Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

lyc1982

|

May 6 2020, 04:39 PM May 6 2020, 04:39 PM

|

|

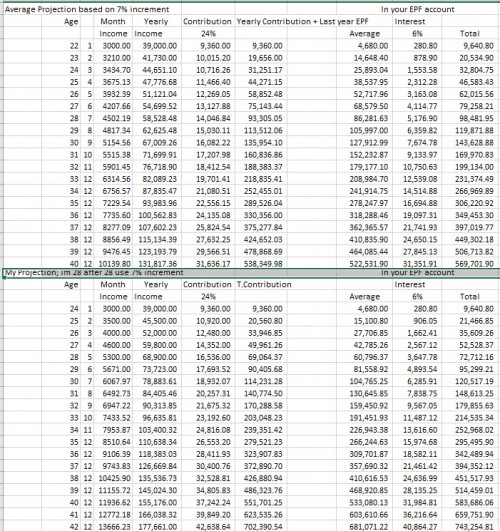

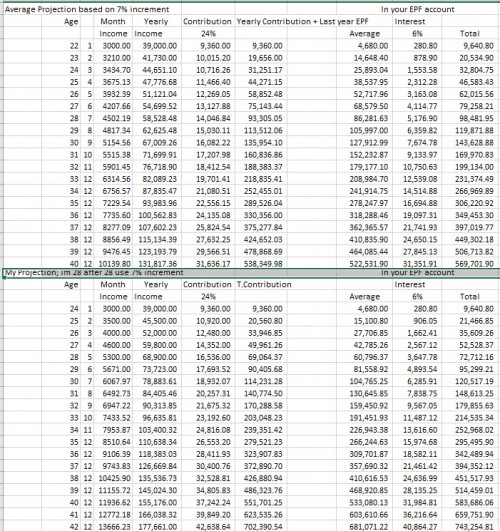

QUOTE(jyll92 @ May 6 2020, 04:06 PM) yea yea my bad. this shud be right  as you can see...even if dividend maintains at 6% (which is optimistic) throughout the years, still not as easy as cake to achieve 1 mil by late 30s, unless you started off with 10k at 24yo anyways...there's an epf calculator in the epf account that we can use to project pretty neat This post has been edited by lyc1982: May 6 2020, 04:41 PM |

|

|

|

|

|

lyc1982

|

May 6 2020, 04:42 PM May 6 2020, 04:42 PM

|

|

QUOTE(danielmckey @ May 6 2020, 04:40 PM) You got all those money in hand. But you cannot spend it afterlife. so....any good suggestion on how to spend the money beforelife ? |

|

|

|

|

|

lyc1982

|

May 8 2020, 11:32 AM May 8 2020, 11:32 AM

|

|

QUOTE(guy3288 @ May 7 2020, 04:25 PM) looking down on people called average for a reason even if have RM10M in EPF also should not say that Knowing full well than 99% of people do not have it, to say is easy to have RM1 Million in EPF and 1M in EPF is nothing is to make many many others feel bad. Yes dont simply say it is easy when more than 99% people cant achieve it. yeap...one guy out of 0.5 million guys can achieve something doesn't mean it' a piece of cake, unless the statistics says it's >90% then it's categorized as "a piece of cake". if it's piece of cake, there won't be poverty in msia |

|

|

|

|

|

lyc1982

|

May 24 2020, 02:10 PM May 24 2020, 02:10 PM

|

|

QUOTE(CoronaV @ May 24 2020, 08:06 AM) FD rate now so terribly low. For age 60 + is it possible to deposit max 60k one shot into EPF for better returns? looking at current situation...loan rate, FD rate all going down i maxed out my 60k self contribution in epf already zero FD |

|

|

|

|

|

lyc1982

|

May 25 2020, 10:09 PM May 25 2020, 10:09 PM

|

|

QUOTE(CoronaV @ May 25 2020, 07:34 PM) That quota thingy for 60k. What if I put 60k now in may this year , next year Jan 2021 I still can enjoy refresh 60k quota am I right? Or have to do it in may 2021? i think it's by year... not by 12 months |

|

|

|

|

|

lyc1982

|

May 26 2020, 11:01 PM May 26 2020, 11:01 PM

|

|

QUOTE(GrumpyNooby @ May 26 2020, 10:27 AM) What is the dividend rate that you guys expecting for this year? 5%? whatever number it is...i hope it's higher than sspn's This post has been edited by lyc1982: May 26 2020, 11:01 PM |

|

|

|

|

|

lyc1982

|

May 28 2020, 03:03 PM May 28 2020, 03:03 PM

|

|

QUOTE(prophetjul @ May 28 2020, 03:00 PM) Can one just dump in Rm60k at a go? maybe over counter...? |

|

|

|

|

|

lyc1982

|

Jun 14 2020, 10:04 PM Jun 14 2020, 10:04 PM

|

|

4% still better than FD...and potentially ASN

|

|

|

|

|

|

lyc1982

|

Jun 22 2020, 12:50 PM Jun 22 2020, 12:50 PM

|

|

QUOTE(utellme @ Jun 22 2020, 12:40 PM) https://themalaysianreserve.com/2019/10/22/...wealth-bracket/"Less than 1% of M’sians in US$1m wealth bracket" - I'm 56 now, after working for 31 years. I don't have USD 1 mil (= RM4.25 mil ) saving too. i belong to the >1% population...  |

|

|

|

|

|

lyc1982

|

Jun 30 2020, 12:44 PM Jun 30 2020, 12:44 PM

|

|

QUOTE(prophetjul @ Jun 30 2020, 08:48 AM) you will be more worried.   |

|

|

|

|

|

lyc1982

|

Jun 30 2020, 03:21 PM Jun 30 2020, 03:21 PM

|

|

QUOTE(honsiong @ Jun 30 2020, 02:50 PM) To be fair, if you have high tax brackets, max out PRS unit trust contribution first to cut tax. if have kids...sspn better |

|

|

|

|

May 6 2020, 04:39 PM

May 6 2020, 04:39 PM

Quote

Quote 0.0505sec

0.0505sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled