QUOTE(bearbear @ Feb 2 2013, 03:41 PM)

Only advantage of closing OCBC SS i can think of is that if you do any withdrawal for it to be considered as 'new fund'

Same dilemma i will face when my 3 months 4% expire this month.

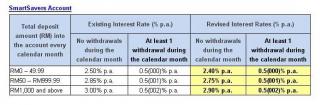

Say i have 10k in FD and 4k in SS (2k deposited during FD promo and 1k each month to maintain 2.9%)

Come maturity, i will need to withdraw the amount out from OCBC to other bank and transfer back again to be considered as 'fresh fund'

Example

1/2: withdrawal of 16k out from FD and SS to Banker's draft, bank in immediately to another bank

5/2: receive fund in another bank

6/2: Go back to OCBC to deposit the same money for the new FD combo for 3 months.

However, i am not entitled for 2.9% in my SS for the 1st month as i have made withdrawal?

Nice catch there by OCBC.

But by closing the SS and reopening the SS within few days, your account start off new and your 1st month SS interest will be 2.9% as in the record no withdrawal is made?

bro ronnie pls let me know how you deal with it.

The same branch sure wont allow you close the SS and reopen. Not sure can you do that in other branches. Let us know if you can because my FD will be matured on 5 Feb.

On your planned approach, your money in SS will be entitled to 0.5% interest only because you have withdrawn money in Feb.

Getting a banker cheque from matured FD costs you nothing but together with Money from SS will cost you RM2.15.

An alternative is opening FD in HL since the interest is almost the same except for the tenure period.

Going back to Ocbc means your SS account have to be untouched or you are willing to lose out 2.9% -0.5%=2.4% interest on your SS for Feb month only. For march and april you will enjoy 2.9% rate.

I was thinking of withdrawing from my SS account as the amount is growing bigger and bigger. As long as I can get better than 2.9% rate elsewhere, the interest loss is minimized.

No withdrawal from SS means the matured fund there is having 2.9% rate when you can possibly earn as high 3.9-4% elsewhere.

Withdrawal means you new portion of SS is getting a miserable amount of 0.5% for that particular month only. The average interest you get is 2.1% with RM1k deposit in each month.

If the amount in SS is huge it is worth just withdrew it and put it somewhere else.

For your case you can make the following calculation and compare.

Withdrawal from SS

16k - 10.7k in FD and 5.3k in SS.

Calculate the interest earn for FD and SS based on 1st month 0.5 and subsequent month 2.9%.

No withdrawal from SS

10k- 6.7k in FD and 3.3k in SS

Calculate the interest earn for FD and SS based on full rate. Added on previous 4k in SS.

Compare these two. Above is a rough estimate without taking into RM 1k deposit in march and april.

When the fund in SS is huge such as RM50k it may make sense to withdraw and deposit elsewhere.

This post has been edited by gsc: Feb 3 2013, 10:50 PM

Feb 1 2013, 10:58 PM

Feb 1 2013, 10:58 PM

Quote

Quote

0.0331sec

0.0331sec

0.24

0.24

6 queries

6 queries

GZIP Disabled

GZIP Disabled