QUOTE(roystevenung @ Mar 6 2021, 06:57 PM)

Alright thanks for confirming. I have asked my agent, still awaiting his reply.All about PRUDENTIAL & insurance updates!, any insurance related issue are welcome

All about PRUDENTIAL & insurance updates!, any insurance related issue are welcome

|

|

Mar 6 2021, 06:59 PM Mar 6 2021, 06:59 PM

Show posts by this member only | IPv6 | Post

#1021

|

All Stars

26,525 posts Joined: Jan 2003 |

|

|

|

|

|

|

Mar 7 2021, 08:03 PM Mar 7 2021, 08:03 PM

Show posts by this member only | IPv6 | Post

#1022

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(Human Nature @ Mar 6 2021, 06:59 PM) You may also login to Prudential Customer Portal PruAccess Plus to view details of the policy Human Nature liked this post

|

|

|

Mar 7 2021, 08:03 PM Mar 7 2021, 08:03 PM

|

All Stars

26,525 posts Joined: Jan 2003 |

QUOTE(roystevenung @ Mar 7 2021, 08:03 PM) Thanks. That's how I downloaded the statements |

|

|

Mar 18 2021, 08:14 AM Mar 18 2021, 08:14 AM

|

Junior Member

313 posts Joined: Sep 2007 |

Need some advise,

Was chatting with a close friend who is using Prudential. He took this PruSave Assurance With Profit plan back in 2003. His agent is also not with him and Mia. I told him this does not look like a medical plan and it does not have details like my insurance, eg medical cards child care etc. Basically I told him to call Prudential Customer care but I would like a general opinion before Prudential assigns another agent and messes his existing plan for some quick commission. I helped him log into the online portal and luckily it's still active. He has been paying around rm175 since 2003 and his sum assured is send 60k. His surrender value is arnd 39k. Few question for Prudential; 1. When it matures will he get his surrender value + sum assured or just sum assured or what is the calculation for this PruSave? 2. He is 42yrs old with high blood pressure. Can he upgrade his current Prudential Package to something that supports his future medical benefits or just attempt for a new medical insurance and leave his PruSave alone ? I have my insurance agent who is great but he does not know Prudential. Any fair advise will be appreciated. |

|

|

Mar 18 2021, 09:00 AM Mar 18 2021, 09:00 AM

Show posts by this member only | IPv6 | Post

#1025

|

All Stars

14,871 posts Joined: Mar 2015 |

Take medications to control the blood pressure, then the blood pressure readings would look nice thus no issue with the insurance plan application or need to pay extra loading.

|

|

|

Mar 18 2021, 10:07 AM Mar 18 2021, 10:07 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

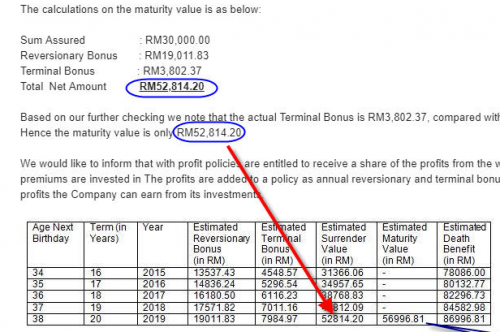

QUOTE(xbotzz @ Mar 18 2021, 08:14 AM) Need some advise, 1. Based on some information gathered, the policy is an endowment plan. Was chatting with a close friend who is using Prudential. He took this PruSave Assurance With Profit plan back in 2003. His agent is also not with him and Mia. I told him this does not look like a medical plan and it does not have details like my insurance, eg medical cards child care etc. Basically I told him to call Prudential Customer care but I would like a general opinion before Prudential assigns another agent and messes his existing plan for some quick commission. I helped him log into the online portal and luckily it's still active. He has been paying around rm175 since 2003 and his sum assured is send 60k. His surrender value is arnd 39k. Few question for Prudential; 1. When it matures will he get his surrender value + sum assured or just sum assured or what is the calculation for this PruSave? 2. He is 42yrs old with high blood pressure. Can he upgrade his current Prudential Package to something that supports his future medical benefits or just attempt for a new medical insurance and leave his PruSave alone ? I have my insurance agent who is great but he does not know Prudential. Any fair advise will be appreciated. Here's a snippet of the calculation (you may get your friend's policy to find out the amount or email Prudential for the details)  2. Depends on how well the BP is controlled. There is nothing much to upgrade on an endowment plan and you might want to check if the plan has a maturity date. If he is looking for a medical plan, it's best he starts applying a new plan. This post has been edited by lifebalance: Mar 18 2021, 10:55 AM xbotzz liked this post

|

|

|

|

|

|

Mar 18 2021, 10:29 AM Mar 18 2021, 10:29 AM

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(xbotzz @ Mar 18 2021, 08:14 AM) Need some advise, Your friend may either email or call the Prudential Customer Service to know in more details of his PruSave coverage as PruSave is able to attach various riders to the policy, including Critical Illness/Accident Coverage/Hospital Income etc.Was chatting with a close friend who is using Prudential. He took this PruSave Assurance With Profit plan back in 2003. His agent is also not with him and Mia. I told him this does not look like a medical plan and it does not have details like my insurance, eg medical cards child care etc. Basically I told him to call Prudential Customer care but I would like a general opinion before Prudential assigns another agent and messes his existing plan for some quick commission. I helped him log into the online portal and luckily it's still active. He has been paying around rm175 since 2003 and his sum assured is send 60k. His surrender value is arnd 39k. Few question for Prudential; 1. When it matures will he get his surrender value + sum assured or just sum assured or what is the calculation for this PruSave? 2. He is 42yrs old with high blood pressure. Can he upgrade his current Prudential Package to something that supports his future medical benefits or just attempt for a new medical insurance and leave his PruSave alone ? I have my insurance agent who is great but he does not know Prudential. Any fair advise will be appreciated. He has been paying since 2003 (RM2100 annually) x 18 years = RM37,800 and getting an estimated surrender value of RM39,000, no doubt it is only an increase of 3.x%, I would say he is already getting his insurance for free. Let us not forget the purpose of insurance that he is covered with a RM60K life/tpd insurance. ---- Upon the policy maturity date, the policy will be paid with an Estimated Maturity Value. The calculation for the Estimated Maturity Value is as per below:- Estimated Maturity Value = Sum Assured (RM60,000) + Reversionary Bonus (Not Guaranteed) + Terminal Bonus (Not Guaranteed) The Estimated Reversionary Bonus is declared yearly and is based on the profit sharing that the underlying life funds which the premiums are invested in. These profits are then added to the policy as an annual reversionary and terminal bonus. The Estimated Terminal Bonus is declared when the policy matures and is based on the profit sharing as mentioned above. Therefore if the policy were to mature on a bad performing year, the Estimated Terminal Bonus may get lesser. OTOH if it matures on a good performing year, it could also be higher than the projected terminal bonus. As in any investments past performance does not guarantee future returns. Therefore the Reversionary Bonus/Terminal Bonus may fluctuate. -- PruSave is an old policy which unable to be upgraded, therefore any add on has to be on the new policy. The medical underwriting will look at the following criteria for someone with a history of Hypertension 1. A person's age & gender 2. BMI 3. Whether the HBP is well controlled (with meds or other means) 4. Family history of HBP related illness (eg, heart attack, stroke, premature death related to illness) If all the above criteria is met, then the policy may be offered as a standard case (with no loading) otherwise expect a minimal loading to postponement / decline (if it not being controlled). xbotzz liked this post

|

|

|

Mar 18 2021, 10:38 AM Mar 18 2021, 10:38 AM

|

All Stars

26,525 posts Joined: Jan 2003 |

I received an SMS about signing up fir Covid19 Upgraded Plan Assistance & Post Vaccination Coverage with Pulse.

Is this free? Any drawback (hidden agenda) from signing up? |

|

|

Mar 18 2021, 11:00 AM Mar 18 2021, 11:00 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Human Nature @ Mar 18 2021, 10:38 AM) I received an SMS about signing up fir Covid19 Upgraded Plan Assistance & Post Vaccination Coverage with Pulse. Usual PDPA consent if you wish to sign up for it. https://www.prudential.com.my/en/privacy-policy/Is this free? Any drawback (hidden agenda) from signing up? |

|

|

Mar 18 2021, 11:00 AM Mar 18 2021, 11:00 AM

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(Human Nature @ Mar 18 2021, 10:38 AM) I received an SMS about signing up fir Covid19 Upgraded Plan Assistance & Post Vaccination Coverage with Pulse. It's free, but you need to agree to share your personal data with 3rd party Is this free? Any drawback (hidden agenda) from signing up? How the 3rd party use your info, for promotional / leads generation sorry I have no idea. Anyway, like Google/FB, it is already collecting information on your surfing patterns to generate leads to its advertisers. At least we ask for your permission rahtid liked this post

|

|

|

Mar 18 2021, 11:04 AM Mar 18 2021, 11:04 AM

|

All Stars

26,525 posts Joined: Jan 2003 |

QUOTE(lifebalance @ Mar 18 2021, 11:00 AM) QUOTE(roystevenung @ Mar 18 2021, 11:00 AM) It's free, but you need to agree to share your personal data with 3rd party Ah okay, thanks for the info. Do you sign up for it?How the 3rd party use your info, for promotional / leads generation sorry I have no idea. Anyway, like Google/FB, it is already collecting information on your surfing patterns to generate leads to its advertisers. At least we ask for your permission |

|

|

Mar 18 2021, 11:06 AM Mar 18 2021, 11:06 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Human Nature @ Mar 18 2021, 11:04 AM) Not for myself. Human Nature liked this post

|

|

|

Mar 18 2021, 11:27 AM Mar 18 2021, 11:27 AM

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

|

|

|

|

|

|

Mar 18 2021, 11:40 AM Mar 18 2021, 11:40 AM

|

All Stars

26,525 posts Joined: Jan 2003 |

|

|

|

Apr 5 2021, 08:56 PM Apr 5 2021, 08:56 PM

Show posts by this member only | IPv6 | Post

#1035

|

Senior Member

1,042 posts Joined: Feb 2011 |

Kawan kawan sekalian, I currently hold the old old prulink plan my medical coverage around 300k only. People kept saying low so ask me to upgrade but I worry by age70 need to pay rm1k per mth for insurance coverage

Wan to ask the cost of insurance stated at brochure if say per year at age 70 is 14k is it i need to pay when I buy at age70 or i buy now at age 70 also need 14k premium yearly? |

|

|

Apr 5 2021, 10:43 PM Apr 5 2021, 10:43 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(@Adele @ Apr 5 2021, 08:56 PM) Kawan kawan sekalian, I currently hold the old old prulink plan my medical coverage around 300k only. People kept saying low so ask me to upgrade but I worry by age70 need to pay rm1k per mth for insurance coverage if you start the investment link policy early, the initial quote will mention how long the premium that you're paying will sustain you until the age of 70, if there is a need to top up in the future to maintain its sustainability at age 70, the insurance company will send you a mail to inform you on this.Wan to ask the cost of insurance stated at brochure if say per year at age 70 is 14k is it i need to pay when I buy at age70 or i buy now at age 70 also need 14k premium yearly? For example, if you're age 35 now and you need to pay - say RM300 monthly to sustain your policy until the age 70, then your yearly premium will remain as RM3,600 annually until the age of 70 (unless as mentioned in the above that the insurance company ask you to do top-ups in between the next 35 years time frame should there be any repricing occur. That being said, the more riders / benefits that you would like to include will increase the premium payable, so instead of worrying whether to pay 1k monthly, you should instead get a plan that meet your current insurance need. This post has been edited by lifebalance: Apr 5 2021, 10:44 PM |

|

|

Apr 5 2021, 11:25 PM Apr 5 2021, 11:25 PM

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(@Adele @ Apr 5 2021, 08:56 PM) Kawan kawan sekalian, I currently hold the old old prulink plan my medical coverage around 300k only. People kept saying low so ask me to upgrade but I worry by age70 need to pay rm1k per mth for insurance coverage Correct me if I am wrong, the RM300K is referring to the Lifetime limit with an annual limit of Rm100K?Wan to ask the cost of insurance stated at brochure if say per year at age 70 is 14k is it i need to pay when I buy at age70 or i buy now at age 70 also need 14k premium yearly? It is definitely a genuine concern as to having to maintain high insurance charges as we grow older. The reason for a higher insurance charges at older age is that hospitalization at that age is generally more expensive as our parts have worn out, so to speak. Hopefully you are also made aware that a 30 days ICU at a private hospital for stroke/coma can also cost > RM120K For the medical insurance, what is stated in the brochure is also subject to change (for the higher) due to the medical inflation. Example, a 3 days 2 night fever admission at a private hospital that used to cost below RM1K, 15 years ago is now at least RM4k! Therefore we cannot expect the medical insurance charge to remain constant. -- Assuming that you had started the medical plan at age 50 with a premium of RM1.5K/pa and the insurance charge is at RM1.4k. This is sufficient to pay of the insurance charges for now. However at age 65, the insurance charges has since gone up to RM3.8k/pa. The variance of the insurance charges (you are still paying RM1.5k pa) will have to be paid from your accumulated cash values along the 15 years period. Once the cash value is unable to support the insurance charges, then you'll need to top up or risk having the policy lapse. There are also many external factors that causes the cash value to be insufficient and the policy unable to sustain until the end of the term. One of the most common issue is because people treat the available cash values as their savings. This, sadly is caused by agents conveniently forgetting to mention that as they grow older their insurance charges will go up. I have lost count of the number of times when a prospect ask me "Ada saving ke tak?" as they had been told that there is a savings element in the ILP. Naturally the back of people's mind, they treat it as savings and tend to withdraw when their finances are tight. They weren't informed that if you were to attached a medical plan, the insurance charges is subject to increase. They are only being sold Unlimited coverage, NO LIMIT BLA BLA BLA, see my XYZ company medical plan is BETTER THAN PRU. There is also external factors that is not taken into account when the insurer calculated the sustainability of the medical plan (projected cost of insurance vs projected cash values). For example, no one predicted Covid and US+EU vs China trade war. During the lockdown in Mar 2020, most funds went down 20%~25%. If your insurance charges were to increase during that time, your cash value would have gone down by 20~25%! One thing good about insurance funds is that no matter what happens people still keep paying their premium and most funds had recovered within 6 months, if not surpassed its original NAV before Covid. [Disclaimer] The above is my personal opinion and experience, if you need the exact detail, do consult your policy document/make a call to Prudential » Click to show Spoiler - click again to hide... « |

|

|

Apr 28 2021, 07:28 PM Apr 28 2021, 07:28 PM

|

Senior Member

2,115 posts Joined: Mar 2009 |

my lifelink policy is due on 1st may but i am not to make payment online, anyone know why?

i suspect my Policy is with Advance premium due date, what does this advance payment mean? it means i cannot pay before the due date? This post has been edited by jianwei90: Apr 28 2021, 07:30 PM |

|

|

Apr 28 2021, 07:40 PM Apr 28 2021, 07:40 PM

Show posts by this member only | IPv6 | Post

#1039

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(jianwei90 @ Apr 28 2021, 07:28 PM) my lifelink policy is due on 1st may but i am not to make payment online, anyone know why? Yes advance payment is not allowed if you use the Prudential online payment. You can use the portal to pay on the 2nd of every mth as the policy due date is always on the 1st of the mth.i suspect my Policy is with Advance premium due date, what does this advance payment mean? it means i cannot pay before the due date? If you still want to pay in advance, you may use bank online transfer to Prudential Assurance (M) Bhd or PruBSN Takaful Bhd (depending on your policy). Key in the policy no as the reference no. |

|

|

Apr 28 2021, 08:07 PM Apr 28 2021, 08:07 PM

|

Senior Member

2,115 posts Joined: Mar 2009 |

QUOTE(roystevenung @ Apr 28 2021, 07:40 PM) Yes advance payment is not allowed if you use the Prudential online payment. You can use the portal to pay on the 2nd of every mth as the policy due date is always on the 1st of the mth. as my policy due date is on 1st of May, if I were to pay on 2nd May, does it mean that there will penalty for late payment?If you still want to pay in advance, you may use bank online transfer to Prudential Assurance (M) Bhd or PruBSN Takaful Bhd (depending on your policy). Key in the policy no as the reference no. As checked in my previous payment record, i managed to pay through prudential online on 1st of every month, does it mean i can try paying on 1st may (due date as well)? Anyway, thanks for the information, appreciate it. |

| Change to: |  0.0300sec 0.0300sec

0.48 0.48

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 04:23 AM |