QUOTE(jjsia @ Sep 29 2012, 06:36 PM)

Possible to share your experience in detail? Eg. How much do we need as a minimum deposit? What kind of documents are needed? Etc.

Thanks.

For DBS, I open a DBS Saving Plus account. I just brought my passport, IC and SGD. At that time, it was ok as the ac min balance was SGD500 and if below, there is a fee of SGD2 per month but now, looks like they have revised the min deposit to SGD5000

:

http://www.dbs.com.sg/personal/deposit/sav...gners/fees.page?

I also looked at Standard Chartered Bank and their Esaver account is pretty good. No min deposit/balance, no monthly fees.

In addition, I have heard that if one TT from their Malaysia Standard Chartered Bank account to their Sing Standard Chartered Bank account, there are no charges. I have not tried this myself.

http://www.standardchartered.com.sg/person...ver-account/en/From their website:

High Interest Rates

No lock-in period

No monthly fees

No minimum deposit

No minimum balance

No fixed term

No hardcopy statements to file

No ATM cards, passbooks or cheque books to lose

I think when you choose a bank, other than considering the bank fees/min balance, it is important that they are one of the below banks (maybe these are all the banks in Sing?

I have no idea):

QUOTE

SGX CDPThis service allows you to receive Singapore-dollar dividend payments or other cash distributions directly into your designated bank account. You can choose from one of the following participating banks in Singapore:

1. Citibank

2. DBS / POSB

3. HSBC

4. OCBC

5. Standard Chartered Bank

6. UOB

For Uob Kay Hian, to open an account, you need your IC & Income statements:

http://www.uobkayhian.com.sg/page/site/pub...copenSGXfr.htmlIf you don't have a CDP account, they will do it for you too. In Singapore, only 1 CDS account... not like in Malaysia. 1 CDS account for each broker.. pensang.

Anyway, found this useful thread:

http://forums.hardwarezone.com.sg/stocks-s...-a-3628498.htmlHope this help.

Added on September 30, 2012, 9:03 amQUOTE(Dividend Warrior @ Sep 29 2012, 06:05 PM)

Wow! The industrial REITs are rising fast!

Thanks for the alert...

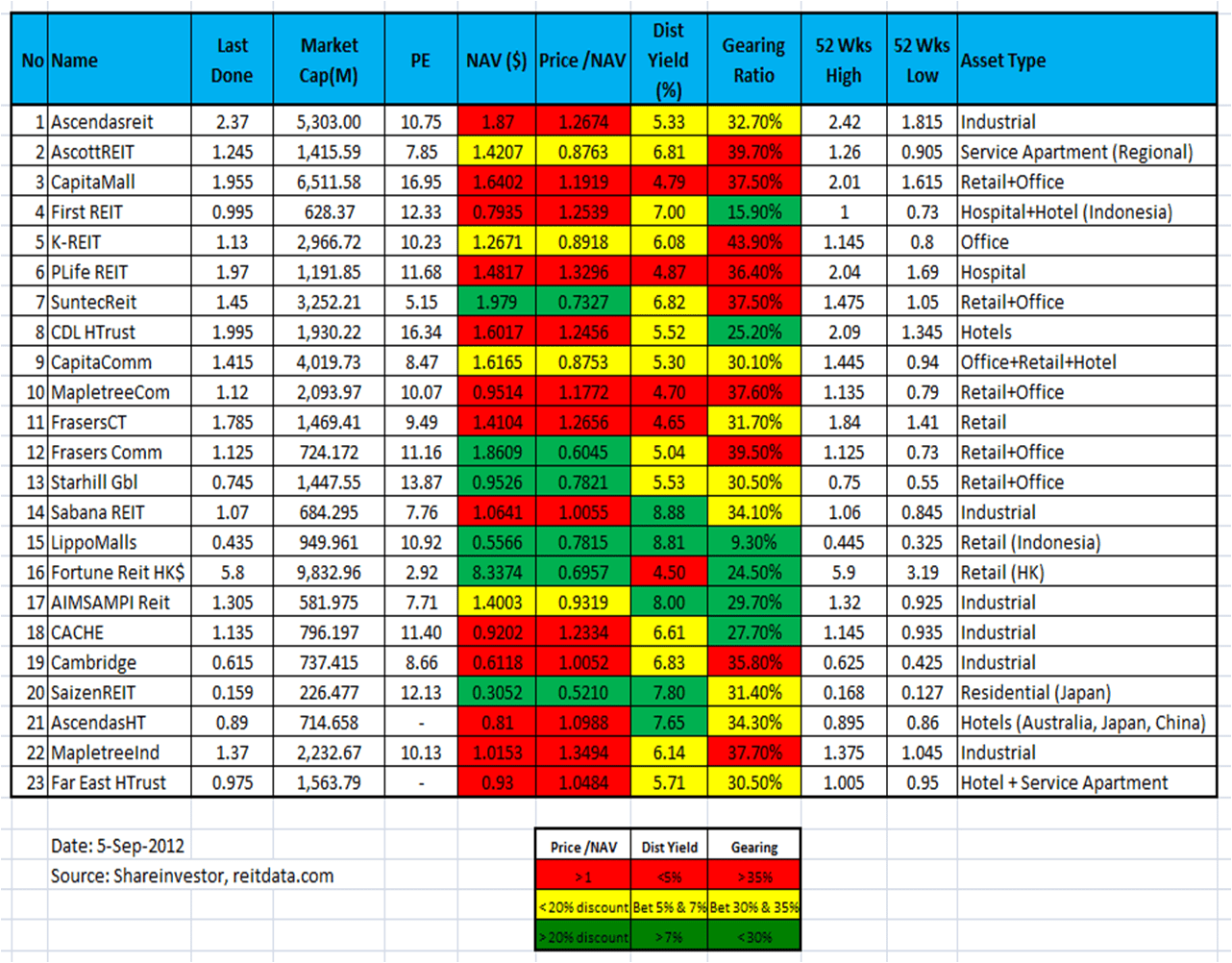

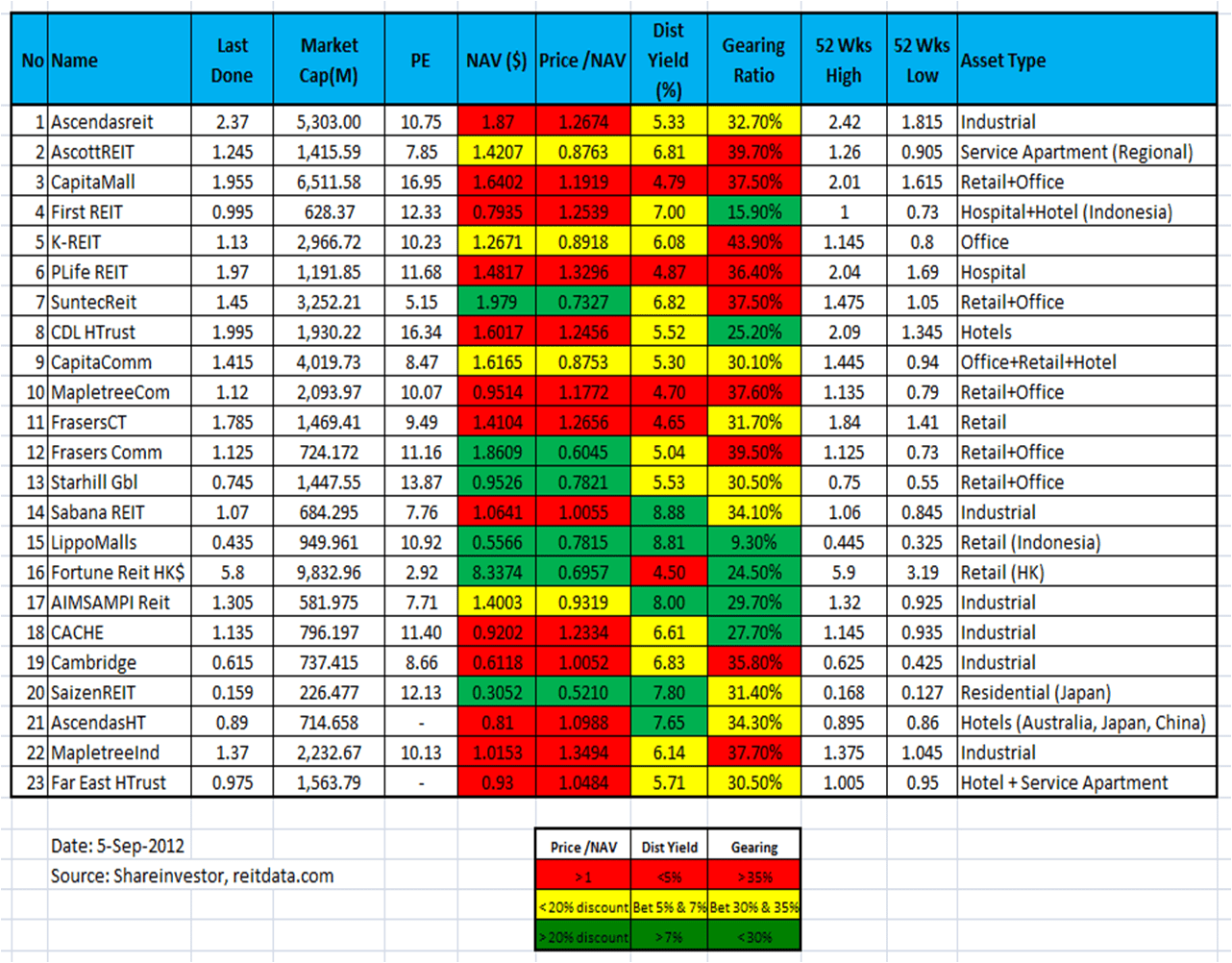

I like to check out comparison table in this blog

http://mystocksinvesting.com/:

http://mystocksinvesting.com/wp-content/uploads/2012/09/Singapore-undervalued-REIT-stock-comparison-5-Sep-2012.png

This post has been edited by Anic: Sep 30 2012, 09:03 AM

Sep 28 2012, 03:25 PM

Sep 28 2012, 03:25 PM

Quote

Quote http://mystocksinvesting.com/wp-content/uploads/2012/09/Singapore-undervalued-REIT-stock-comparison-5-Sep-2012.png

http://mystocksinvesting.com/wp-content/uploads/2012/09/Singapore-undervalued-REIT-stock-comparison-5-Sep-2012.png 0.4971sec

0.4971sec

0.94

0.94

7 queries

7 queries

GZIP Disabled

GZIP Disabled