Ascott Residence: https://links.sgx.com/FileOpen/20210429_1Q%...t&FileID=663745

Singapore REITS, S-REITS

Singapore REITS, S-REITS

|

|

Apr 29 2021, 07:38 AM Apr 29 2021, 07:38 AM

Return to original view | Post

#261

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Ascott Residence: https://links.sgx.com/FileOpen/20210429_1Q%...t&FileID=663745

|

|

|

|

|

|

Apr 29 2021, 09:11 AM Apr 29 2021, 09:11 AM

Return to original view | Post

#262

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

CDL Hospitality: https://links.sgx.com/1.0.0/corporate-annou...ffc9e922daed190

|

|

|

Apr 29 2021, 08:35 PM Apr 29 2021, 08:35 PM

Return to original view | Post

#263

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Apr 30 2021, 07:48 AM Apr 30 2021, 07:48 AM

Return to original view | Post

#264

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Frasers Hospitality Trust: https://links.sgx.com/1.0.0/corporate-annou...dc043aba54edb14

|

|

|

May 4 2021, 07:54 PM May 4 2021, 07:54 PM

Return to original view | Post

#265

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

OUE Commercial: https://links.sgx.com/1.0.0/corporate-annou...9103595760a80da

SGX down for an hour or two, hence the delay. |

|

|

May 4 2021, 09:54 PM May 4 2021, 09:54 PM

Return to original view | Post

#266

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Ascendas REIT to buy the remaining 75% stake in Galaxis.

https://links.sgx.com/1.0.0/corporate-annou...6e7caa94b132bd5 Funded partially by a private placement: https://links.sgx.com/1.0.0/corporate-annou...6e96d67adea77d2 |

|

|

|

|

|

May 5 2021, 08:25 AM May 5 2021, 08:25 AM

Return to original view | Post

#267

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

AIMS APAC: https://links.sgx.com/1.0.0/corporate-annou...fc69a5dbb50c6ec Ascendas's private placement result: https://links.sgx.com/1.0.0/corporate-annou...db1f7ceb7a5eae0 ikanbilis and wongmunkeong liked this post

|

|

|

May 5 2021, 06:45 PM May 5 2021, 06:45 PM

Return to original view | Post

#268

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Since you guys love AIMS APAC: https://s3-ap-southeast-1.amazonaws.com/inv....pdf?1620207917

|

|

|

May 6 2021, 08:37 AM May 6 2021, 08:37 AM

Return to original view | Post

#269

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Ara US Hospitality: https://links.sgx.com/1.0.0/corporate-annou...e3f44c067319ef6 Fraser L&C: https://links.sgx.com/1.0.0/corporate-annou...dc0bc3a49026eba wongmunkeong and Hansel liked this post

|

|

|

May 7 2021, 08:24 AM May 7 2021, 08:24 AM

Return to original view | Post

#270

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

May 11 2021, 09:06 AM May 11 2021, 09:06 AM

Return to original view | Post

#271

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

May 11 2021, 05:52 PM May 11 2021, 05:52 PM

Return to original view | Post

#272

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

BHG: https://links.sgx.com/1.0.0/corporate-annou...630170bf0feec09 EC World: https://links.sgx.com/1.0.0/corporate-annou...34d55052cb990fb wongmunkeong liked this post

|

|

|

May 11 2021, 07:43 PM May 11 2021, 07:43 PM

Return to original view | Post

#273

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

May 11 2021, 10:07 PM May 11 2021, 10:07 PM

Return to original view | Post

#274

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Vector88 @ May 11 2021, 08:16 PM) Returns aside, are you aware of this: https://www.straitstimes.com/business/compa...ed-in-cad-probehttps://www.straitstimes.com/business/compa...g-cad-interview |

|

|

May 12 2021, 08:58 AM May 12 2021, 08:58 AM

Return to original view | IPv6 | Post

#275

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

May 12 2021, 09:02 AM May 12 2021, 09:02 AM

Return to original view | IPv6 | Post

#276

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hansel @ May 12 2021, 01:20 AM) No Revenue, no NPI and no Income Available for Distribution rdgs vs previous corresponding periods. All shown are only 'secondary' parameters,... CICT also did not show rental reversion data for the first time in their recent reporting. CMT used to show that every quarter, even though they do half-year reporting. |

|

|

May 12 2021, 07:37 PM May 12 2021, 07:37 PM

Return to original view | IPv6 | Post

#277

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

United Hampshire US: https://links.sgx.com/1.0.0/corporate-annou...ad7468e287662f1

|

|

|

May 12 2021, 08:15 PM May 12 2021, 08:15 PM

Return to original view | IPv6 | Post

#278

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

wongmunkeong liked this post

|

|

|

May 15 2021, 11:19 AM May 15 2021, 11:19 AM

Return to original view | IPv6 | Post

#279

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(garlicpesto @ May 15 2021, 06:15 AM) am an extremely new investor and am finally ready to invest after being a salarymen for awhile.. is it better to go with Syfe REITS 100% or Lion Phillips REITS on Tiger? Planning on quarterly top up when seen fit. One important thing to note is ETFs are a basket of REITs and they include big/small-caps, and all kinds of industries, all pre-set by the index providers. is it also safe to assume the latest restrictions may cause a dip in REITS, hence a good time to start? However, should you want a different exposure level (say no small caps at all, or the polar opposite, all in small caps), you need to buy individual REITs separately. Indices tend to give large-cap REITs more weightage than small-caps, which may not suit some investors' risk appetite. Some index providers have their own issues too: https://www.sinchew.com.my/content/content_2475450.html As for quarterly top-up, bear in mind of the fees involved if you do that frequently. Investors generally top-up during market sell-down/melt-down, rather than quarterly. It's fine to do quarterly top-up if you think the fees are low relative to your investment amount (expressed in %). Otherwise, accumulate in short-term liquid deposits, then go in all at once during bad times, might give you some alpha. As for latest restriction, this is certainly a good time. Lots of opportunities arise in large-cap space. As prohpetful said, retail and hospitality. I also noticed industrial ones suffered some hit too. Worth taking a look at these counters. I don't know much about small-caps though. This post has been edited by TOS: May 15 2021, 11:23 AM |

|

|

May 15 2021, 07:59 PM May 15 2021, 07:59 PM

Return to original view | IPv6 | Post

#280

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

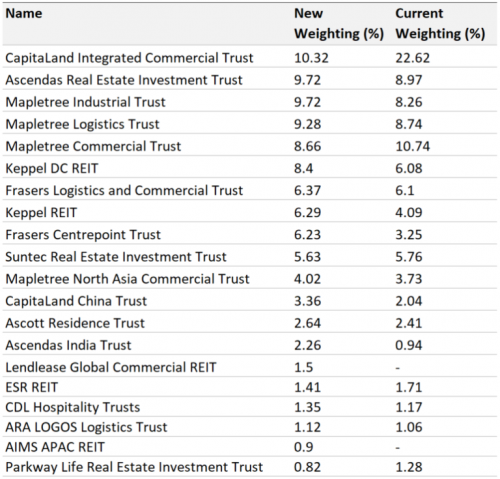

QUOTE(garlicpesto @ May 15 2021, 05:30 PM) Aww thank you! Most investment boards/reddits are not as welcoming to beginners with (silly) questions so I really appreciate that! Not silly at all. It's normal for beginners to ask. Totally fine. Well, even if prophetful is some sort of prophet, I don't think he can forecast share prices months later. Yikes I know people always say time in market is better than timing the market so... Based on the first CB, do you think this new restriction is priced in for now or will prices dip more in months due to inability to pay/inflation as mentioned? Since ive only have a small sum to start with ($20K), i've read many sites and reviews that Syfe (robo) actually has lower fees overall (0.65% PA) in comparison to individual REITS. Here's how their index looks like:  I tried studying REITs and wanted to cherry pick the best but I am fairly new to SG markets so was thinking of giving this a shot first. Unless you mind dropping some nuggets on a few thats worth looking into? Have a look at this: https://forum.lowyat.net/index.php?showtopi...&#entry99272404 For starters, might be of good help. (I presume you understand basic shares/stocks investment, otherwise you need something even simpler than the ones stated below) Before you cherry-pick, make sure you understand your appetite and some points to note: 1. Large-caps or small-caps or a mixed of them? If mixed, in what proportion? Heavy weight in large-caps or small-caps? 2. Which industry: Retail, Office, US Office, Industry, Integrated Developments, Data center, Hospitality, or even business trusts like Netlink NBN? 3. Get yourself familiarize with terms used in the industry often. This helps: https://www.reitsweek.com/reits-glossary 4. Ask here if you don't understand. Many members here will help. However, bear in mind everyone has different "appetite and risk profile", so one man's meat may be another's poison. |

| Change to: |  0.0437sec 0.0437sec

0.14 0.14

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 06:48 AM |