Dasin Retail Trust: https://links.sgx.com/1.0.0/corporate-annou...3f8233c776f652e

Singapore REITS, S-REITS

Singapore REITS, S-REITS

|

|

May 17 2021, 08:33 PM May 17 2021, 08:33 PM

Return to original view | IPv6 | Post

#281

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Dasin Retail Trust: https://links.sgx.com/1.0.0/corporate-annou...3f8233c776f652e

|

|

|

|

|

|

May 18 2021, 09:37 AM May 18 2021, 09:37 AM

Return to original view | IPv6 | Post

#282

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(prophetjul @ May 18 2021, 09:20 AM) https://links.sgx.com/FileOpen/ECWREIT%20-%...t&FileID=666621 That is what we call "survival of the fittest" Another Reit privatisation? The Board of Directors of EC World Asset Management Pte. Ltd., as manager of EC World Real Estate Investment Trust (“ECW”, and as manager of ECW, the “Manager”), wishes to announce that it has been approached by Forchn International Pte. Ltd. in relation to a potential transaction involving ECW’s interests in all of its properties, which may or may not lead to the divestment of these properties. The Manager has not entered into any exclusive or binding arrangement in connection with the discussions and Forchn International Pte. Ltd. is leading the discussions on behalf of a consortium of purchasers. No decision has been made in respect of the price or the terms under which any such divestment would take place, and the Manager wishes to emphasise that there is no certainty or assurance whatsoever that any transaction will occur. The Manager will make the relevant announcements on SGXNET in the event there are any material developments which warrant disclosure, in compliance with its obligations under the Listing Manual of Singapore Exchange Securities Trading Limited (the “SGX-ST”). Unitholders and investors are advised to refrain from taking any action in respect of units in ECW (“Units”) which may be prejudicial to their interests, and to exercise caution when dealing in the Units. Persons who are in doubt as to the action they should take should consult their stockbroker, bank manager, solicitor or other professional advisers. |

|

|

May 18 2021, 09:45 AM May 18 2021, 09:45 AM

Return to original view | IPv6 | Post

#283

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Vector88 @ May 18 2021, 09:38 AM) Shares jump 5%, suggesting premium paid likely some 5% above current price, but discount to NAV is some 14% though. Better keep your fingers crossed this will not end up like the Sabana-ESR merger. |

|

|

May 18 2021, 09:54 AM May 18 2021, 09:54 AM

Return to original view | IPv6 | Post

#284

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(ronn77 @ May 18 2021, 09:20 AM) Hi taikors, Concentrated portfolio is possible in S-REIT world, especially if you solely focus on large caps. This is a highly oligopolistic market. Good sponsors and large, mid-caps enjoy some premium over the small ones. I have been investing in singapore stocks for past few years but my portfolio on reit is rather limited. I've been eyeing on Suntec Reit and understand that they are shopping mall operator and have been affected by covid, hence the price remain attractive. Not sure if it's a good choice but perhaps some sifus here can give some tips or comment? I don't know your risk profile, not sure of whether your existing portfolio already has blue chips/large-mid caps in it, and need to consider your existing industry exposure. You don't want (or you may prefer) all stakes in retail + office only (since Suntec is mainly office + retail). You are right about the poor performance, CICT also exhibit similar trend, amid the spectre of more rental rebates. Suntec has a high leverage ratio of some 44-45% too, something to take note of. |

|

|

May 18 2021, 11:09 AM May 18 2021, 11:09 AM

Return to original view | IPv6 | Post

#285

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(prophetjul @ May 18 2021, 10:18 AM) I don't know. Markets decide, not me... Perhaps given the leverage and fear that it's small-cap, refinancing risk. 5% is what the market thinks, perhaps it may rise in days to come. We never know. But it's a known fact that small-caps always trade at a discount to book value. Not new stuff for you, I believe. |

|

|

May 18 2021, 05:39 PM May 18 2021, 05:39 PM

Return to original view | IPv6 | Post

#286

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

wongmunkeong liked this post

|

|

|

|

|

|

May 18 2021, 08:08 PM May 18 2021, 08:08 PM

Return to original view | IPv6 | Post

#287

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

As soon as 3Q this year, you can own a piece of HSBC's UK HQ building.

https://www.bloomberg.com/news/articles/202...-singapore-reit |

|

|

May 20 2021, 08:54 AM May 20 2021, 08:54 AM

Return to original view | IPv6 | Post

#288

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

MIT's acquisition spree on DCs: https://links.sgx.com/1.0.0/corporate-annou...0a3dad56852d641 Hansel liked this post

|

|

|

May 24 2021, 08:46 AM May 24 2021, 08:46 AM

Return to original view | IPv6 | Post

#289

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Hansel liked this post

|

|

|

May 24 2021, 05:53 PM May 24 2021, 05:53 PM

Return to original view | IPv6 | Post

#290

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

May 25 2021, 12:29 AM May 25 2021, 12:29 AM

Return to original view | IPv6 | Post

#291

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hansel @ May 24 2021, 08:39 PM) There are times that we use the accredited investor status and there are times that we don't,... you figure out for yourself when we do which,.... Oh I didn't know that. New to me I have to admit. My initial thought was accredited investors carry that title all the time. So whether or not they subscribe to private placements does not affect their status right? Obviously say, a HNWI won't lose his HNWI status simply because he does not subscribe to a certain private placement, no? Your comment sound like one can choose whether or not to be that "accredited investor" status, something I never heard of. (My previous post was a joke anyway.) |

|

|

May 25 2021, 02:16 PM May 25 2021, 02:16 PM

Return to original view | IPv6 | Post

#292

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

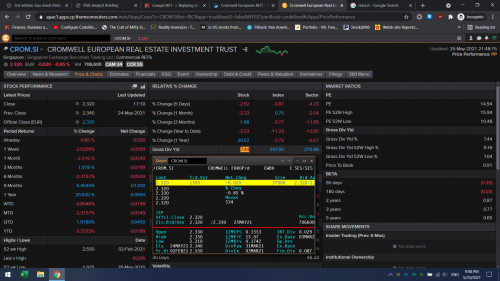

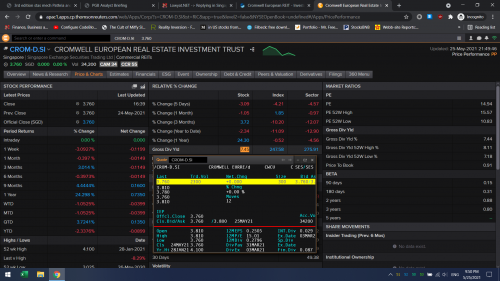

QUOTE(tadashi987 @ May 25 2021, 02:04 PM) hi asking a might be noob question here Currency and interest rates. is there any differences between: CROMWELL REIT EUR SGX:CWBU div yield: ~7.038% CROMWELL REIT SGD SGX:CWCU it looks like they both are the same, but not sure why their dividend yield varies quite a fair bit? Yield fluctuates if market thinks currency hedge is different from future anticipated movements. Otherwise there are arbitrage opportunities. There could also be counterparty risk depending on who is the counterparty involved in the currency/interest rates swaps. tadashi987 liked this post

|

|

|

May 25 2021, 09:50 PM May 25 2021, 09:50 PM

Return to original view | IPv6 | Post

#293

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(tadashi987 @ May 25 2021, 02:05 PM) hi asking a might be noob question here is there any differences between: CROMWELL REIT EUR SGX:CWBU div yield: ~5% CROMWELL REIT SGD SGX:CWCU div yield: ~2.98% it looks like they both are the same, but not sure why their dividend yield varies quite a fair bit? QUOTE(TOS @ May 25 2021, 02:16 PM) Currency and interest rates. Sorry, I would like to retract my reply earlier. The yield for Cromwell is around 7.44-7.45 % p.a. Where do you get that 5% from? 2.98% is even lower then Parkway Life and Keppel DC. Yield fluctuates if market thinks currency hedge is different from future anticipated movements. Otherwise there are arbitrage opportunities. There could also be counterparty risk depending on who is the counterparty involved in the currency/interest rates swaps. The difference in currency/interest rates should be very little as shown in my Reuters Eikon terminal. The difference is there however, albeit insignificant. CWBU for EUR version 7.44% p.a.  CWCU for SGD version 7.45% p.a.  A difference of some (5-2.98 = around 2)% is very significant and will attract arbitrage. Sorry my bad for not realizing this earlier. To further add-on, liquidity is another issue to consider. The EUR version is more actively traded, so it is also reasonable that it commands some liquidity premium over the SGD version, hence the lower yield for CWBU (EUR version). This post has been edited by TOS: May 25 2021, 10:02 PM |

|

|

|

|

|

May 26 2021, 07:57 AM May 26 2021, 07:57 AM

Return to original view | IPv6 | Post

#294

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.businesstimes.com.sg/companies-...aunch-a-uk-reit QUOTE PROPERTY heavyweight City Developments (CDL) is having a torrid time. It wrote down S$1.78 billion of its investment in Sincere Property Group, which contributed to a net loss of S$1.92 billion for the full year ended Dec 31, 2020. The group saw improvement across its core business segments in Q1 2021. But its large hotel business struggled, with revenue per available room globally down 52 per cent year on year. Recently reported developments about CDL's planned listing of a real estate investment trust (Reit) may, therefore, be welcomed by investors. A Bloomberg report quoted people with knowledge of the matter as saying that Qatar Investment Authority may inject HSBC Holdings' London headquarters building into a UK commercial property Reit to be listed by CDL in Singapore, possibly as early as the third quarter. CDL has two predominantly office properties in London that could be injected into the UK Reit: 125 Old Broad Street and Aldgate House. These were acquired in 2018 for £385 million and £183 million, respectively. The price at which CDL injects these assets into a Reit will be important. Shareholders will be looking for something more than the purchase price, with the company having held the properties for around three years, as a testament to the group's ability to recycle assets and grow its fund management business. CDL currently has two other Singapore-listed trust vehicles in its stable: CDL Hospitality Trusts (CDLHT) and IReit Global. The latter's manager is jointly owned by CDL and French asset manager Tikehau Capital. A UK-focused office Reit would add positively to CDL's presence in the Singapore Reit space. Monies freed up from divesting assets to the Reit can possibly be used to help the hotel business, which may take a long time to recover, or to pursue other opportunities. Question of timing Investors may wonder if the timing is right for the launch of an office Reit. The iEdge S-Reit Index is down 1.0 per cent year to date, underperforming the Straits Times Index's gain of 10.6 per cent. Signs of inflation in the United States have caused the 10-year US Treasury yield to spike. The 10-year Singapore government bond yield has also risen - to around 1.5 per cent in late May from 0.8 per cent a year ago. A higher risk-free rate, as represented by long-dated government bond yields, would generally reduce investor demand for yield instruments such as Reits and increase the yield required by Reit investors. Question of assets Even so, a UK office Reit could benefit from improvement in sentiment in the London commercial property market. Activity in the leasing market is picking up amid the opening up of the United Kingdom. More than a third of the country's population has been fully vaccinated. And since May 17, pubs and restaurants in the UK have opened for indoor service with some restrictions on numbers. In the first quarter, Central London saw an increase in leasing transactions for the first time since the pandemic started - although at 1.3 million square feet, take-up was 56 per cent below the 10-year quarterly average, according to CBRE. Adding HSBC's headquarters at 8 Canada Square in Canary Wharf would enhance the attractiveness of CDL's UK commercial Reit. An investor in this Reit would get exposure to assets in London's new financial hub of Canary Wharf as well as the traditional financial hub of the City, where 125 Old Broad Street is. The emerging submarket of Aldgate, meanwhile, has attracted occupiers from the technology, media and telecoms sector. Critically, adding HSBC's headquarters will boost the scale of the Reit from an estimated £600 million to £1.8 billion (S$3.4 billion). That would make the new Reit larger than CDLHT and IReit, which have total assets of S$2.9 billion and 769 million euros (S$1.2 billion) as at end-2020, respectively. Outlook for UK market Elite Commercial Reit, which made its debut on the local bourse in February last year, has paved the way when it comes to UK-focused Reits. It owns a £515 million portfolio of office assets, which are over 99 per cent leased to the UK government. Elite is currently trading below its initial public offering price. Investors may have concerns about the exposure to sterling, even though it is up around 4 per cent year-to-date versus the Singapore dollar. And although the Reit could be the largest in CDL's stable, it is likely to still be dwarfed by Singapore office-centric Keppel Reit and Suntec Reit. These have total assets of S$7.8 billion and S$11.2 billion as at end-2020, respectively. There are also some concerns about the health of the UK office property market. According to CBRE, office availability in Central London continued to increase over Q1 to stand at 25.3 million square feet. The vacancy rate rose to 8.9 per cent. Questions linger over the continued pre-eminence of London as an international business hub post-Brexit, and the impact to aggregate office space demand from the new hybrid model of office and remote working. Nearer term, a flight to quality may see tenants seek accommodation in the new skyscrapers coming up in London. Many developers, including British Land, are betting on top rents for the best new buildings as tenants pay more for offices that suit their post-pandemic needs. CDL's key task is to convince investors that the properties in the Reit are fit for purpose in meeting the needs of potential customers in a post-pandemic world. If it succeeds, it may pave the way for more UK property Reits to list in Singapore. Peers such as Ho Bee Land, which has a sizeable London commercial portfolio, could follow in its tracks. https://www.businesstimes.com.sg/companies-...ompeting-forces QUOTE Companies & Markets NEWS ANALYSIS; Data centre Reits navigate growth amid competing forces Rae Wee 26 May 2021 Business Times Singapore STBT © 2021 Singapore Press Holdings Limited Expansion relies on acquisition firepower, though there is also keen interest on building assets from scratch Singapore MAPLETREE Industrial Trust's (MIT) latest US$1.32 billion proposed purchase of 29 data centres in the United States speaks to the continued appetite for assets tied so intimately to the trend of 5G and the natural data boom. On the local bourse, there are three real estate investment trusts (Reits) with substantial exposure to this asset class: Ascendas Reit, Keppel DC Reit, and MIT. Over the past five years, total unitholder returns for all three Reits, as at May 25, was about 214 per cent for Keppel DC Reit, 131 per cent for MIT, and 70 per cent for Ascendas Reit, based on Bloomberg data. Within the same period, the benchmark Straits Times Index gave a total return of 37 per cent. Total unitholder returns include distribution yield. Growth for some dominant players in this space will rely on their firepower to be able to make acquisitions. But it is also becoming a crowded space, and analysts are flagging that these players will need to find new ways to hunt down assets, and take more care in their lease mix. Gone shopping The offshore acquisitions by major property players in Singapore have already come in thick and fast this year. In April, CapitaLand made plans to invest 3.66 billion yuan (S$757.7 million) to acquire its first hyperscale data centre campus in Shanghai's Minhang District. A month earlier, Ascendas Reit snapped up 11 data centres in Europe for S$904.6 million from New York-listed data centre Reit Digital Realty Trust. As for MIT, it announced last week the proposed acquisition of 29 data centres across 18 US states for US$1.32 billion. MIT said that the proposed acquisition will make it one of the largest owners of data centres among Asian-listed Reits. It is also in line with MIT's target for data centres to make up two-thirds of its portfolio in the medium term. While Singapore is tightening its supply with its temporary pause on data centres, markets such as Europe and the US continue to present good opportunities for acquisitions for data centre players here, said RHB analyst Vijay Natarajan. India is another emerging market to look at, he added, given its large population and the need to store data centres and servers. With acquisitions, DBS Group Research's analyst Dale Lai said that Keppel DC Reit could rely on its sponsor, Keppel Telecommunications & Transportation, to suss out assets to buy. As for Ascendas Reit and MIT, "they have acquired data centres from Digital Realty and they could continue to tap on this relationship for further acquisitions". There remains financial firepower for acquisitions. MIT's post-acquisition gearing would be at 40.3 per cent. As at March 31, Ascendas Reit's and Keppel DC Reit's were 38 per cent and 37.2 per cent respectively. About 10 per cent of Ascendas Reit's portfolio consists of data centres, following the acquisition of the 11 European data centres. The total sum of its investment properties stands at some S$15.1 billion as at March 31. As for Keppel DC Reit, whose entire portfolio is made up of data centres, it has assets under management (AUM) of S$3 billion as at end-December, 2020. It had a total of 20 data centres in its portfolio, as at March 31. These properties are in Singapore, Malaysia, Australia, the United Kingdom, The Netherlands, Ireland, Italy, and Germany. As for MIT, following the proposed acquisition - targeted for completion in the third quarter this year - the proportion of data centres in MIT's portfolio by AUM will increase to 53.6 per cent, standing at some S$4.6 billion. The acquisition will bring MIT a total of 61 data centres under its belt - five in Singapore and 56 in North America, of which, 13 are held through a 50:50 joint venture (JV) with Mapletree Investments. With acquisition opportunities tightening, Reit sponsors may look to develop data centres from scratch, analysts added. As it is, there seems to be keen interest to build up data centres in Singapore. Brenda Ong, executive director for logistics and industrial at Cushman & Wakefield, said that there "have been a few (data centre) operators identifying and pooling potential 'land' wherever possible, to be ready (for) when the moratorium is lifted". After building such assets, these could eventually be injected into a Reit, analysts said. The urgency comes as Singapore itself has put a moratorium on data centres to be built here. In the last five years, 14 data centres with a total IT capacity of 768 MW were approved to be constructed on industrial state land, the Ministry of Trade of Industry had said in February. This was a huge surge compared with the 12 data centres with a total IT capacity of 307 MW in the preceding five-year period. Given the intense use of water and electricity by such data centres, the government paused temporarily the release of state land for data centres, as well as the development of data centres on existing state land. With the moratorium in place since 2019, the government expects to provide details on its review by the end of 2021. Fine print In navigating growth, data centre players will also have to watch their lease mix. Investors should sit up to look through the fine print. Notably, out of the 29 North American data centres that MIT is now proposing to acquire, the portfolio's largest property - a multi-tenanted mixed-use data centre and office property - is only 63.5 per cent occupied, given recent office lease termination, said Citi analyst Brandon Lee in a research note. "While some commercial space could be converted into data centre space given its existing network connectivity and power availability, conversion and lease-up would take time and a short-term or safer solution would be to lease as office to increase income," he added. "We expect challenges given rising vacancies and tenant incentives in Atlanta's downtown office market." Of MIT's five existing Singapore data centres, four are leased to single tenants, including Starhub and Equinix. The last is catered "for companies in the lifestyle and knowledge-driven industries". Another way to look at the risk behind tenant mix is to review the type of leases being signed. One form is known as a triple net lease, in which the tenant is responsible for all ongoing expenses at the property in addition to base rents. These property expenses include real estate taxes, building insurance, and maintenance, on top of rent and utilities. Citi's Mr Lee said one positive of the latest MIT deal is that it expects minimal yearly capex of US$4 to 5 million, in part as 82 per cent of the leases are on a triple-net basis. With Ascendas Reit, its recently acquired 11 European data centres comprise 58 per cent of triple net leases, while the other 42 per cent are leases within colocation data centres, as at Dec 31, 2020. Both Keppel DC Reit's fully-fitted and shell-and-core data centres have a mix of triple net and double net leases. Shell-and-core data centres are buildings that have the bare bones necessary for data centre development, along with available power and connectivity. The tenant is then responsible for the fit-out. As for Keppel DC Reit, whose entire portfolio is made up of data centres (like this one in Germany), it has assets under management of S$3 billion as at end-December, 2020. Singapore Press Holdings Limited Hansel liked this post

|

|

|

May 27 2021, 02:35 PM May 27 2021, 02:35 PM

Return to original view | IPv6 | Post

#295

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.businesstimes.com.sg/companies-...he-road-for-now QUOTE Companies & Markets HOCK LOCK SIEW; Retail Reits facing a bump in the road - for now Nisha Ramchandani 25 May 2021 Business Times Singapore © 2021 Singapore Press Holdings Limited THE tougher safe-distancing measures announced earlier this month are a disappointing but possibly temporary setback for Singapore's retail Reits, some of which have been touted as post-pandemic "reopening" plays over the last few months. Although Singapore's borders still remain largely shut to tourists, domestic demand has helped to keep cash registers ringing. In the second consecutive month of growth, retail sales for March increased 6.2 per cent year-on-year, partly due to a low base. On a month-on-month (seasonally adjusted) basis, retail sales were 3 per cent higher. The latest restrictions, which are a softer version of last year's "circuit breaker" and will remain in place until June 13, are likely to interrupt this recovery. This, in turn, could further weigh on investor sentiment towards Reits, which were already grappling with concerns over inflation and rising bond yields, analysts have pointed out. Under the latest safe management measures, shopping mall operators are required to cap foot traffic at their premises at just one person per 16 square metres (sq m) of gross floor area (GFA), compared to one person per 10 sq m previously. Food & beverage establishments are also no longer allowed to cater to dine-in customers. In addition, working from home is once again the default mode, which has reduced the number of people out and about. The impact will vary from one retail Reit to another though. Retail Reits with largely suburban malls in the portfolio - such as Frasers Centrepoint Trust (FCT) - are expected to prove more resilient than those with malls downtown or in the central business district. While dining out isn't an option now, F&B outlets at suburban malls could still see steady sales from takeaways and through food delivery services. Supermarkets and grocers at these malls could also see strong demand, as was the case last year. On the other hand, retail Reits such as Lendlease Global Commercial Reit, Starhill Global Reit and SPH Reit have exposure to downtown malls, which makes them more dependent on the tourist dollar and the office crowd. Share prices of retail Reits have declined following the tighter measures, serving as an opportunity to accumulate the more resilient ones. OCBC Investment Research forecasts a rebound in DPU by 27.3 per cent for retail Reits for the current financial year, followed by growth of 5.6 per cent in FY22/23. However, downside risks loom for the retail Reits. One risk for investors is that landlords may have to step up the amount of rental assistance given to tenants to keep them from closing their doors, which could weigh on the distributions per unit (DPU). According to a report by CGS-CIMB, every half-month of rental rebates doled out to all tenants would impact the FY21 distribution per unit (DPU) for retail Reits by between 2 and 5 per cent. Still, "unless substantial rental rebates are given out, we do not expect the tighter measures to have a substantial impact on the Reits' financials as the impact from rental reversion will be spread out", the report said. Another risk for investors could be the challenging leasing environment. While occupancies have remained high at over 96 per cent, CGS-CIMB is forecasting rental reversions of -3 per cent to -20 per cent for FY21. A lot may depend on how the next couple of weeks pan out, especially if the government moves to extend the existing safe-distancing measures or tightens them even further. The latter would likely give way to more austere rules, delivering a big blow to the broader retail industry. Yet, there is reason for optimism. Singapore has acted decisively to stamp out the surge in infections. With experience from the "circuit breaker" days, landlords and tenants also have a sense of how to deal with the current heightened measures - for instance, through e-commerce. The ongoing vaccination programme offers some hope too, with the government now adjusting its strategy by spreading out the duration between doses so as to cover a bigger proportion of the population faster. Successfully containing the resurgence in Covid-19 cases over the next few weeks could mean the difference between a speed bump and an altogether more significant setback for retail Reits in the pursuit of recovery. Singapore Press Holdings Limited Hansel liked this post

|

|

|

May 28 2021, 05:39 PM May 28 2021, 05:39 PM

Return to original view | IPv6 | Post

#296

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

MNACT acquisition: https://links.sgx.com/1.0.0/corporate-annou...7ecf23f4bd0ae9f Hansel liked this post

|

|

|

Jun 1 2021, 08:06 AM Jun 1 2021, 08:06 AM

Return to original view | IPv6 | Post

#297

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Ascott Residence's investment in Japan's rental housing properties: https://links.sgx.com/FileOpen/20210601_New...t&FileID=669671

|

|

|

Jun 3 2021, 09:05 AM Jun 3 2021, 09:05 AM

Return to original view | IPv6 | Post

#298

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(prophetjul @ Apr 28 2021, 01:32 PM) EGM notification: https://links.sgx.com/1.0.0/corporate-annou...e201be83d8ddece |

|

|

Jun 4 2021, 08:43 AM Jun 4 2021, 08:43 AM

Return to original view | IPv6 | Post

#299

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

It's official: a new UK REIT is coming from CDL.

https://links.sgx.com/FileOpen/CDL_Holding_...t&FileID=670136 This post has been edited by TOS: Jun 4 2021, 08:43 AM |

|

|

Jun 4 2021, 05:58 PM Jun 4 2021, 05:58 PM

Return to original view | IPv6 | Post

#300

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://links.sgx.com/FileOpen/Elite-Announ...t&FileID=670188

Elite Commercial's REIT listing in the UK. QUOTE(prophetjul @ Jun 4 2021, 09:02 AM) Some sponsors only care about management fees once they realized their holdings hahaThe 8 canada square tower looks ok to me. Need to look at their other UK assets in the portfolio. This post has been edited by TOS: Jun 4 2021, 05:58 PM |

| Change to: |  0.4008sec 0.4008sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 08:57 PM |