QUOTE(orangutan @ Feb 7 2018, 10:04 AM)

Really? I tried to view the 2018 statement it says wait for the dividend QUOTE

MBM2015: Statement for 2018 will be made available after the dividend for 2017 has been declared.

EPF DIVIDEND, EPF

|

|

Feb 7 2018, 10:06 AM Feb 7 2018, 10:06 AM

|

Senior Member

9,789 posts Joined: Jun 2008 From: Rubber Duck Pond |

|

|

|

|

|

|

Feb 7 2018, 10:09 AM Feb 7 2018, 10:09 AM

|

Senior Member

1,608 posts Joined: Nov 2007 |

|

|

|

Feb 7 2018, 10:10 AM Feb 7 2018, 10:10 AM

|

Senior Member

9,789 posts Joined: Jun 2008 From: Rubber Duck Pond |

|

|

|

Feb 7 2018, 10:20 AM Feb 7 2018, 10:20 AM

|

Senior Member

1,608 posts Joined: Nov 2007 |

|

|

|

Feb 7 2018, 10:31 AM Feb 7 2018, 10:31 AM

|

Senior Member

9,789 posts Joined: Jun 2008 From: Rubber Duck Pond |

|

|

|

Feb 7 2018, 10:34 AM Feb 7 2018, 10:34 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(yklooi @ Feb 7 2018, 09:49 AM) QUOTE Are there any changes to the nomination policy for Simpanan Shariah? Nomination policy for Simpanan Shariah members remains the same including the nominee(s) for Muslim members who will act as administrator (Wasi) are responsible for distributing the savings in accordance with Shariah while, nominee(s) for non-Muslim members are the beneficiaries, in line with the SAC decision. For estate nomination, Looks like Non Muslim contributors will be subject to the Shariah committee decisions! This post has been edited by prophetjul: Feb 7 2018, 10:35 AM |

|

|

|

|

|

Feb 7 2018, 12:51 PM Feb 7 2018, 12:51 PM

|

Junior Member

232 posts Joined: Jul 2015 |

The consequences of a higher % from Islamic vs. Conventional EPF or vice versa would be a political timebomb.

|

|

|

Feb 7 2018, 01:01 PM Feb 7 2018, 01:01 PM

|

Junior Member

232 posts Joined: Jul 2015 |

Gross investment income (top line only, excl. other income and incomes)

Q1 2017 = RM11.80b Q2 2017 = RM11.51b Q3 2017 = RM12.95b Q4 2017 = RM12.00b (assumed) Total gross investment income 2017 = RM48.26b Taking into account of potential upsides in revaluation reserves, impairments, forex gains and zakat and net profit ratios of past trends and payout, The outcome is about 6.9% - 7.3%. Gross revenue 2017 is definately a blockbuster since all quarters are double digits compared to prior years! This post has been edited by pearl_white: Feb 7 2018, 01:02 PM |

|

|

Feb 7 2018, 01:10 PM Feb 7 2018, 01:10 PM

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

QUOTE(pearl_white @ Feb 7 2018, 01:01 PM) Gross investment income (top line only, excl. other income and incomes) I assume the reported figures are the combined figures for the old and new funds. Will be very interesting if they split the figures into 2 groups.Q1 2017 = RM11.80b Q2 2017 = RM11.51b Q3 2017 = RM12.95b Q4 2017 = RM12.00b (assumed) Total gross investment income 2017 = RM48.26b Taking into account of potential upsides in revaluation reserves, impairments, forex gains and zakat and net profit ratios of past trends and payout, The outcome is about 6.9% - 7.3%. Gross revenue 2017 is definately a blockbuster since all quarters are double digits compared to prior years! Anyone with such infor? |

|

|

Feb 7 2018, 01:13 PM Feb 7 2018, 01:13 PM

|

Senior Member

1,600 posts Joined: Aug 2011 |

|

|

|

Feb 7 2018, 01:50 PM Feb 7 2018, 01:50 PM

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(pearl_white @ Feb 7 2018, 01:01 PM) Gross investment income (top line only, excl. other income and incomes) Do you have the numbers for 2016?Q1 2017 = RM11.80b Q2 2017 = RM11.51b Q3 2017 = RM12.95b Q4 2017 = RM12.00b (assumed) Total gross investment income 2017 = RM48.26b Taking into account of potential upsides in revaluation reserves, impairments, forex gains and zakat and net profit ratios of past trends and payout, The outcome is about 6.9% - 7.3%. Gross revenue 2017 is definately a blockbuster since all quarters are double digits compared to prior years! |

|

|

Feb 7 2018, 09:53 PM Feb 7 2018, 09:53 PM

Show posts by this member only | IPv6 | Post

#2612

|

Senior Member

1,573 posts Joined: Oct 2015 |

Is there a way to contribute to EPF voluntarily? I am a freelancer, not earning fixed wages.

|

|

|

Feb 7 2018, 10:00 PM Feb 7 2018, 10:00 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

|

|

|

Feb 7 2018, 10:05 PM Feb 7 2018, 10:05 PM

Show posts by this member only | IPv6 | Post

#2614

|

Senior Member

1,573 posts Joined: Oct 2015 |

QUOTE(David83 @ Feb 7 2018, 10:00 PM) I think you can open an individual account and contribute yourself like those who is doing business themselves (sole proprietor). I used to contribute to EPF, but stopped when i began my freelancing. I guess I can remit my money into the account, and can quite simply be done via online bank transfer? |

|

|

Feb 7 2018, 10:14 PM Feb 7 2018, 10:14 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Feb 8 2018, 09:20 AM Feb 8 2018, 09:20 AM

Show posts by this member only | IPv6 | Post

#2616

|

Senior Member

1,757 posts Joined: May 2011 |

deleted

This post has been edited by drbone: Feb 8 2018, 09:20 AM |

|

|

Feb 8 2018, 09:21 AM Feb 8 2018, 09:21 AM

Show posts by this member only | IPv6 | Post

#2617

|

Senior Member

1,757 posts Joined: May 2011 |

QUOTE(watabakiu @ Feb 7 2018, 10:05 PM) I used to contribute to EPF, but stopped when i began my freelancing. I guess I can remit my money into the account, and can quite simply be done via online bank transfer? QUOTE(David83 @ Feb 7 2018, 10:14 PM) Yup, maximum amounts of RM5000, multiple times. |

|

|

Feb 8 2018, 10:37 AM Feb 8 2018, 10:37 AM

|

Senior Member

4,514 posts Joined: Apr 2010 |

|

|

|

Feb 8 2018, 11:46 AM Feb 8 2018, 11:46 AM

|

All Stars

48,447 posts Joined: Sep 2014 From: REality |

QUOTE(pearl_white @ Feb 7 2018, 01:01 PM) Gross investment income (top line only, excl. other income and incomes) Hmm..Q1 2017 = RM11.80b Q2 2017 = RM11.51b Q3 2017 = RM12.95b Q4 2017 = RM12.00b (assumed) Total gross investment income 2017 = RM48.26b Taking into account of potential upsides in revaluation reserves, impairments, forex gains and zakat and net profit ratios of past trends and payout, The outcome is about 6.9% - 7.3%. Gross revenue 2017 is definately a blockbuster since all quarters are double digits compared to prior years! Well its in my target actually.. EPF would announced around 7% +/- 💪 |

|

|

Feb 8 2018, 12:19 PM Feb 8 2018, 12:19 PM

|

Senior Member

671 posts Joined: Jan 2006 |

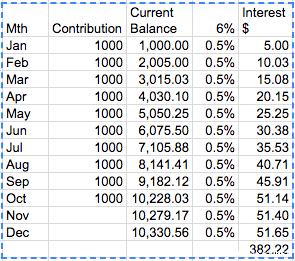

As per attachment, keeping it simple, if dividend is 6%, therefore, 6% / 12 mths = 0.005 or 0.5% per mth Did I get the calculation correct? I also can't seem to find EPF email to ask them this. Anyone have it? |

| Change to: |  0.0199sec 0.0199sec

0.20 0.20

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 06:39 PM |