Singapore REITS, S-REITS

|

|

Nov 25 2015, 12:49 PM Nov 25 2015, 12:49 PM

|

Senior Member

2,679 posts Joined: Oct 2014 |

Can start changing sgd

|

|

|

|

|

|

Nov 25 2015, 02:06 PM Nov 25 2015, 02:06 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(elea88 @ Nov 25 2015, 11:34 AM) i am waiting for dividends to come it, then buy together.rm gaining - mainly due to downed russian jet-middle east tensions. oil price gained >5% in a week, good for oil exporting country currencies. question is will tensions escalate, fighting erupts or it will cool? plus, >70% fed will hike rates on dec 16. may be good chance to buy usd or sgd in the next week or two. This post has been edited by AVFAN: Nov 25 2015, 02:18 PM |

|

|

Nov 25 2015, 02:33 PM Nov 25 2015, 02:33 PM

|

Senior Member

3,109 posts Joined: Aug 2007 From: Malaysia > Singapore |

Erm ... look like this few month a lot REITS is back to below PE 10 yah.. good good... shall we see drop even further to PE 7... Cheers. Dividend punters

|

|

|

Nov 25 2015, 03:23 PM Nov 25 2015, 03:23 PM

Show posts by this member only | IPv6 | Post

#1964

|

Senior Member

808 posts Joined: Apr 2009 |

|

|

|

Nov 25 2015, 08:39 PM Nov 25 2015, 08:39 PM

|

Senior Member

2,679 posts Joined: Oct 2014 |

Reply from UOB Bank :

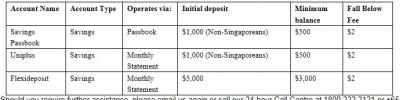

To open an account, the Bank would require customers to be physically present in Singapore as verification and sighting of documents are needed. Should you be coming to Singapore, please note that the following documents will be required for opening a personal savings account: • Passport; and • Other form of more permanent identification e.g. identification cards or social security passes etc. • Proof of residential address (such as the latest telephone/utilities bill or latest bank statement; all documents to be in English) • A Letter of Reference from a Bank whereby the customer is currently having an existing banking relationship with the Bank itself; Or • A Letter from an Introducer (the introducer must be our existing UOB Singapore account holder) Please note that the provision of the above documents does not automatically indicate that the Bank will accept the account opening for customer. The approval of the account opening is at the Bank’s sole discretion and the Bank reserves the right to reject the account opening without disclosing any reason. We have attached the following link with more information on the various deposit accounts offered by UOB: http://www.uob.com.sg/personal/deposits/index.html For your easy reference, we have also attached a table listing the mode of operation; initial deposit/minimum balance as well as fall below fee of the various accounts: Should you require further assistance, please email us again or call our 24-hour Call Centre at 1800 222 2121 or +65 6222 2121 (if you are calling from overseas). We will be glad to assist you. Thank you for choosing UOB, we are pleased to be of service to you. Attached thumbnail(s)

|

|

|

Nov 27 2015, 12:33 PM Nov 27 2015, 12:33 PM

|

Senior Member

4,258 posts Joined: Nov 2012 |

STI now 285x. Doing bottom fishing again. 27xx coming again ?

|

|

|

|

|

|

Nov 27 2015, 01:00 PM Nov 27 2015, 01:00 PM

|

Senior Member

2,679 posts Joined: Oct 2014 |

QUOTE(yck1987 @ Oct 6 2015, 11:38 PM) Anyone here using SCB Standchart Trading where is no minimum commision charges? Im just open a dash acc with them link with online trading acc. Sifu here can shed some light to me this newbie or give suggestion to buy some Reits? Yeah pls share some coz i m going to open with sc also nxt mth. Booked bus ticket to Sg.This post has been edited by prince_mk: Nov 28 2015, 12:38 PM |

|

|

Dec 1 2015, 08:33 PM Dec 1 2015, 08:33 PM

|

Senior Member

2,679 posts Joined: Oct 2014 |

As for a start, intend to buy Keppel Reit and Cache Logistic. But why the price dropped so much? Advisable to go in now as fed might increase rate.

This post has been edited by prince_mk: Dec 1 2015, 08:34 PM |

|

|

Dec 2 2015, 08:21 AM Dec 2 2015, 08:21 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Dec 2 2015, 08:35 AM Dec 2 2015, 08:35 AM

|

Senior Member

2,679 posts Joined: Oct 2014 |

|

|

|

Dec 2 2015, 11:52 AM Dec 2 2015, 11:52 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(prince_mk @ Dec 2 2015, 08:35 AM) those 3... err...!starhill is at best stable, have not appr for 2 yrs. likely suffering from weak aussie $. lippo - i cut loss, junked a year ago. first reit - was the brightest star but was killed recently when riardy alluded to it moving to jakarta. bad taste lingers. industrials not very promising at this time, but do look at aimsamp amd soilbuildbiz - been good to me. overall, i am confident of the largest cap retail/comm ones - suntec, capitamall, capitacomm - should bounce back strong when the fed story eases. |

|

|

Dec 2 2015, 01:46 PM Dec 2 2015, 01:46 PM

Show posts by this member only | IPv6 | Post

#1972

|

Senior Member

808 posts Joined: Apr 2009 |

QUOTE(AVFAN @ Dec 2 2015, 11:52 AM) those 3... err...! your capitalmall & comm up up up now starhill is at best stable, have not appr for 2 yrs. likely suffering from weak aussie $. lippo - i cut loss, junked a year ago. first reit - was the brightest star but was killed recently when riardy alluded to it moving to jakarta. bad taste lingers. industrials not very promising at this time, but do look at aimsamp amd soilbuildbiz - been good to me. overall, i am confident of the largest cap retail/comm ones - suntec, capitamall, capitacomm - should bounce back strong when the fed story eases. |

|

|

Dec 2 2015, 03:07 PM Dec 2 2015, 03:07 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

|

|

|

|

|

|

Dec 2 2015, 05:06 PM Dec 2 2015, 05:06 PM

|

Senior Member

2,679 posts Joined: Oct 2014 |

QUOTE(AVFAN @ Dec 2 2015, 11:52 AM) those 3... err...! Let me do some research tonight. Thanksstarhill is at best stable, have not appr for 2 yrs. likely suffering from weak aussie $. lippo - i cut loss, junked a year ago. first reit - was the brightest star but was killed recently when riardy alluded to it moving to jakarta. bad taste lingers. industrials not very promising at this time, but do look at aimsamp amd soilbuildbiz - been good to me. overall, i am confident of the largest cap retail/comm ones - suntec, capitamall, capitacomm - should bounce back strong when the fed story eases. This post has been edited by prince_mk: Dec 2 2015, 05:38 PM |

|

|

Dec 2 2015, 05:52 PM Dec 2 2015, 05:52 PM

|

Senior Member

9,361 posts Joined: Aug 2010 |

|

|

|

Dec 2 2015, 06:22 PM Dec 2 2015, 06:22 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

|

|

|

Dec 2 2015, 08:09 PM Dec 2 2015, 08:09 PM

|

Senior Member

645 posts Joined: Apr 2007 |

Anyone looking at china based reit/trusts, eg CRCT, now that rmb is accepted into imf?

|

|

|

Dec 3 2015, 02:54 AM Dec 3 2015, 02:54 AM

|

Junior Member

206 posts Joined: Nov 2005 |

Parkway life reit any good?

|

|

|

Dec 3 2015, 08:54 AM Dec 3 2015, 08:54 AM

|

Senior Member

4,174 posts Joined: Dec 2008 |

QUOTE(wjchay @ Dec 2 2015, 08:09 PM) For China, i have this.Mapletree Greater China Commercial Trust engages in the investment of various real estate properties for commercial purposes in the Greater China region. It invests in real estate properties for retail and/or office purposes, as well as other real estate-related assets. The company is based in Singapore. u can also check out JAPAN. Croesus RTrust |

|

|

Dec 3 2015, 09:32 AM Dec 3 2015, 09:32 AM

|

Senior Member

645 posts Joined: Apr 2007 |

QUOTE(elea88 @ Dec 3 2015, 09:54 AM) For China, i have this. Mapletree looks good - mixture of retail + offices. CRCT is 100 retail, if not mistaken.Mapletree Greater China Commercial Trust engages in the investment of various real estate properties for commercial purposes in the Greater China region. It invests in real estate properties for retail and/or office purposes, as well as other real estate-related assets. The company is based in Singapore. u can also check out JAPAN. Croesus RTrust I have got some Croesus, so far stable at 0.80. |

| Change to: |  0.0550sec 0.0550sec

0.67 0.67

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 10:00 AM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote