Keppel KBS looks really cheap at this point. The yield, even assuming some dilution is above 10%. Think I'll finally buy some tomorrow.

Singapore REITS, S-REITS

Singapore REITS, S-REITS

|

|

Nov 1 2018, 06:27 PM Nov 1 2018, 06:27 PM

Return to original view | Post

#41

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

Keppel KBS looks really cheap at this point. The yield, even assuming some dilution is above 10%. Think I'll finally buy some tomorrow.

|

|

|

|

|

|

Nov 2 2018, 09:04 AM Nov 2 2018, 09:04 AM

Return to original view | Post

#42

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Hansel @ Nov 2 2018, 12:58 AM) Your good theory is only true IF future acquisitions by Kep-KBS US REIT are dpu-accretive. What happens if Keppel-KBS turns out to be like Manulife US REIT which bought one property after another, with each property being dpu-reducing after the acquisition ? Your view is still intact for the long term but in the short term the sell off appears to be over done. When REITs rebounds eventually in the next few months, this one could be a winner. The yield has risen so much, more than enough to offset a relatively minor DPU fall from the acquisition.I'd rather if a REIT Manager can't manage its properties well enough to give long term income to investors, unitholders must then do something to correct this ! Otherwise, more and more acquisitions are performed and the manager gets to enjoy more and more acquisition fee,... without any regards to unitholders. QUOTE(Ramjade @ Nov 2 2018, 07:36 AM) I have to agree with Havoc on this. At this price no matter what they do, you are getting way above 7%. Have to give them chance. 1 year should be sufficient. Yes I am applying for rights and excess. I got in at 0.67 not IPO price so consider quite cheap for me. 30% discount you don't want to take? QUOTE(prophetjul @ Nov 2 2018, 08:42 AM) My order just filled at pre open auction at 56 cents |

|

|

Nov 2 2018, 11:21 AM Nov 2 2018, 11:21 AM

Return to original view | Post

#43

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Ramjade @ Nov 2 2018, 09:09 AM) How do you subscribe to the rights? As in how would you make payment? I was given the impression that these corporate actions are not so straight forward for non-residents. |

|

|

Nov 2 2018, 02:55 PM Nov 2 2018, 02:55 PM

Return to original view | Post

#44

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Ramjade @ Nov 2 2018, 11:59 AM) Yes that's true for CDP holders. You need SG address. And is annoying as hell the way SG govt structured it so that CDP holders without SG address cannot participate. Use nominee like FSM SG or maybank KE prefunded to get around SG govt roadblock. Put in the amount of cash required, tell your broker you want to subscribe for rights, and whether you want excess. He will settle everything for you. Just make sure have sufficient cash inside. That's Maybank KE prefunded. Not sure about FSM SG structure. Of course make sure wben8 form active or else kena slap with 30% with holding tax. QUOTE(elea88 @ Nov 2 2018, 12:03 PM) just give instruction via whatsapp if its MKE.. or via phone if STD CHART. all nominee Thanks for the clarification guys. I bought keppel KBS using FSM since SCB won't let me hold the shares. Anyway I think the worst of selling pressure on the rights should be over, with those who want to dump the rights usually do so on the first opening session.if direct CDP.. then you will need a singapore address. |

|

|

Nov 5 2018, 09:08 PM Nov 5 2018, 09:08 PM

Return to original view | Post

#45

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Hansel @ Nov 5 2018, 07:18 PM) http://lampiran1.hasil.gov.my/pdf/pdfam/GO_012018_01.pdf There's no mention on required reporting for dividends or capital gains.. But if they plan on taxing those in future, it makes sense for them to start laying the groundwork now. Though taxing offshore income is going to introduce many potential pitfalls I imagine. What happens to Malaysians who are working abroad, in places like SG or Australia? Do they have to pay taxes to LHDN? If so, our citizenship will become a burden like the US." 1.4 Program Khas ini juga bertujuan memberi peluang kepada pembayar cukai melaporkan pendapatan yang sepatutnya selaras dengan pelaksanaan Common Reporting Standard (CRS) pada 30 September 2018 yang mana LHDNM bakal menerima maklumat kewangan pembayar cukai daripada pentadbir cukai luar negara. " http://www.hasil.gov.my/bt_goindex.php?bt_...=5000&bt_sequ=3 " Pendapatan Diremit Dari Luar Malaysia Mulai tahun taksiran 2004, pendapatan yang diperoleh dari luar Malaysia dan diterima di Malaysia oleh seseorang individu yang bermastautin dan diremitkan ke Malaysia dikecualikan daripada cukai pendapatan. " |

|

|

Nov 6 2018, 01:09 AM Nov 6 2018, 01:09 AM

Return to original view | Post

#46

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(cherroy @ Nov 5 2018, 11:15 PM) Based on above several post, it seems like many have misunderstood the CRS under AEOI. Hi Cherroy, thanks for the detailed explanation on the CRS. However, the issue that all of us here would like answered is whether are we legally obliged to report to LHDN the annual gains (be it capital gains or dividends) from SREITs or any other stock market investments.Under CRS, those participant countries like Sg, Malaysia, Australia and many more (can refer http://www.oecd.org/tax/transparency/autom...nformation.htm) , who have signed the agreement on the AEOI, will exchange information between them. Eg. If A is tax resident of Malaysia, but having a bank deposit account in Sg for investment or whatever (as long as appear in the bank ac list), Sg counterpart will send those bank information to LHDN every year. By then, LHDN will know A has SGD xxxxxx in Sg, and it can be easily cross checked by LHDN that whether A has been duly report their tax accordingly that match the amount of money in Sg. As if A's income based on tax submission, A total income shouldn't be more than eg. 1 mil, but as Sg bank account got 10 mil balance, clearly it will raise red flag. The CRS enable more transparent, no more previously of people "hiding" money at overseas. The CRS has nothing to do with the Sreit or dividend income taxable issue. Sreit income and dividend (single tier) are still tax exempted income, as it is a foreign source of income. But those Sreit income or dividend that bank into A account in Sg bank, under CRS, it will be send to LHDN database, as all account info will need to be sent under CRS. While those using nominee account to receive Sreit income or any other foreign dividend, it is still tax exempted, but remember to keep those statement (just if needed), as a proof of your foreign income. |

|

|

|

|

|

Nov 6 2018, 06:19 PM Nov 6 2018, 06:19 PM

Return to original view | Post

#47

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Hansel @ Nov 6 2018, 11:01 AM) Thank again, bros,... for responses,... As part of a financial institution, I have checked with my colleagues who are involved in CRS reporting. All financial institutions are required to report its local tax office on any foreign tax-residents accounts on a regular basis. My company does it on a monthly basis. The tax office will forward the info to its respective tax office. So as Malaysians holding accounts in SG, the banks will forward our info to SG's tax office who will in turn forward it to LHDN. As long as you open a bank account in a country that is signatory to that agreement, LHDN will know of your bank accounts. This doesn't apply to just bank accounts but other forms of investments too.SG banks and brokerages do not send the CRS Records to LHDN every year as a standard procedure. If it is going to be like this,... then all the countries in the OECD implementing the CRS would need to send ALL records from their respective countries to each other,.. imagine the sort of work that is required and the sort of system and disk space needed to process this,... I believe the sharing of information is on an 'upon request' basis, targetted onto specific individuals who are 'popular'. The more 'popular' the individual, the more will LHDN request for infos about that individual from the more countries by activating the CRS procedure. This post has been edited by Havoc Knightmare: Nov 6 2018, 06:26 PM |

|

|

Nov 6 2018, 06:50 PM Nov 6 2018, 06:50 PM

Return to original view | Post

#48

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(elea88 @ Nov 6 2018, 03:55 PM) [Ramjade][hansel] It certainly matches our expectations of how value destructive the deal is. While I would understand why someone who bought this prior to the deal, to be very upset. But the steep drop in price more than offsets a 10-20% dilution in DPU, making the REIT a very attractive proposition in the short term. My gut feel says that the management did not expect to have to raise equity in such a hostile market environment just 3 months ago, and did not expect to have to lower the rights price to just 50 cents.https://financialhorse.com/rights-issues-fo...lVG08RtG6KTRQNY http://www.probutterfly.com/blog/is-the-ke...rRcb6oxhfjYKduk |

|

|

Nov 7 2018, 03:01 PM Nov 7 2018, 03:01 PM

Return to original view | Post

#49

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

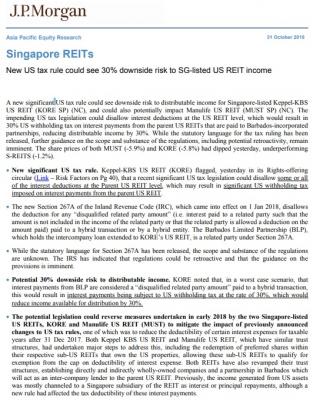

This changes the whole investment thesis for the REIT and puts to rest the debate as to why the REIT has slid so much...

But even if we assume a current yield of 11%, after a 30% withholding tax applies in the worst case, the yield should be ~8%. Decent, but not exciting given market sentiments. This post has been edited by Havoc Knightmare: Nov 7 2018, 03:04 PM Attached thumbnail(s)

|

|

|

Nov 8 2018, 10:31 PM Nov 8 2018, 10:31 PM

Return to original view | Post

#50

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(elea88 @ Nov 8 2018, 11:08 AM) QUOTE(Hansel @ Nov 8 2018, 12:29 PM) Hmm,... yeah, I saw the good reporting too this morning,... dpu is up !! But on the 1-year chart, the unit price keeps inching-down,.... https://finance.yahoo.com/chart/BWCU.SI#eyJ...nZSI6bnVsbH0%3D Edited by adding : If the price stays still or moves in a tight range, I'm still okay if the dpu is steady or growing,... eg as in Netlink NBN Trust,... But EC World REIT's price is inching-down,....causing capital loss. QUOTE(prophetjul @ Nov 8 2018, 12:32 PM) While I currently bought some at 69 cents a month ago and like the story of this REIT, I would like to sound a note of caution on the REIT. The REIT has borrowed in SGD while all its assets are denominated in RMB. The slide of the RMB vs the SGD has resulted in the debt load going up, although still at a comfortable level at present. Also, this mismatch of FX for assets vs liabilities has resulted in the NAV per share declining as assets shrink vs debt. The REIT could face difficulties in future if the RMB were to slide against the SGD sharply. And as we know, MAS has a policy of gradually strengthening the SGD so this gearing might become an issue some time down the road. But having said all that, I think China will continue to do fine in the next 1-2 years, more so if Trump ends the ongoing trade war with China. |

|

|

Nov 8 2018, 11:55 PM Nov 8 2018, 11:55 PM

Return to original view | Post

#51

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(kart @ Nov 8 2018, 11:32 PM) Ladies and gentlemen, The industrial sector in SG has not bottomed out yet, in terms of rental rates. Rent is still falling as there is a glut of industrial space that is slowly being absorbed. The worst is likely behind for the sector although it may take a few more quarters before rental rates start to rebound. And as long as DPU keeps falling, it's hard for the share price to stay the same, much less rise. Having said that, AIMS AMP is among the top on the list of industrial REITs that I would buy once I'm certain that rents have stabilized and bottomed out.Does anyone have an idea about the decreasing share price of AIMS AMP Capital Industrial REIT, reaching a low point of SGD 1.29? Yeah, it provides a good chance for us to buy at a dip, but this is a REIT which should not as volatile as a share. The price of AIMS has dropped more than SGD 0.025 (the latest quarterly dividend), after dividend ex-date. Similar to EC World REIT, as Hansel said, we are experiencing capital loss for AIMS. Thank you for your information. |

|

|

Nov 11 2018, 01:13 AM Nov 11 2018, 01:13 AM

Return to original view | Post

#52

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Hansel @ Nov 10 2018, 12:37 PM) Bros,... I'm afraid I have a different opinion here. I observed and opined that the only way for an Industrial REIT in SG to turn around is only via one of two ways :- Your view is correct, traditional industrials is a sunset industry particularly for a high-cost economy like Singapore. However, if the yield is attractive enough to compensate for the risk of loss of revenue during any transformation into a high-tech centre or business park, then it might still be worth holding it. 1) turn their warehouse assets into hi-tech centres or business parks, ie need to put in AEI's, which would of course, incur capex's. 2) buy assets in certain countries, may not be Australia anymore due to the falling AUD. If a REIT is going to just sit and wait for industrial space inside SG to run out so that supply goes down, or wait for more take-ups in their empty spaces from an economic upturn, it's going to be futile. The outcome may cause the Industrial REIT turn out into something like Sabana REIT. Added : I would not be waiting for rents to stabilise or bottom-out, I would be waiting fir the REIT to, say,... make an acquisition in a good foreign ctry or to a lesser extent, convert any of their warehouses into, say,.... a high-tech centre or business park... Think about it, if you have a REIT that consists purely of SG-based high grade business parks, I would expect it to yield close to Keppel DC, 5-6%. To me, everything has a price that I would be willing to enter into, even if it is a really lousy asset. Just whether I'm being compensated more than enough to bear that risk. |

|

|

Nov 11 2018, 01:21 AM Nov 11 2018, 01:21 AM

Return to original view | Post

#53

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Hansel @ Nov 10 2018, 01:18 PM) The is the framework :- To me it is better to borrow in the currency of the assets, so that any currency depreciation is balanced out nicely without putting the REIT at risk. Also, the REIT will only need to hedge the cash that is to be repatriated back (if the REIT practices hedging its currency risks). However it is tempting for the REIT manager to borrow at the lowest interest cost (and thus incurring the forex mismatch risk). It might not seem to be a big issue for most REITs that have this mismatch, but for certain currencies that are particularly weak in the long run such as the Indonesian Rupee or Indian Rupiah, the mismatch poses an unusually greater risk.1) Country from where rental is collected from. 2) Country where dividend is paid out. Then the effects from the above framework starts to pour. Looking from the angle of currency,.... If 1) is GENERALLY stronger than 2),.. effects are :- a) borrowing from 1) will provide a natural hedge. b) borrowing from 1) will cause 2) to service more financial costs,... etc,... |

|

|

|

|

|

Nov 17 2018, 12:09 PM Nov 17 2018, 12:09 PM

Return to original view | Post

#54

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Vector88 @ Nov 16 2018, 11:03 AM) The REIT is at risk as some of the hospital lease payments are made through Lippo Karawaci, the parent company of Lippo. If that company goes down, the REIT may stop receiving rent payments. Also, the expiring hospital contracts in 2021 onwards will be renewed at much lower rates, which is what happened to some of Lippo Mall REIT anchor tenants, which are (unsurprisingly) owned by the Lippo group. As tempting as the Lippo related REITs/stocks are, I will stay away from them at all cost due to corporate governance issues, ie that the management of the company is not to be trusted to act in the best interest of REIT holders.This post has been edited by Havoc Knightmare: Nov 17 2018, 12:10 PM |

|

|

Nov 19 2018, 05:47 PM Nov 19 2018, 05:47 PM

Return to original view | Post

#55

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Vector88 @ Nov 19 2018, 10:56 AM) ya man.... I sold all of them today... Although I've been in SREITs for 8 years already, the past year has been a very key lesson in the importance of corporate governance. When times are good, all boats rise together carried by the tide... But when tough times arrive, what Warren Buffet said comes to mind- You only find out who is swimming naked when the tide goes out. Some loss, but manageable as they are the smallest holding in my portfolio... this Lippo really screw investors kau kau ... last time in Lippo Mall reit, now First reit The Mapletrees and Capitalands have done well against the broader market while you have Lippo related REITs on the other end. Some of these things can't be learnt from textbooks or even blogs, but through experiencing it first hand yourself. |

|

|

Nov 20 2018, 10:45 AM Nov 20 2018, 10:45 AM

Return to original view | Post

#56

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(prophetjul @ Nov 20 2018, 09:00 AM) Yeah Bond yields are starting to drop again.. should be supportive of REITs, particularly the these names.The interesting thing now is the yields are widening again due to market correction. When is the time to fish the perpetual pearls like the Capitalland, Mapletree, Frasers? QUOTE(Vector88 @ Nov 20 2018, 09:53 AM) Good luck.. collect gems if you can come across any during this sell off.QUOTE(kart @ Nov 20 2018, 10:21 AM) Does anyone have any idea about AIMS AMP Capital Industrial REIT not trading on SGX? First trade was only done at 10.37am. Using POEMS to view.I cannot see any price movement in Google Finance, and Maybank KE Trade website. |

|

|

Nov 20 2018, 03:18 PM Nov 20 2018, 03:18 PM

Return to original view | Post

#57

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(elea88 @ Nov 20 2018, 11:35 AM) first reit.. Dived deep.. $.97.. I still hv a bit. Yup, it's as I described. This REIT is dependent on Lippo Karawaci for rental payments for some hospitals. It would be a mistake to confuse it for a typical REIT which is not directly affected by it's sponsor's financial situation. In fact the whole concept of a REIT is to cleanly separate the assets out from the Sponsor, so that investors have pure exposure to the assets only and not Sponsor. But in this case, it's proof that investors need to do a lot more due diligence when it comes to a REIT.the reason.. https://www.fool.sg/2018/11/20/why-did-firs...unge-yesterday/ On a side note, I picked up some Ascendas India Trust on the sell off. It's an underrated REIT with more growth prospects than the Indonesian REITs and it's backed by Ascendas. At least I can sleep peacefully without having to worry about corporate governance issues and dodgy sponsors. Eventhough the Indian rupee has been sliding, DPU growth has been far stronger. |

|

|

Nov 24 2018, 10:50 AM Nov 24 2018, 10:50 AM

Return to original view | Post

#58

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(fairylord @ Nov 20 2018, 11:07 PM) It's bad generally if the Sponsor is able to exert strong influence over the REIT. The concept of a REIT is meant for sponsors to dispose of their assets and raise cash. So if the Sponsor is able to exert strong influence, they may treat the REIT like a recycling bin to dump their underperforming assets. I can think of an MREIT with 'mixed' assets where the Sponsor has dumped plenty of non performing assets in to raise cash, and relied on certain key assets to mask the underperformance. |

|

|

Nov 27 2018, 11:45 AM Nov 27 2018, 11:45 AM

Return to original view | Post

#59

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

Dec 6 2018, 11:02 PM Dec 6 2018, 11:02 PM

Return to original view | Post

#60

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

| Change to: |  0.0462sec 0.0462sec

0.57 0.57

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 12:42 AM |