Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

GrumpyNooby

|

Nov 2 2020, 07:20 AM Nov 2 2020, 07:20 AM

|

|

Challenges with retirement savings in a pandemic A recent landmark global retirement study shows mixed results for Malaysia’s retirement and pension prospects. This is a problem because the country is just a decade away from ageing nation status. Simply put, as the population grows older, the need for sustainable, long-term retirement funds is going to become that much more important. This concern has been exacerbated by the Covid-19 pandemic and the damage it has done to individuals and businesses. https://www.theedgemarkets.com/content/adve...s-in-a-pandemic

|

|

|

|

|

|

real55555

|

Nov 3 2020, 09:32 AM Nov 3 2020, 09:32 AM

|

|

QUOTE(cybpsych @ Oct 31 2020, 08:14 AM) EPF: Don't touch your Account 1 savings, says CEOhttps://www.thestar.com.my/news/nation/2020...avings-says-ceoPETALING JAYA: The Employees Provident Fund advised its members' against withdrawing savings from Account 1 to address the challenges brought on by Covid-19. ... Alizakri said that allowing members to withdraw from Account 1 could damage their future well-being and advised members to approach EPF's Retirement Advisory Service (RAS) officers to help plan their finances as they deal with current challenges. He said accessing funds in Account 1 should not be the only way for members to weather difficult times as the government has provided numerous means of direct financial assistance. Yes he is right. I cannot see people will put back the money they withdrawed from account 1, plus the compounding effect means even if you put back a bigger amount a few years down the road, the compounding effect has reduced drastically. Did a simple calculation on compounding calculator, your 10k maintained in EPF with constant 5% dividend will become 25k in 20 years time. With a lot of the people having less than the required savings for retirement, this 25k could really make up a sizeable portion in their retirement fund. Plus a 10k withdrawal allowed in one off or over a period of time is gonna do damage to the country in 20-50 years to come when the current working generation retire. They will have lesser retirement funds meaning government will have to spend more to help these people, and this in turn will burden the working group during that time. It will be a move that will affect the next 20-50 years. Meanwhile, I believe there are genuine cases where people are really facing hardship putting food on table. It'll be a tough job for government to do a balance act on this. More scrutiny in allowing those that only need the withdrawal to survive will take time and this mean assistance not channeled in timely manner. Looser conditions will mean more people going to abuse it. |

|

|

|

|

|

cybpsych

|

Nov 3 2020, 09:44 AM Nov 3 2020, 09:44 AM

|

|

QUOTE(real55555 @ Nov 3 2020, 09:32 AM) Yes he is right. I cannot see people will put back the money they withdrawed from account 1, plus the compounding effect means even if you put back a bigger amount a few years down the road, the compounding effect has reduced drastically. Did a simple calculation on compounding calculator, your 10k maintained in EPF with constant 5% dividend will become 25k in 20 years time. With a lot of the people having less than the required savings for retirement, this 25k could really make up a sizeable portion in their retirement fund. Plus a 10k withdrawal allowed in one off or over a period of time is gonna do damage to the country in 20-50 years to come when the current working generation retire. They will have lesser retirement funds meaning government will have to spend more to help these people, and this in turn will burden the working group during that time. It will be a move that will affect the next 20-50 years. Meanwhile, I believe there are genuine cases where people are really facing hardship putting food on table. It'll be a tough job for government to do a balance act on this. More scrutiny in allowing those that only need the withdrawal to survive will take time and this mean assistance not channeled in timely manner. Looser conditions will mean more people going to abuse it.true those who genuinely can face through current economic situation, dont touch epf. however, many will be forced to take-up this offer the second it opened up withdrawal. they need to live now, cant be bother to look further down the road. this is a catch-22 conundrum. |

|

|

|

|

|

real55555

|

Nov 3 2020, 10:05 AM Nov 3 2020, 10:05 AM

|

|

QUOTE(cybpsych @ Nov 3 2020, 09:44 AM) true those who genuinely can face through current economic situation, dont touch epf. however, many will be forced to take-up this offer the second it opened up withdrawal. they need to live now, cant be bother to look further down the road. this is a catch-22 conundrum. a lot probably got 'brainwashed' by the thinking I spend now I enjoy now, when the problem come in later years it will be solved by then. But I guess the best way how this can be done is to channel the EPF withdrawal direct to banks to pay for car loans house loans etc and should be a cash withdrawal (transfer to epf account holder's bank account). This is the only way to prevent abuse it for lifestyle expenses. While it may not help the ones need money to put food on table, but i think this is the direction in the implementation in allowing withdrawal of EPF as it touches on retirement fund. |

|

|

|

|

|

cybpsych

|

Nov 3 2020, 10:34 AM Nov 3 2020, 10:34 AM

|

|

QUOTE(real55555 @ Nov 3 2020, 10:05 AM) a lot probably got 'brainwashed' by the thinking I spend now I enjoy now, when the problem come in later years it will be solved by then. But I guess the best way how this can be done is to channel the EPF withdrawal direct to banks to pay for car loans house loans etc and should be a cash withdrawal (transfer to epf account holder's bank account). This is the only way to prevent abuse it for lifestyle expenses. While it may not help the ones need money to put food on table, but i think this is the direction in the implementation in allowing withdrawal of EPF as it touches on retirement fund. agree. example, i still prefer the previous Acct 2 withdrawal direct to loan account, instead of withdrawal to CASA per arrangement now. anyhow, those undisciplined members may still continue to change new car, get new car loan, and also draw from EPF later  still same way to enjoy their uplifted "driving/ego" lifestyle  |

|

|

|

|

|

SUSyklooi

|

Nov 3 2020, 11:10 AM Nov 3 2020, 11:10 AM

|

|

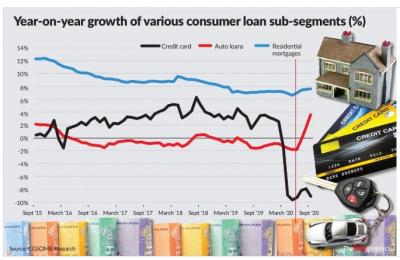

QUOTE(cybpsych @ Nov 3 2020, 10:34 AM) agree. example, i still prefer the previous Acct 2 withdrawal direct to loan account, instead of withdrawal to CASA per arrangement now. anyhow, those undisciplined members may still continue to change new car, get new car loan, and also draw from EPF later  still same way to enjoy their uplifted "driving/ego" lifestyle still same way to enjoy their uplifted "driving/ego" lifestyle   that seems to be very true,...... judging from the quick look of this chart (some people started to take loans again after the lockdown) https://www.thestar.com.my/business/busines...s-remain-stable Attached thumbnail(s)

|

|

|

|

|

|

prophetjul

|

Nov 3 2020, 12:06 PM Nov 3 2020, 12:06 PM

|

|

QUOTE(yklooi @ Nov 3 2020, 11:10 AM)  that seems to be very true,...... judging from the quick look of this chart (some people started to take loans again after the lockdown) https://www.thestar.com.my/business/busines...s-remain-stableSome cannot resist the vehicle tax waivers!  |

|

|

|

|

|

GrumpyNooby

|

Nov 3 2020, 12:08 PM Nov 3 2020, 12:08 PM

|

|

QUOTE(prophetjul @ Nov 3 2020, 12:06 PM) Some cannot resist the vehicle tax waivers!  I want to get a new car before 31/12/2020 but there's no stocks available. Guess I'll just pass and wait till early next year. |

|

|

|

|

|

MUM

|

Nov 3 2020, 12:19 PM Nov 3 2020, 12:19 PM

|

|

QUOTE(prophetjul @ Nov 3 2020, 12:06 PM) Some cannot resist the vehicle tax waivers!   yes, seems like can save Abt 29k for a BMW series 7 car  but can only save 1.7k for a MYVI....  Sales Tax Exemption On Passenger Cars In Malaysia: How Much Will You Save? https://ringgitplus.com/en/blog/personal-fi...l-you-save.html |

|

|

|

|

|

prophetjul

|

Nov 3 2020, 12:54 PM Nov 3 2020, 12:54 PM

|

|

QUOTE(MUM @ Nov 3 2020, 12:19 PM)  yes, seems like can save Abt 29k for a BMW series 7 car  but can only save 1.7k for a MYVI....  Sales Tax Exemption On Passenger Cars In Malaysia: How Much Will You Save? https://ringgitplus.com/en/blog/personal-fi...l-you-save.htmlAnd those who buy lower tier cars may end up jobless and the consequence of their cars being hauled up by the banks. |

|

|

|

|

|

MUM

|

Nov 3 2020, 12:58 PM Nov 3 2020, 12:58 PM

|

|

QUOTE(prophetjul @ Nov 3 2020, 12:54 PM) And those who buy lower tier cars may end up jobless and the consequence of their cars being hauled up by the banks. OMG    |

|

|

|

|

|

danielmckey

|

Nov 3 2020, 01:02 PM Nov 3 2020, 01:02 PM

|

|

Gomen still got money to give dividend?

|

|

|

|

|

|

Cubalagi

|

Nov 3 2020, 01:24 PM Nov 3 2020, 01:24 PM

|

|

QUOTE(danielmckey @ Nov 3 2020, 01:02 PM) Gomen still got money to give dividend? EPF dividend doesn't come from gomen. |

|

|

|

|

|

polarzbearz

|

Nov 3 2020, 08:37 PM Nov 3 2020, 08:37 PM

|

|

QUOTE(romuluz777 @ Oct 28 2020, 04:34 PM) If we are paying personal income tax, we are hit with a higher tariff the more we earn. Why should our hard earned EPF savings be earning less interest for the upper tiers ? I am totally against any form of negative dividend restructuring for the >1M or >500K bracket. At worst case, maintain the current status quo where a flat rate is applied to all. This actually is quite legit argument from all other replies I've seen so far. The income tax is already "penalising' the mid/upper mid classes and doing additional tier is just making the matter worse (double penalty?) |

|

|

|

|

|

SKYjack

|

Nov 4 2020, 10:18 AM Nov 4 2020, 10:18 AM

|

|

Has negative dividend restructuring for the >1M or >500K bracket implemented?

I am exploring returning $1M I withdrew for investment 5 years ago. AS I am age 70, do not want to invest in any risky ventures. I am aware $60K is the limit.

What other low risk investments are available to senior citizens other than FDs? At the moment FD returns are poor!

|

|

|

|

|

|

SUSyklooi

|

Nov 4 2020, 10:28 AM Nov 4 2020, 10:28 AM

|

|

Wow,...with 1 mil... It will takes abt 16 yrs at 60k pa limits to fully deposits all into epf.... By that time is already 86 yrs old

|

|

|

|

|

|

SUSBora Prisoner

|

Nov 4 2020, 10:29 AM Nov 4 2020, 10:29 AM

|

|

QUOTE(SKYjack @ Nov 4 2020, 10:18 AM) Has negative dividend restructuring for the >1M or >500K bracket implemented? I am exploring returning $1M I withdrew for investment 5 years ago. AS I am age 70, do not want to invest in any risky ventures. I am aware $60K is the limit. What other low risk investments are available to senior citizens other than FDs? At the moment FD returns are poor! interesting! good lesson to all of us to rethink about withdrawing everything when reaching that age |

|

|

|

|

|

danielmckey

|

Nov 4 2020, 10:58 AM Nov 4 2020, 10:58 AM

|

|

QUOTE(Cubalagi @ Nov 3 2020, 01:24 PM) EPF dividend doesn't come from gomen. Read this from EPF website... KWSP website. |

|

|

|

|

|

Cubalagi

|

Nov 4 2020, 11:19 AM Nov 4 2020, 11:19 AM

|

|

QUOTE(danielmckey @ Nov 4 2020, 10:58 AM) Read this from EPF website... KWSP website. This doesn't say EPF dividends come from government. EPF dividends come from the EPF fund performance However the goveement guarantees a minimum 2.5% return if the fund doesn't achieve that. (and this is only for convetional, not shariah). |

|

|

|

|

|

backspace66

|

Nov 4 2020, 12:32 PM Nov 4 2020, 12:32 PM

|

|

Indirectly it does come from the MGS, IIRC it contributes to 1/3 of the dividend

|

|

|

|

|

Nov 2 2020, 07:20 AM

Nov 2 2020, 07:20 AM

Quote

Quote

0.0186sec

0.0186sec

0.81

0.81

6 queries

6 queries

GZIP Disabled

GZIP Disabled