QUOTE(yklooi @ Aug 13 2020, 03:42 PM)

thanks for highlighting this plan.....

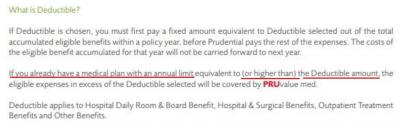

looking at the attached image, as per the illustration scenario....

looks like a good idea.

just asking, since you have 225k lifetime limit, why you want to buy 20k deductible?...why not start from perhaps RM100k (maybe that is much cheaper too)

any idea the age limit one can buy? does your parent age be a concern?

image from

https://www.prudential.com.my/export/sites/...nhanced_Eng.pdf

I bought it when he was 49, i think the entry age is 45 - 70, premium is only RM1587 annually, expiry age 80.. looking at the attached image, as per the illustration scenario....

looks like a good idea.

just asking, since you have 225k lifetime limit, why you want to buy 20k deductible?...why not start from perhaps RM100k (maybe that is much cheaper too)

any idea the age limit one can buy? does your parent age be a concern?

image from

https://www.prudential.com.my/export/sites/...nhanced_Eng.pdf

the drawback is i have to fork out the first 6k whenever something happen, unless it is outpatient then i only have to pay 10% of the total cost.

another is the low lifetime limit (225k).

but good thing is it is cheaper and it does the job to offset the risk that i have to fork out large sum of money, my budget was very limited back then

The way i see it is how many time i can claim the insurance, if 100k, then 225/100 then i assume he can only get major sick 2 times in his life.

for 50k, then 225/50, 4 times, imo it is very few consider we still have 20+ years until he reach 80, and 50k is quite large amount for me if the 225k runs out.

hence i think 20k makes the most sense to me, just that i am not sure whether it can be utilized this way or i have to finish the lifetime limit of the first one first before i can use the second one.

This post has been edited by likitsaelee: Aug 13 2020, 04:02 PM

Aug 13 2020, 03:55 PM

Aug 13 2020, 03:55 PM

Quote

Quote

0.0230sec

0.0230sec

1.08

1.08

6 queries

6 queries

GZIP Disabled

GZIP Disabled