I bought IREIT at open as soon as I heard the news that CDL was taking up a 12% stake in it..

Singapore REITS, S-REITS

Singapore REITS, S-REITS

|

|

Apr 30 2019, 09:28 PM Apr 30 2019, 09:28 PM

Return to original view | Post

#121

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

I bought IREIT at open as soon as I heard the news that CDL was taking up a 12% stake in it..

|

|

|

|

|

|

May 1 2019, 11:38 PM May 1 2019, 11:38 PM

Return to original view | Post

#122

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

May 2 2019, 01:58 PM May 2 2019, 01:58 PM

Return to original view | Post

#123

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

May 2 2019, 10:56 PM May 2 2019, 10:56 PM

Return to original view | Post

#124

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(fairylord @ May 2 2019, 10:21 PM) Bro Hansel, arent the CEreit and Ireit = SReits? Or they are actually REITs of oversea assets just listed on SGX? If you don't accept that a REIT listed on the SGX is an SREIT.. then there is a very small SREIT universe because there are almost no pure SG REITs. Many of the blue chip REITs derive a large portion of their revenue from out of SG, and the pure-plays like Capitaland Commercial Trust are actively looking to acquire assets in Europe.To most of us, SREITs represent a grand buffet of international cuisine that is not available on any other stock exchange... This post has been edited by Havoc Knightmare: May 2 2019, 10:57 PM |

|

|

May 4 2019, 11:01 AM May 4 2019, 11:01 AM

Return to original view | Post

#125

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

May 4 2019, 10:31 PM May 4 2019, 10:31 PM

Return to original view | Post

#126

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

https://www.theedgesingapore.com/why-singap...t-reit-listings

The international buffet continues to grow in variety... |

|

|

|

|

|

May 5 2019, 03:13 PM May 5 2019, 03:13 PM

Return to original view | Post

#127

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Hansel @ May 5 2019, 01:33 PM) Bro,... you must pay attention to currency movements in order to invest into this Euro REIT. Euro is underperforming but this REIT is deep value. The tenancy contracts are likely at least 30-40% below market value now. Hence when the contracts are renewed in 2022 onwards, the DPU will be a lot higher. CDL is part of the SG arm of the Hong Leong/Quek family. They are quite savvy asset traders and probably spotted the deep value in this 'obscure' REIT.In simple terms, the announcement said the the business entities, HLIH and CSEPL has voting 'influence' (being deemed units) over 78,600,000 units or 12.4% of the total number of voting units of iREIT Global. |

|

|

May 5 2019, 03:29 PM May 5 2019, 03:29 PM

Return to original view | Post

#128

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

May 7 2019, 03:14 AM May 7 2019, 03:14 AM

Return to original view | Post

#129

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

May 7 2019, 12:14 PM May 7 2019, 12:14 PM

Return to original view | Post

#130

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

May 8 2019, 08:38 AM May 8 2019, 08:38 AM

Return to original view | Post

#131

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

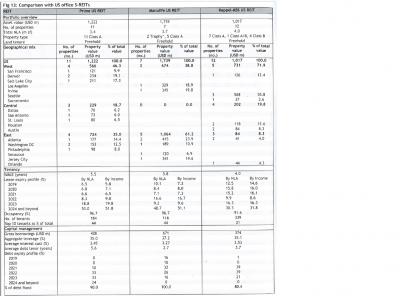

QUOTE(Hansel @ May 7 2019, 12:27 PM) Tq bro for the heads-up,.... How do you see the above REIT in comparison to :- 1) its sister REIT, Keppel-KBS US REIT ? 2) its competitor REIT, Manulife US REIT..... QUOTE(prophetjul @ May 7 2019, 01:30 PM)

You're welcome.. to answer bro Hansel's questions, I've attached the comparison from the report. It seems that this REIT holds better quality office assets than the other Keppel KBS REIT, hence the name Prime. Maybank feels that this REIT is closer to Manulife in terms of asset quality than its sister REIT. I have not done any research of my own into this REIT, so am just quoting Maybank. |

|

|

May 8 2019, 03:39 PM May 8 2019, 03:39 PM

Return to original view | Post

#132

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Ramjade @ May 8 2019, 09:38 AM) QUOTE(markedestiny @ May 8 2019, 02:29 PM) Maybe soon, after institutional investors start to take profit off the overvalued SREITs? Institutions are unlikely to sell unless bond yields rise. REITs trade as a hybrid of bonds/stocks and behave more like junk bonds.https://www.reitsweek.com/2019/05/instituti...rong-rally.html |

|

|

May 8 2019, 08:07 PM May 8 2019, 08:07 PM

Return to original view | Post

#133

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(markedestiny @ May 8 2019, 05:04 PM) Ok, maybe they have put on hold their plan to take profit given the sudden change of event on the US China trade talk. Institutional investors are more diverse in opinions and strategies than retail investors, it's not possible to treat them like a single bloc who move together... some are taking profit but there might be others who think it can move higher.This post has been edited by Havoc Knightmare: May 8 2019, 08:10 PM |

|

|

|

|

|

May 8 2019, 10:01 PM May 8 2019, 10:01 PM

Return to original view | Post

#134

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Hansel @ May 8 2019, 09:29 PM) ...tq bro Havoc for the infos,.. You're welcome. I agree with you on the industrial REIT bit. I've avoided all industrial REITs based in SG for a few years due to this factor. Over the last few years the industrial REITs have consistently been hit by defaults (the latest being Hyflux and CWT) and rising vacancy rates. The REITs themselves have varying quality, with those that have the most resilient DPU being most bond-like.It's hard to say what will happen,... when economy starts to be affected by the trade war, things slow down and industrial REITs will be the first to get hit. hence,.. ...from another angle, instos may choose to sell first. Whatever the reason, I will choose to stay invested. |

|

|

May 16 2019, 11:17 PM May 16 2019, 11:17 PM

Return to original view | Post

#135

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(Hansel @ May 16 2019, 09:30 PM) Bros,... not signalling anything, but just updating your guys,.... iREIT's 1Q19 results were released today... My guess is they saw the deep value in the REIT, since the rental contracts are likely far below market levels. German office rent has surged over the last few years while IREITs rental contracts were signed pre IPO in 2013 or 2014 if I'm not mistaken. That's one of the main reason why I'm very bullish on IREIT in the long run. My estimates based on looking at reports from real estate companies, that IREITs current tenants are paying 30-40% below market rates at the moment.1) DPU in Euro dropped by 1.1% vs the same qtr last year due to property maintenance expenses having been jacked-up by 30%. 2) DPU in SGD dropped even more by 2.7% due to weakening of the Euro vs SGD. 3) Mgr said the below :- “Looking ahead, weintend to continue to undertake various initiatives to upkeep the existing properties and retain its existing tenants. We will also seek further diversification and scale via acquisitions to strengthen IREIT’s portfolio, even if this may have some negative impact on distributions in the short term.” Hence, property maintenance expenses will continue to be high moving forward, and dpu may drop upon any acquisition done. Well,... yeah, they said 'in the short term'. Just curious : What was CDL's motives for acquiring such large stakes in the mgr and in the REIT here ? https://www.reuters.com/article/us-germany-...e-idUSKBN1JK055 This post has been edited by Havoc Knightmare: May 16 2019, 11:19 PM |

|

|

May 21 2019, 01:10 PM May 21 2019, 01:10 PM

Return to original view | IPv6 | Post

#136

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

On a somewhat related note, how do you guys track your portfolio performance? I'm using a heavily customized version derived from the Google Sheets portfolio tracker made by the SG blogger Investment Moats. Just curious if there are other systems that are available out there. Would be good to have back ups.

|

|

|

May 22 2019, 10:15 PM May 22 2019, 10:15 PM

Return to original view | Post

#137

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(simonhtz @ May 21 2019, 06:19 PM) Using yahoo finance now. I would like to use Kyith’s version of tracker. Is it hard to setup? It's not too hard, depending on how much customisation you want. For me, I've been able to track my portfolio returns daily, among other things. Since I have stocks across 3 different platforms, it's been a very good portfolio management tool. I've learnt a lot from these SG IT guys.I like his articles, he mentioned that he’s IT. Makes me wonder, sibeh free sia this fella. This post has been edited by Havoc Knightmare: May 22 2019, 10:17 PM |

|

|

Jun 11 2019, 12:55 PM Jun 11 2019, 12:55 PM

Return to original view | IPv6 | Post

#138

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(elea88 @ Jun 11 2019, 10:37 AM) https://www.straitstimes.com/business/compa...nd-retail-china It means the sponsor, Capitaland is injecting 3 new malls into CRCT. I haven't looked in depth into this, but the share price reaction could be due to anticipation of equity raising- rights issue for example.changing hands? i hv Capitaland retail.. means what huh? |

|

|

Jun 27 2019, 01:50 PM Jun 27 2019, 01:50 PM

Return to original view | IPv6 | Post

#139

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

Trying to steer the conversation back to SREITs.. third IPO of USD REIT this year is incoming. Hopefully demand is weak after Eagle though I am doubtful..

https://www.theedgesingapore.com/capital/ip...spectus-june-28 |

|

|

Jul 2 2019, 02:59 PM Jul 2 2019, 02:59 PM

Return to original view | IPv6 | Post

#140

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

The assets look decent but the price is too expensive. I would buy if prices fall enough so that it yields at least 7% excluding the income support. Seems like someone is holding the price up so that its artificially so expensive.

|

| Change to: |  0.4190sec 0.4190sec

0.76 0.76

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 06:19 AM |