QUOTE(jimlim007 @ Jan 23 2013, 05:32 PM)

about the tax impose during entry to msia country, the bill will state clear which item are taxed which are not? if tax imposed, need to pay to the corriour? and how do you distribute items back to members? use poslaju, F2F?

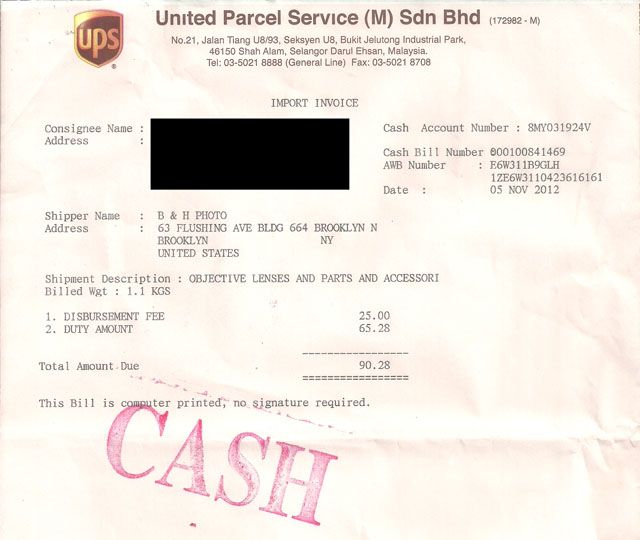

Either COD or Poslaju, depend on how you want to handle. If you are kind enough, you can help to poslaju, of course, buyer will pay the postage fee. If F2F then much easier.For the tax, the tax invoice will list down the taxed item and amount clearly, so the buyer will pay the taxed amount for their item.

Another payment is the disbursement fee, RM25 which need to pay to UPS as handling fee for the custom clearance if any item got tax. Then the RM25 should be equally divided by those buyer who got tax. UPS will help to handle the tax and pay on behalf and you will pay to the courier boy.

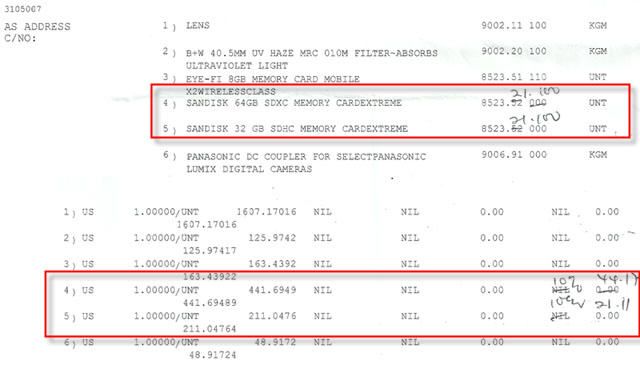

See the previous taxed items and invoices:

This post has been edited by philipcs: Jan 23 2013, 05:49 PM

Jan 23 2013, 05:48 PM

Jan 23 2013, 05:48 PM

Quote

Quote

0.0302sec

0.0302sec

0.81

0.81

7 queries

7 queries

GZIP Disabled

GZIP Disabled