QUOTE(poks @ Jun 18 2013, 04:45 PM)

Hello all,

how's trading?

Boyvai need some tips here

**looking at buying audusd .. 9500 seems like a good level.

long time no see.how's trading?

Boyvai need some tips here

**looking at buying audusd .. 9500 seems like a good level.

aud/usd i gain good profit

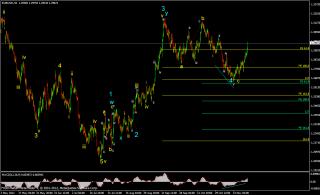

past count i already post twice on daily.

here count on 27 may 2013

Credited EW Forecast

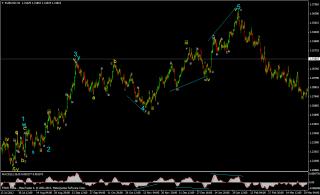

update today

as u can see already on 61.8% area.on correction wave.thanks pointing up this pair lol.but beware this is on correction wave,but if use trading price action good area resistance on daily.tayor.

Jun 18 2013, 08:25 PM

Jun 18 2013, 08:25 PM

Quote

Quote

0.0203sec

0.0203sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled