Outline ·

[ Standard ] ·

Linear+

Forex Version XI, Foreign Exchange Market Discussion

|

joseph8

|

Mar 18 2013, 10:05 AM Mar 18 2013, 10:05 AM

|

Getting Started

|

QUOTE(clamp_wl @ Mar 16 2013, 11:37 PM) i heard a lot of forex out there are not authorised by Bank Negara Malaysia. what channel do u guys invest and is it true that u can earn back what u invest within months? if it is true, why there is financial crisis everywhere. i would jz want a clarification on this forex trading. thank you I have been with fxpro for quite sometime. Deposit and withdrawal no problem. I heard that it is quite a grey area when it comes to BNM. I think as long as we TT our funds to forex provider overseas using authorised banks, then it should be fine. |

|

|

|

|

|

joseph8

|

Mar 18 2013, 12:05 PM Mar 18 2013, 12:05 PM

|

Getting Started

|

QUOTE(poks @ Mar 18 2013, 12:00 PM) the name itself does not give any confidence to me. sounds like some console game.. btw, the best way is to learn to trade yourself. not by others. boyvi.. mt4 seems like can't use (i think my setting or something).. today everything open with a gap. what happen to cyprus.. lazy to read, can someone make a summary. tq  fxpro is based in cyprus....  |

|

|

|

|

|

joseph8

|

Mar 18 2013, 03:31 PM Mar 18 2013, 03:31 PM

|

Getting Started

|

QUOTE(sleepwalker @ Mar 18 2013, 03:24 PM) Actually its more of a bail-in than out.. they are not bailing out the banks.. they are raiding the banks to bail out the country. EU 1.2980-1.3000 being defended 'kaw kaw'. Cyprus is so small that it does not impact much to the EU but the reaction is due to the fact that EU forced the country raid their own banks for a rescue package. What people are worrying is which country would be hit next? Wah...this is so unfair to those people who put money in the bank isn't? Why didn't last time they bail in the banks in P.I.I.G.S countries? |

|

|

|

|

|

joseph8

|

Mar 18 2013, 03:32 PM Mar 18 2013, 03:32 PM

|

Getting Started

|

QUOTE(joseph8 @ Mar 18 2013, 03:31 PM) Why didn't last time they bail in the banks in P.I.I.G.S countries? I mean was last time bail in or bail out to those P.I.I.G.S countries? |

|

|

|

|

|

joseph8

|

Mar 18 2013, 03:41 PM Mar 18 2013, 03:41 PM

|

Getting Started

|

QUOTE(sleepwalker @ Mar 18 2013, 03:34 PM) Yes.. absolutely stupid. Imagine you get taxed 6.75% if you have up to 100,000 euro in the bank and higher if you have more. People are rushing to withdraw money but that was imposed by the EU. That is what they are worrying now. If EU can do this to Cyprus, they can do it to the PIIGS too. Hence the panic selling over the weekend. Almost everything is in the red today all over the world due to this. People are reacting more to the 'action' and not the 'causes' of the bail-out of Cyprus. Wah...can't imagine the consequences if they do it to PIIGS banks. Banking sector will be hit hard...another round of Lehman brothers, but Euro version. Then another round of quantitative easing, but euro version too. |

|

|

|

|

|

joseph8

|

Mar 18 2013, 03:55 PM Mar 18 2013, 03:55 PM

|

Getting Started

|

QUOTE(marioprimus @ Mar 18 2013, 03:47 PM) I've learned more about online trading of forex and stocks through Ask Mario Singh blog. He personally answers questions daily and give great insights for anyone to learn stock market easily. As for myself i follow Kathy Lien and Ilya Spivak on Twitter. No interaction though coz they got too much follower  |

|

|

|

|

|

joseph8

|

Mar 19 2013, 09:53 AM Mar 19 2013, 09:53 AM

|

Getting Started

|

Comic that describes current situation in Cyprus Double bank robbery in in Cyprus = Man getting robbed by his own bank and bank being robbed by ECB.  |

|

|

|

|

|

joseph8

|

Mar 20 2013, 09:33 AM Mar 20 2013, 09:33 AM

|

Getting Started

|

QUOTE(poks @ Mar 20 2013, 09:12 AM) Great cartoon  btw, looking to buy gbpusd ... looking at 1.5070 and 1.5072... waiting price to past either one since the gap is small.. will buy at most probably 1.5072 .. else no trade. tayor.. For buy and hold mid - long term? |

|

|

|

|

|

joseph8

|

Mar 20 2013, 10:01 AM Mar 20 2013, 10:01 AM

|

Getting Started

|

QUOTE(poks @ Mar 20 2013, 09:56 AM) Depends... i will actually see the movement on that particular day i enter my trade; if it's explosive, i'll close.. if it's normal movement ie.40~50 pips and i decide to hold, i'll put BE. if it's lame movement, i'll close... but if everything goes according to plan today, i'm looking at the movement to break 1.522 to actually decide.. I see.... I think most likely a highly volatile day because it has been doji (consolidate) for the past 3 days. Breakout seems imminent. Furthermore it has MPC meeting minutes at 5.30pm |

|

|

|

|

|

joseph8

|

Mar 21 2013, 09:26 AM Mar 21 2013, 09:26 AM

|

Getting Started

|

QUOTE(PuckingFussy @ Mar 21 2013, 09:20 AM) i'm quite new here, may i know what's SL to BE? all i did was, i bought USD NZ 2m units and gain around 7k this morning. my fav is Yen, when Yen goes up, I'll strike in with USD+EU+SGD against Yen what Poks meant was to put in a break even (BE) stop loss, to protect capital. The trade has nothing to lose. It could also be part of the trailing stop method. |

|

|

|

|

|

joseph8

|

Mar 21 2013, 09:54 AM Mar 21 2013, 09:54 AM

|

Getting Started

|

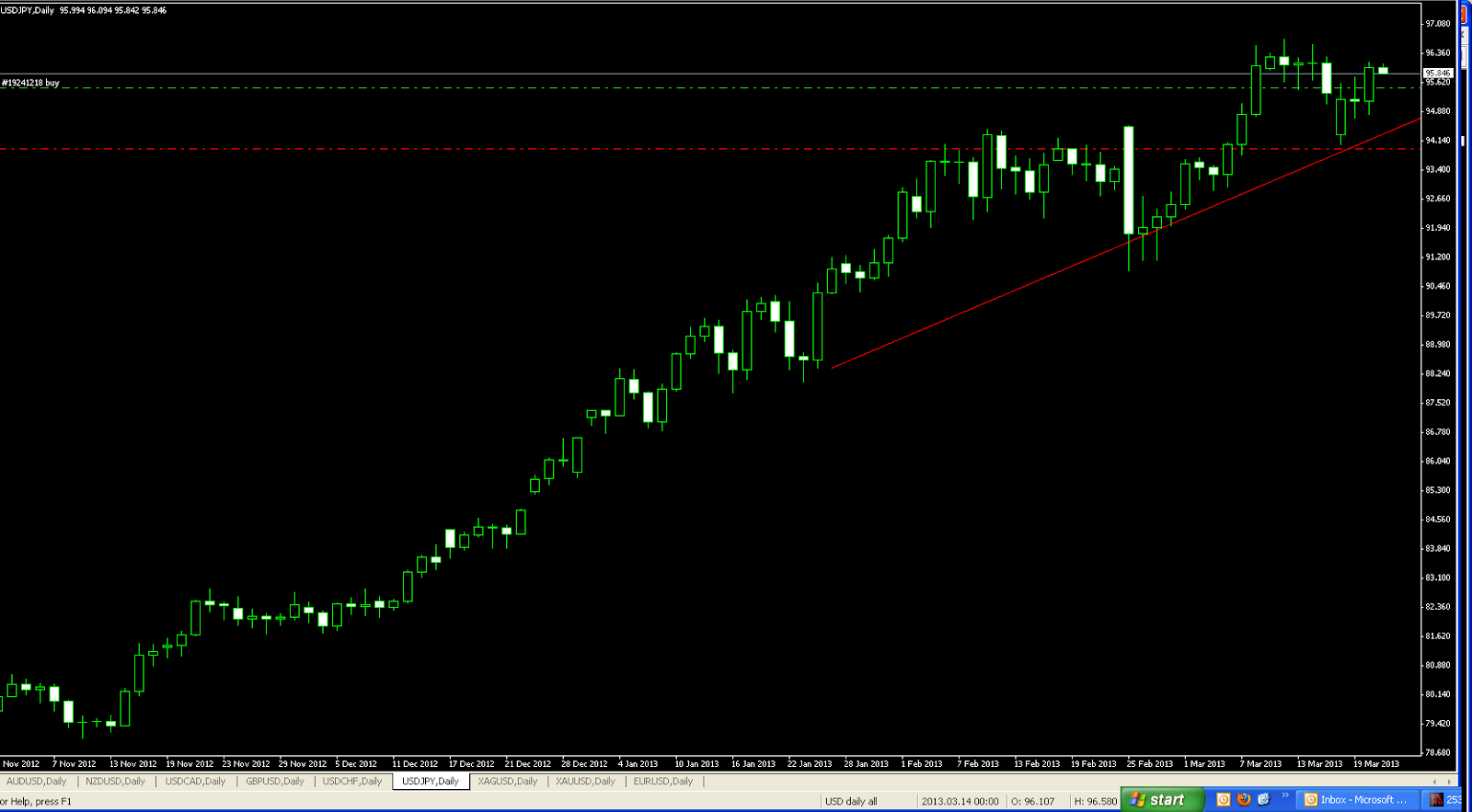

QUOTE(PuckingFussy @ Mar 21 2013, 09:27 AM) I see, thanks for your info. so now which pair are u guys looking at ? my favourite yen is going up, but not too much yet, still waiting I am still holding long on audusd.  and long usdjpy. hopefully it is not too late to join the usdjpy party.  |

|

|

|

|

|

joseph8

|

Mar 21 2013, 12:19 PM Mar 21 2013, 12:19 PM

|

Getting Started

|

QUOTE(Quinn @ Mar 21 2013, 12:07 PM) just look for cloud breakout and sync with higher tf. see the usdjpy is trap in the h4 cloud. wow...all of you are against usdjpy...i am the only contrarian...  .. thanks for all your advice. i will watch out. but anyway i already have my stops below the counterattack candlestick. |

|

|

|

|

|

joseph8

|

Mar 26 2013, 02:41 PM Mar 26 2013, 02:41 PM

|

Getting Started

|

Anyone here pro in elliot/fibo?

Is it a must that wave 4 cannot overlap wave 1?

|

|

|

|

|

|

joseph8

|

Mar 28 2013, 08:54 AM Mar 28 2013, 08:54 AM

|

Getting Started

|

QUOTE(kimwee85 @ Mar 27 2013, 10:36 PM) Hey guys, I am looking for opening small trading account. Any suggestion? Can try FXDD. they have micro lot. I have been using this to test strategy. |

|

|

|

|

|

joseph8

|

Apr 30 2013, 11:19 AM Apr 30 2013, 11:19 AM

|

Getting Started

|

QUOTE(badyuan @ Apr 20 2013, 07:10 PM) guys, lm choosing a reliable forex broker now. how would you rate among these option ? which one better ? in term on spread, reliability and convenience to deposit/withdraw ? 1) FxPrimus 2) FxPro 3) Exness 4) Pepperstone 5) iForex Appreciate for the help. Thanks Been with fxpro for quite sometime. No issue with deposit/withdrawal. the only doubt i have in them is that their HQ is in Cyprus, not sure if they have move their HQ following the Cyprus bail in issue. |

|

|

|

|

Mar 18 2013, 10:05 AM

Mar 18 2013, 10:05 AM

Quote

Quote

0.0624sec

0.0624sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled