QUOTE(ronnie @ Nov 7 2023, 07:54 AM)

Bruh not 1 day lah..employer deduct your EPF 27.2.23 for Feb salary

bank into EPF 10.3.23

EPF pay u 1 day dividen only for Mac 2023, you lost 32days dividend.

QUOTE(guy3288 @ Feb 9 2023, 06:08 PM)

This kind of interest lost is totally voluntary,

you only have yourself to blame if you lose it.

But the "forced" mandatory interest loss by all of us is more insidious

and more irritating as we don have a say at all.

EPF pretend inefficient , pay contributor only 1 Day interest

sakau our interest at least 15 days every month

If total contribution is RM7 billion a month

at 4% interest EPF sakau at least RM130 million contributors' money

over the years how much interest we have lost to EPF?

And this is not one off,

it is going on and on year after year

Employer must pay by 15th, give and take 5 days,

EPF should pay us 10days interest

not just 1 DAY every month.

you only have yourself to blame if you lose it.

But the "forced" mandatory interest loss by all of us is more insidious

and more irritating as we don have a say at all.

EPF pretend inefficient , pay contributor only 1 Day interest

sakau our interest at least 15 days every month

If total contribution is RM7 billion a month

at 4% interest EPF sakau at least RM130 million contributors' money

over the years how much interest we have lost to EPF?

And this is not one off,

it is going on and on year after year

Employer must pay by 15th, give and take 5 days,

EPF should pay us 10days interest

not just 1 DAY every month.

QUOTE(guy3288 @ Feb 10 2023, 08:38 AM)

This is wrong

You are making mum's effort to educate commonsense more difficult!

Doesnt matter which day of the month EPF received your money,

it pays only 1 DAY interest for that month

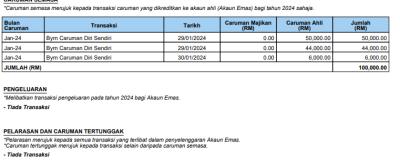

Eg Feb 2023 contribution -

EPF received RM60k from A on 1.2.2023, A only can get 1 day interest for Feb.

EPF received RM60k from B on 28.2.23 - B also get 1 day interest same

This is not called interest prorated daily

Prorated daily means A should get 28days interest

and B get only 1 day interest for Feb.

So for voluntary contribution, keep your money first in KDI

dont deposit early in the month, no point

If you manage to deposit as late in the month

but get it received by EPF end of month

you lose minimal interest to EPF

Now imagine our compulsory monthly contribution

EPF says must pay by 15th every month

If late kena penalty, most employers pay EPF on 10th each month

But EPF pays only 1 DAY interest for us for that month

EPF untung your interest for 15-20DAYS

Every month EPF receive new monthly contribution RM6-7 Billions

EPF untung 15-20 days from this huge amount

1 year EPF at least untung RM130 Million from this compulsory contributions alone!

You are making mum's effort to educate commonsense more difficult!

Doesnt matter which day of the month EPF received your money,

it pays only 1 DAY interest for that month

Eg Feb 2023 contribution -

EPF received RM60k from A on 1.2.2023, A only can get 1 day interest for Feb.

EPF received RM60k from B on 28.2.23 - B also get 1 day interest same

This is not called interest prorated daily

Prorated daily means A should get 28days interest

and B get only 1 day interest for Feb.

So for voluntary contribution, keep your money first in KDI

dont deposit early in the month, no point

If you manage to deposit as late in the month

but get it received by EPF end of month

you lose minimal interest to EPF

Now imagine our compulsory monthly contribution

EPF says must pay by 15th every month

If late kena penalty, most employers pay EPF on 10th each month

But EPF pays only 1 DAY interest for us for that month

EPF untung your interest for 15-20DAYS

Every month EPF receive new monthly contribution RM6-7 Billions

EPF untung 15-20 days from this huge amount

1 year EPF at least untung RM130 Million from this compulsory contributions alone!

Nov 7 2023, 09:27 AM

Nov 7 2023, 09:27 AM

Quote

Quote

0.0492sec

0.0492sec

0.88

0.88

7 queries

7 queries

GZIP Disabled

GZIP Disabled