Outline ·

[ Standard ] ·

Linear+

STOCK MARKET DISCUSSION V128, YAT YEE FATT !!!!

|

cristiano7mu

|

Feb 20 2013, 10:48 PM Feb 20 2013, 10:48 PM

|

|

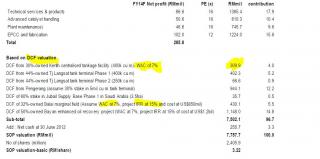

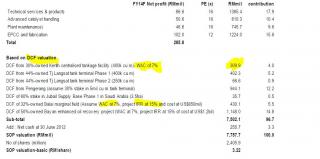

Hi guys, recently I am looking at Dialog and today I read few research report by few houses. Most of the researcher used DCF with diff WACC. Just wondering how do they determined the WACC and where do they obtain the CF for each Centralised Terminal Facilties(CTF).Since each terminal Cash Flow are not provided publicly and each research house report has diff CF for the same CTF. Hence I am curious how these analyst figure out each terminal Cash flow then. Pls refer to the attachment for the screenshot. Maybank report: Kertih CTF: WACC - 10.5% Amresearch report: Kertih CTF: WACC - 7% RHB report: Kertih CTF: WACC - 7.2% OSK report: Kertih CTF: WACC - 6% Anyone here und how they derived the Value for each CTF? Attached thumbnail(s)

|

|

|

|

|

|

cristiano7mu

|

Feb 20 2013, 10:59 PM Feb 20 2013, 10:59 PM

|

|

QUOTE(foofoosasa @ Feb 20 2013, 10:53 PM) For me, the adjustment of the WACC just to achieve their own object. If the want to value XYZ stock higher, just put the WACC lower. Just pluck in the number to make the value appear inline with their objective  . That why I never trust any research valuation. Pretty bullshit in my opinion. hahaha i was thinking the same but how bout the DCF part? Any idea how they determine the CF? DCF = CF / (1 + wacc) etc etc etc They simply adjust wacc to get what they want. CF part Also simply come out with an amount to get the DCF they wanted? This post has been edited by cristiano7mu: Feb 20 2013, 11:00 PM |

|

|

|

|

Feb 20 2013, 10:48 PM

Feb 20 2013, 10:48 PM

Quote

Quote

0.0382sec

0.0382sec

0.40

0.40

7 queries

7 queries

GZIP Disabled

GZIP Disabled