Minimum 5000 PremierMiles = RM90 cash back and increment of 1000 PremierMiles can be converted to RM18 cash back

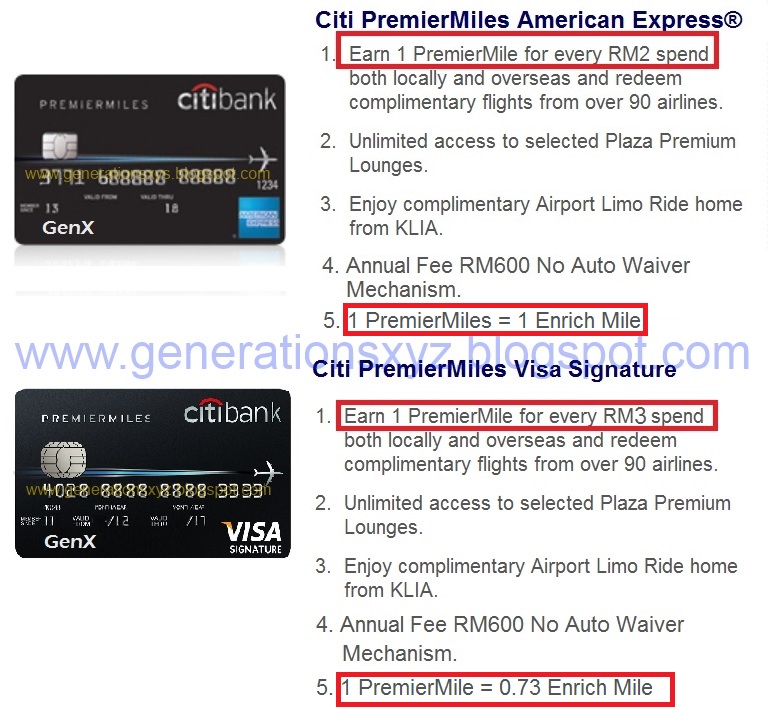

Review of the Citibank PremierMiles Visa Signature and Platinum Card and their Benefits.

And for those of you thinking of getting Citibank Cash Back Platinum Credit Card, click here to read my short review. The annual income requirement for the Citibank Platinum Cash Back have been reduced to RM40K this year.

To read my mini review of the Citi Prestige World MasterCard Elite which offer unlimited entries to airport lounge with the Priority Pass Membership Card, click here to my article The Best Credit Card for Airport Lounge.

For review of the Citi PremierMiles American Express versus Citi Prestige MasterCard World Elite, click here to my article New 2013 Credit Cards

This post has been edited by Gen-X: Oct 15 2013, 01:13 PM

Nov 12 2012, 06:14 PM

Nov 12 2012, 06:14 PM Quote

Quote

0.0253sec

0.0253sec

0.11

0.11

7 queries

7 queries

GZIP Disabled

GZIP Disabled