Saw the EPF retirement article in The Star. That prompted me to do some analysis as one thing bothers me.

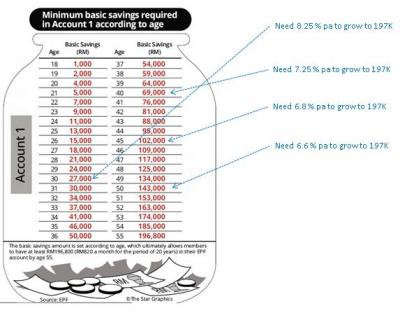

They stated the required amounts at different ages to achieve 197k at age 55. I did some back-calculations to find out what were the dividend rates they used to achieve the 197k. See picture below.

AA

Surprised that they used different rates for different ages. Requires a return of

* 8.25% pa with 27k at age 30,

* 6.6% pa with 143k at age 50

to achieve 197k at age 55.

If they used 6.6% for the age 30 case, then the amount will be larger than 27k to get 197K at age 55. Wonder why did they use a larger %.

BB

Monthly expenses at RM820?

* not realistic to me. Should be at least RM2000 for the average Msian.

* the RM820 is not inflation adjusted. Even at 3% pa inflation (as reported by our nice govt), the RM820 will be RM1480 20 years later.

CC

The table is also misleading. For those in their teens, good news! All they need to do now is to put RM1000, 2000, 4000 for ages 18, 19 & 20 in their EPF and by the time they are 55, they will have 197k in there. Their retirement funds are now taken care of! Ha. For the age 18 case, the required return is 15.4% pa to get 197K by age 55. Realistic? Yes, the power of compound interest but this is twisting it too far.

DD

They used 6 - 15% pa in their studies. Wah! Maybe I should expect a higher % from EPF now. They know EPF better than most of us.

Cheerio.

May 25 2015, 08:12 AM

May 25 2015, 08:12 AM

Quote

Quote

0.0348sec

0.0348sec

0.82

0.82

7 queries

7 queries

GZIP Disabled

GZIP Disabled