make a prediction/forecast. These data and secondary data can be derived from their annual reports.

Estimated Income for 2015 (incl. other income) - RM38.5billion (assuming Q4 2015 RM7bil)

Historical Net Income % margin (net of taxes and zakat) 95%

Historical contributor reserve increases - RM65bil (2014 60bil + RM5bil)

Closing EPF contributions in 2014 - rm598bil

Closing estimated contributions in 2015 - RM598bil + RM65bil =RM663bil

Estimated EPF payout to contibutors

Net Income (net of taxes and zakat) divided by average (2015 + 2014) contributor balance

= 38.5 * 95% divided by (663+598)/2

= 36.575 divided by 630.5

= 5.8% (Dividend for 2015)

Sensitivities

- Q4 2015 actual income - huge impact

- Contribution increases - huge impact

- Net income margin - minimal impact as historical hovers between 95%-96%

This post has been edited by pearl_white: Jan 27 2016, 03:10 PM

|

|

|

|

|

|

pearl_white

|

Feb 16 2016, 10:01 AM Feb 16 2016, 10:01 AM

|

Getting Started

|

It has been officially confirmed that 2015 dividend for EPF would be "COMMENDABLE". COMMENDABLE in light of tough economic conditions that is.

Based on previous calculations at 5.8% and + any balance of undistributed % (i.e. reserves), I would deduce that it will definately be less than 6.75% (2014) and may be more than 6.25% (2013).

I put the finger on 6.0% to be prudent. COMMENDABLE in light of tough economic conditions.

|

|

|

|

|

|

pearl_white

|

Feb 20 2016, 04:02 PM Feb 20 2016, 04:02 PM

|

Getting Started

|

If it is really 6.4% as speculated, tho in previous calculation it is possible if they use their reserves, i would like to see the Q4 results and look for the amt. of the impairments made. Understating impairments would yield another rm1bil in profits.

if they really use up the reserves, alot of question would be raised and next years' dividend would be bad.

|

|

|

|

|

|

pearl_white

|

Dec 23 2016, 02:43 PM Dec 23 2016, 02:43 PM

|

Getting Started

|

Selling FGV only materialises the loss now.

But in the books, provisions for investment impairments have been made in prior years.

Hence, the loss has been taken into accounts ended 2015. So, it will not affect 2017 dividend.

Based on culmulative performances of Q1 to Q3 2016 EPF results, the estimated dividend rate is < 5.5%

However, because of the strong dollar, we could see massive revaluation reserves, unrealised forex gain in the year end accounting.

So, my guess is 5% - 6% next year.

|

|

|

|

|

|

pearl_white

|

Feb 4 2017, 06:46 PM Feb 4 2017, 06:46 PM

|

Getting Started

|

Please do some analyses rather than hope, predict, pray or benchmark others. QUOTE(pearl_white @ Dec 23 2016, 02:43 PM) Selling FGV only materialises the loss now. But in the books, provisions for investment impairments have been made in prior years. Hence, the loss has been taken into accounts ended 2015. So, it will not affect 2017 dividend. Based on culmulative performances of Q1 to Q3 2016 EPF results, the estimated dividend rate is < 5.5% However, because of the strong dollar, we could see massive revaluation reserves, unrealised forex gain in the year end accounting. So, my guess is 5% - 6% next year. |

|

|

|

|

|

pearl_white

|

Feb 5 2017, 11:05 AM Feb 5 2017, 11:05 AM

|

Getting Started

|

And what many ppl do not realise, time and time again, the newspaper reports about epf selling their london properties are meant to re-inforce the re-valuation. So do the likes of KWAP. QUOTE(pearl_white @ Feb 4 2017, 06:46 PM) Please do some analyses rather than hope, predict, pray or benchmark others. |

|

|

|

|

|

pearl_white

|

Feb 16 2017, 05:58 PM Feb 16 2017, 05:58 PM

|

Getting Started

|

Gross investment income (top line only, excl. other income and incomes)

Q1 2016 = RM6.78b

Q2 2016 = RM8.44b

Q3 2016 = RM12.32b

Q4 2016 = RM10.00b (assumed)

Total gross investment income 2016 = RM37.54b

Total net profit for 2015 = RM44+b (payout 6.4%)

So, assuming 1:1 correlation, 37.54/44 * 6.4% gives 5.40% (to nearest 2 % points)

Potential upsides that will be adjusted in a/cs -

Re-valuation on properties (UK) - +RM2b

Reduction in impairments - RM1b

Forex gains - RM0.5b

it will be rm40.54b, leading to a 40.54/44 * 6.4% = 5.9%

Taking into account for other incomes and net of expenditures + Zakat, say RM1b, then you may have = 6.05%

so, the estimate will be 5.8% to 6.1% for 2016.

|

|

|

|

|

|

pearl_white

|

Feb 19 2017, 09:08 AM Feb 19 2017, 09:08 AM

|

Getting Started

|

5.7% for 2016.

waiting for details tomorrow.

|

|

|

|

|

|

pearl_white

|

Feb 7 2018, 12:51 PM Feb 7 2018, 12:51 PM

|

Getting Started

|

The consequences of a higher % from Islamic vs. Conventional EPF or vice versa would be a political timebomb.

|

|

|

|

|

|

pearl_white

|

Feb 7 2018, 01:01 PM Feb 7 2018, 01:01 PM

|

Getting Started

|

Gross investment income (top line only, excl. other income and incomes)

Q1 2017 = RM11.80b

Q2 2017 = RM11.51b

Q3 2017 = RM12.95b

Q4 2017 = RM12.00b (assumed)

Total gross investment income 2017 = RM48.26b

Taking into account of potential upsides in revaluation reserves, impairments, forex gains and zakat and net profit ratios of past trends and payout,

The outcome is about 6.9% - 7.3%.

Gross revenue 2017 is definately a blockbuster since all quarters are double digits compared to prior years!

This post has been edited by pearl_white: Feb 7 2018, 01:02 PM

|

|

|

|

|

|

pearl_white

|

Feb 17 2019, 11:22 AM Feb 17 2019, 11:22 AM

|

Getting Started

|

Looks like many are happy with the dividend declaration of 6.15%. However, many do not read the accompanying statement/press release from EPF.

Effective 1st January 2019 and the adoption of MFRS9, EPF will no longer provide for impairments to its investments. (note : if there were impairments for example, it would be recognised in the statement of comprehensive income and not the current year P/L).

The dividend rate would be much much lower if this had not been the case.

|

|

|

|

|

|

pearl_white

|

Jan 29 2020, 09:44 AM Jan 29 2020, 09:44 AM

|

Getting Started

|

Based on info from unaudited accounts, 3.8% to 4.5%.

|

|

|

|

|

|

pearl_white

|

Jan 29 2020, 03:59 PM Jan 29 2020, 03:59 PM

|

Getting Started

|

Layman comparison.

Gross Investment Income (RM'bil)

Q1 2018 - 12.88

Q2 2018 - 12.39

Q3 2018 - 14.61

Q4 2018 - 11.00

------------------

Total - 50.88

Gross Investment Income (RM'bil)

Q1 2019 - 9.66

Q2 2019 - 12.32

Q3 2019 - 13.50

Q4 2019 - 10.00 (est)

------------------

Total - 45.48

Note : 2019 Have to adopt MFRS 9 (impairments of investments). 2018 was not adopted.

So, off the cuff maths, (45.48 / 50.88 ) * 6.15% = 5.5%

5.5% is before MFRS 9 and also new contributors contribution to the total contributor pool to the total existing funds in EPF. This also assumes all financial ratios for its operations remain the same.

This post has been edited by pearl_white: Jan 29 2020, 04:03 PM

|

|

|

|

|

|

pearl_white

|

Jan 30 2020, 09:46 AM Jan 30 2020, 09:46 AM

|

Getting Started

|

People just are either blind, biased or don't read properly.

1st post - based on info on unaudited accounts - 3.8% - 4.5%

2nd post - based on layman - 5.5%

Don't bother to think a little while how to from 5.5% can become 3.8% to 4.5% before typing.

|

|

|

|

|

|

pearl_white

|

Feb 17 2020, 01:56 PM Feb 17 2020, 01:56 PM

|

Getting Started

|

Forget about any announcement this month.

Most likely in June 2020 for dividend announcement.

|

|

|

|

|

|

pearl_white

|

Feb 20 2021, 05:16 PM Feb 20 2021, 05:16 PM

|

Getting Started

|

QUOTE(netcrawler @ Feb 20 2021, 04:54 PM) Already know the dividend is 5.05%? I do not see the relation of net surplus from investments to i-sinar since surplus is not cash available to distribute anyway. Maybe the person who made the 5.05% should explain. The entire finance community theories/concepts of finance would have to be reviewed after with this 5.05% revelation. Everyone who is in finance would have to go back to school to relearn everything. This post has been edited by pearl_white: Feb 20 2021, 05:17 PM |

|

|

|

|

|

pearl_white

|

Feb 22 2021, 10:21 AM Feb 22 2021, 10:21 AM

|

Getting Started

|

QUOTE(plumberly @ Feb 22 2021, 10:04 AM) Feeling worried too. I am quick to add 1 and 1 together to get 11. As it is late and after CNY, sensing that it might be lower than expected (expecting at least 5%) AND also the implementation of the tiered dividend. Waiting for the new top guy before the announcement? Yes. |

|

|

|

|

|

pearl_white

|

Feb 27 2021, 12:27 PM Feb 27 2021, 12:27 PM

|

Getting Started

|

Sigh...Got nearly RM150k as dividends....Poor performance, Q4 2020 must be bad despite good stock market closure. Off by RM30k  This post has been edited by pearl_white: Feb 27 2021, 12:28 PM This post has been edited by pearl_white: Feb 27 2021, 12:28 PM |

|

|

|

|

|

pearl_white

|

Mar 2 2022, 01:40 PM Mar 2 2022, 01:40 PM

|

Getting Started

|

Based on 6.15%, I shud have rm220k dividend. But it doesn't appear yet in my 2021 statement

Are all your statements showing any dividends?

|

|

|

|

|

|

pearl_white

|

Mar 3 2022, 08:34 AM Mar 3 2022, 08:34 AM

|

Getting Started

|

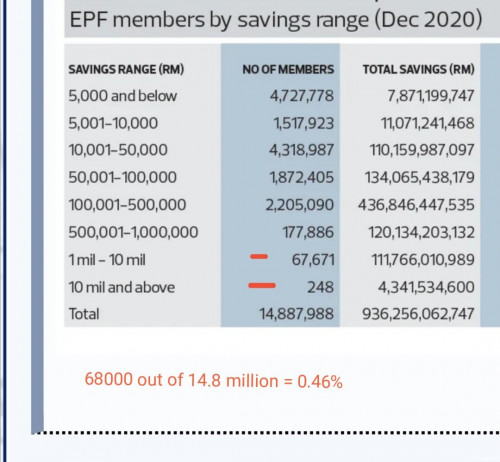

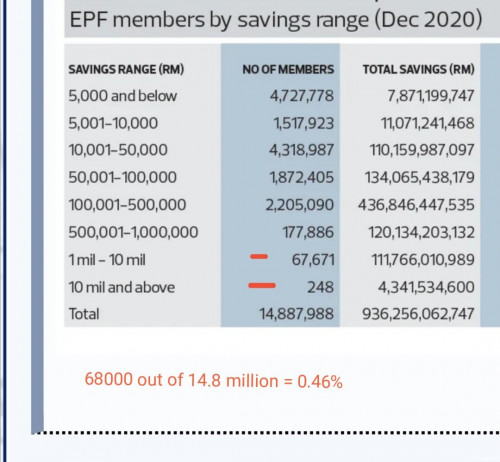

The tiered dividends would have to be above returns for FD rates, what basis for that rate depends, eg. choice of 1, 2 years effective rate. Otherwise, ppl would just pull out. On the other hand, it must be worth noting that if EPF were to tier it, does it also mean that other types of funds would tier it eg. ASB? And when you look at the composition of members savings, the numbers of >RM1 million are insignificant in member size and its value to total portfolio value is small.  EPF can afford and lose these members if they implement it. The question is, can you alter your monthly contributions (employee/employer) should you chose to cap it at <RM 1million? Possible to refuse to contribute? This post has been edited by pearl_white: Mar 3 2022, 08:43 AM |

|

|

|

|

Jan 27 2016, 03:08 PM

Jan 27 2016, 03:08 PM

Quote

Quote

0.0493sec

0.0493sec

0.65

0.65

7 queries

7 queries

GZIP Disabled

GZIP Disabled