Kindly be informed that to simplify our product offerings, we are streamlining some of our products. Therefore, effective 1 September 2020, the accounts as mentioned in Table 1, Section A below will be known as the accounts named in Table 1, Section B.

All other product features, account numbers, fees and charges will remain unchanged.

| Table 1 | |

| Section A | Section B |

| Current Product Name | Now Known As |

| JustOne Preferred Current Account | JustOne Personal Current Account |

| JustOne Preferred Savings Account | JustOne Personal Savings Account |

| Saadiq JustOne Preferred Account-i | Saadiq JustOne Personal Account-i |

| Saadiq JustOne Preferred Investment Account-i | Saadiq JustOne Personal Investment Account-i |

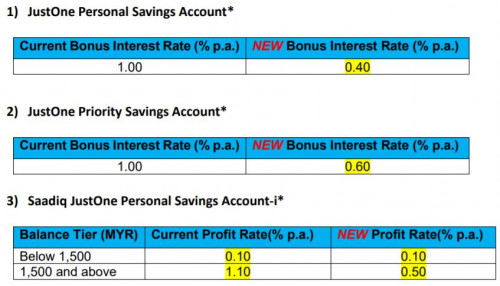

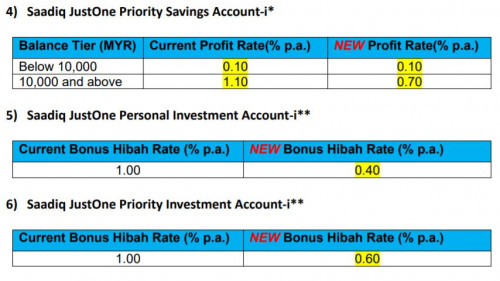

Please take note that effective 1 September 2020, the bonus interest/bonus hibah/profit rate for JustOne Accounts will be revised as follows.

https://av.sc.com/my/content/docs/Announcem...-Sept-20-v3.pdf

Aug 11 2020, 08:20 PM

Aug 11 2020, 08:20 PM

Quote

Quote

0.0401sec

0.0401sec

0.12

0.12

7 queries

7 queries

GZIP Disabled

GZIP Disabled