hi finance expert, how you guys grow your RM10k from EPF withdrawal?

your ideas are much appreciate.

Fund Investment Corner v3, Funds101

Fund Investment Corner v3, Funds101

|

|

Dec 6 2020, 11:55 AM Dec 6 2020, 11:55 AM

Return to original view | Post

#1

|

Junior Member

53 posts Joined: May 2020 |

hi finance expert, how you guys grow your RM10k from EPF withdrawal?

your ideas are much appreciate. |

|

|

|

|

|

Dec 6 2020, 12:43 PM Dec 6 2020, 12:43 PM

Return to original view | Post

#2

|

Junior Member

53 posts Joined: May 2020 |

QUOTE(MUM @ Dec 6 2020, 12:06 PM) What is your expected returns of investment per year for this 10k? double in a year?How much money will you willing to see looses before you get out of it? QUOTE(thefryingfox @ Dec 6 2020, 12:13 PM) Buy ps5 and a few game and enjoise ...use the oppurtunity to create online network or even twitch channel....generate income ...or create youtube page to review games I have a youtube channel, not easy to gain subscribers yet alone new channel For sure bro.. QUOTE(bee88 @ Dec 6 2020, 12:18 PM) true of that but anyways to get higher. |

|

|

Dec 6 2020, 12:48 PM Dec 6 2020, 12:48 PM

Return to original view | Post

#3

|

Junior Member

53 posts Joined: May 2020 |

|

|

|

Dec 6 2020, 03:17 PM Dec 6 2020, 03:17 PM

Return to original view | Post

#4

|

Junior Member

53 posts Joined: May 2020 |

QUOTE(victorian @ Dec 6 2020, 01:24 PM) epf given 5~6% annually, shouldn't be any way to make it higher?QUOTE(waghyu @ Dec 6 2020, 02:45 PM) too risky right? is like going to genting...QUOTE(whirlwind @ Dec 6 2020, 03:12 PM) what is UT? |

|

|

Dec 7 2020, 09:07 AM Dec 7 2020, 09:07 AM

Return to original view | Post

#5

|

Junior Member

53 posts Joined: May 2020 |

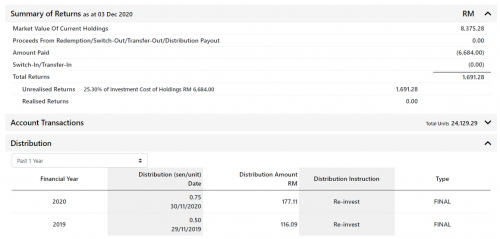

QUOTE(cklimm @ Dec 6 2020, 05:30 PM) Its ok, just take it out and learn whatever lesson from it. Yeap it will be a good experience, but as if i have a lot of capital bro.Its better to lose 10k now than 1 million in 2050. QUOTE(infested_ysy @ Dec 6 2020, 05:47 PM) Yeah, and become 1 out of the 100,000 other micro youtubers with 50 subscribers even though they've tried everything they could to become popular I managed to get a youtube 1k subscribers in within 2 years, all about work and luck.You need to be very very talented and lucky to make a living on those platforms QUOTE(polarzbearz @ Dec 6 2020, 09:28 PM) One thing to note - most UT (Unit Trust) fund sucks, and regardless of their performance, you're ought to pay their fund management fees anyway. been trying for UT with EPF last 4 years and below is my result, 25% return after 4 years. similar with EPF.There's a few fund that stands out and pass the test of time (past 5-6 years performance) slightly outperforming EPF consistently, but exposing yourself to way higher risk (also let's not forget EPF stood the real test of time since 1952. 5 years is nothing to shout about). Whether the risk is acceptable or not depends on your current appetite and investment horizon. If you're approaching retirement, forget about unit trust, simply not worth it. If you're young, maybe, but then consider the downsides as well (fees, performance, etc.) and one thing for sure if you do - buy and forget. Don't even think of trading "ACTIVELY" with unit trust like a stock - because it's not. Any investment vehicles containing basket of stocks (UT, ETFs, etc.) are best treated passively.  |

|

|

Dec 7 2020, 09:08 AM Dec 7 2020, 09:08 AM

Return to original view | Post

#6

|

Junior Member

53 posts Joined: May 2020 |

|

|

|

|

|

|

Dec 7 2020, 09:12 AM Dec 7 2020, 09:12 AM

Return to original view | Post

#7

|

Junior Member

53 posts Joined: May 2020 |

QUOTE(popopi @ Dec 7 2020, 09:09 AM) http://isinar.kwsp.gov.my/3. Bila dan bagaimanakah saya boleh memohon i-Sinar? Sekiranya anda tergolong dalam Kategori 1, anda boleh mula memohon pada 21 Disember 2020. Bagi anda yang tergolong dalam Kategori 2 pula, permohonan boleh dibuat bermula 11 Januari 2021. Permohonan i-Sinar hanya secara online di laman web isinar.kwsp.gov.my |

|

|

Dec 7 2020, 09:45 AM Dec 7 2020, 09:45 AM

Return to original view | Post

#8

|

Junior Member

53 posts Joined: May 2020 |

|

|

|

Dec 7 2020, 10:20 AM Dec 7 2020, 10:20 AM

Return to original view | Post

#9

|

Junior Member

53 posts Joined: May 2020 |

QUOTE(CSW1990 @ Dec 7 2020, 09:55 AM) For 10k cash invested in no risk investment , don’t expect it can beat EPF. thinking invest in gadgets to make videos / do a small used car. one low risk and one high risk respectivelyThose eligible for withdraw are either jobless or pay cut, should focus on getting a job or find a better pay job, not on how to grow this 10k to 20k or 50k in high risk investment tool QUOTE(popopi @ Dec 7 2020, 09:57 AM) i see there is category 1 and category 2... sh*t i forgot that for stable job. because my job always unstable and most of the people around me having pay cut.from my understanding, if i still have stable job. i not allowed... OR i read wrong? popopi liked this post

|

| Change to: |  0.0192sec 0.0192sec

0.61 0.61

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 07:15 PM |