QUOTE(gurrenlagann @ Nov 4 2017, 02:10 PM)

I think the answer is here....https://www.fundsupermart.com.my/main/faq/1...me-PRS--8865#16

Private Retirement Fund, What the hell is that??

|

|

Nov 4 2017, 02:18 PM Nov 4 2017, 02:18 PM

Return to original view | Post

#181

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(gurrenlagann @ Nov 4 2017, 02:10 PM) I think the answer is here....https://www.fundsupermart.com.my/main/faq/1...me-PRS--8865#16 |

|

|

|

|

|

Nov 6 2017, 11:01 PM Nov 6 2017, 11:01 PM

Return to original view | Post

#182

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(silverwave @ Nov 6 2017, 10:46 PM) Hi, just wondering for the Rm3k PRS to get tax rebate, can the 1k given by government be included? It yes, i will just transfer Rm2k to the fund. do you mean the RM1000 from the Youth incentive scheme?if yes,....try read this.... https://www.fundsupermart.com.my/main/faq/1...me-PRS--8865#31 |

|

|

Dec 11 2017, 08:57 PM Dec 11 2017, 08:57 PM

Return to original view | Post

#183

|

Senior Member

5,143 posts Joined: Jan 2015 |

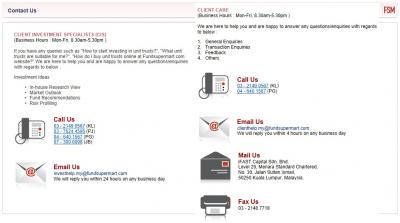

QUOTE(GunBlaDeR @ Dec 11 2017, 08:35 PM) if there is no response or if you cannot continue to wait for response and when you really need to know....can try contact them....my uneducated guess is NO top up for FSM does not have more of your details.... This post has been edited by T231H: Dec 11 2017, 08:58 PM Attached thumbnail(s)

|

|

|

Apr 4 2018, 01:05 AM Apr 4 2018, 01:05 AM

Return to original view | Post

#184

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(yfiona @ Apr 3 2018, 11:38 PM) did it mention about the max age to qualify?https://www.sc.com.my/home/special-incentiv...lief-incentive/ that is actually a good age....can buy funds at 0% SC and invest to get tax relief then can withdraw anytime with no penalty.... (maybe there is a minimum holding period for new investment......) This post has been edited by T231H: Apr 4 2018, 01:06 AM |

|

|

Apr 4 2018, 10:04 AM Apr 4 2018, 10:04 AM

Return to original view | Post

#185

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(xcxa23 @ Apr 4 2018, 09:58 AM) I'm a still confused about the prs thingy even after reading at ppa site This post has been edited by T231H: Apr 4 2018, 10:08 AMNow I already got acc with fsm for buying fund and from my understanding still nd to open prs account right? you need to open a PPA a/c before you can buy PRS fund Open thru fsm or ppa site? Anyone also can...currently if use PPA online to open the a/c....opening fees of 10.60 is free while with FSM it is not free And then buy prs fund thru fsm? Ppa? Fund hs? anyone also can, but i think PPA can only do top up on existing PRS fund not buy new fund As for the incentive, my understanding is invest 1k get back 1k for those under 30 age and it will credited to the prs account? Can I withdraw the incentive or reinvest the 1k? just hope this link to the PRS FAQs can provide you with the answers.. https://www.fundsupermart.com.my/main/faq/1...cheme-PRS--8865 |

|

|

Apr 23 2018, 05:25 PM Apr 23 2018, 05:25 PM

Return to original view | Post

#186

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(netroais @ Apr 23 2018, 05:09 PM) Hi, "CIMB Islamic PRS Plus Asia Pacific Ex Japan Equity - Class C".want to ask around other sifu. I open PRS account at FSM since April 2015 and select "CIMB Islamic PRS Plus Asia Pacific Ex Japan Equity - Class C". so for every month put in RM250 to get the 3k tax relief. My question why since 2015, I don't get any dividend credited to my account? at FSM historical view, I only can see buy in statement, No dividend for my PRS. Compare to my eastspring investment, I can see the dividend credited to my account. Anyone can answers this question? How to know the fund performance? It is so bad that no dividend for PRS fund I selected? according to the product highlight sheet.... this fund is not expected to pay any distribution https://www.fundsupermart.com.my/main/admin...ceMYCIPRS5C.pdf How to know the fund performance? see this.... https://www.fundsupermart.com.my/main/fundi...ass-C-MYCIPRS5C It is so bad that no dividend for PRS fund I selected? for UT funds (PRS fund is also UT)...dividend distribution make no impact to the value of your holding.... it is sort of Left hand out, right hand in |

|

|

|

|

|

Apr 30 2018, 10:07 AM Apr 30 2018, 10:07 AM

Return to original view | Post

#187

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(mephyll @ Apr 30 2018, 09:29 AM) Seriously i never acknowledge about this. can it be read as PPA submit the reports at end of June and December,??........thus April and Oct for it takes about 4 months to process??btw i found this: "Payment is made bi-annually after PPA submits their report, which is usually at the end of June and December." Source: <a href='http://<referral link removed>/my/lifestyle/rm1000-incentive-for-youths-who-contribute-to-prs-private-retirement-scheme' target='_blank'>http://<referral link removed>/my/lifestyle/rm1000-incent...tirement-scheme</a> not April but June? |

|

|

May 8 2018, 07:14 PM May 8 2018, 07:14 PM

Return to original view | Post

#188

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(l4nc3k @ May 8 2018, 07:08 PM) I just got my letter from PPA after opening an account. maybe this can helpsIs there any guide for purchasing PRS via FSM? I tried reading their guide but so confused on what form to fill and submit. My PRS fund is from CIMB if it helps. Thanks sifus How to Purchase PRS Funds Please find the steps below for the purchase of PRS funds. Fundsupermart.com (FSM) will process your transaction once you have done the steps below. https://www.fundsupermart.com.my/main/prs/prsForms.tpl |

|

|

May 8 2018, 07:55 PM May 8 2018, 07:55 PM

Return to original view | Post

#189

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(l4nc3k @ May 8 2018, 07:31 PM) For CIMB related, they require the Join Account Opening Form / Contribution Form. you already had PPA a/c number and had already bought a CIMB prs fund not thru FSM ....Where to find that? I applied for CIMB PRS through the PPA portal. now you wanted to buy CIMB PRS fund thru FSM? is ALL the above correct? .... the CIMB forms and related action are in the link given earlier... |

|

|

May 9 2018, 02:55 PM May 9 2018, 02:55 PM

Return to original view | Post

#190

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Sep 20 2018, 03:48 PM Sep 20 2018, 03:48 PM

Return to original view | Post

#191

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(mekboyz @ Sep 20 2018, 03:24 PM) I got CIMB PRS but i never login to it.. just used PPA unknown to what fund CIMB PRS fund you refered to....btw my value went down recently.. when will the dividend pay out? you can check out the fund's prospectus to see the stated Distribution policy..... example.....see image Attached thumbnail(s)

|

|

|

Sep 24 2018, 11:52 PM Sep 24 2018, 11:52 PM

Return to original view | Post

#192

|

Senior Member

5,143 posts Joined: Jan 2015 |

RM3000 Tax Relief

As announced in Budget 2012, an individual is eligible to have a Tax relief up to RM3,000 per annum. The individual tax relief is applicable on gross contribution, i.e. inclusive of upfront charges. For example, if an individual invested RM3,000 with a Provider and that Provider deducted RM10 for account opening fee, and RM50 for sales charge, the full RM3,000 is eligible for tax relief, and not RM2,940. Tax relief of up to RM3,000 per annum will be applied on taxable income, for individual contributions made to the PRS for the first 10 years from assessment year 2012. Individuals may claim their individual tax relief for the PRS under Section F-F18 of the BE Form, which can be located at the Lembaga Hasil Dalam Negeri Malaysia (LHDNM) website at www.hasil.gov.my Contribution statements to support the claim for tax relief may be obtained from the Provider as proof of investment made for the year of assessment. https://www.sc.com.my/home/special-incentiv...lief-incentive/ |

|

|

Sep 28 2018, 07:03 PM Sep 28 2018, 07:03 PM

Return to original view | Post

#193

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(super_tenere @ Sep 28 2018, 06:59 PM) hello guys try this?i'm pretty much blind in this since i work in private company, i ask my dad where i can save (other than ASB) he mention PRS so where do i start? https://www.ppa.my/ https://www.fundsupermart.com.my/main/prs/prsLandingPage.tpl https://www.publicmutual.com.my/prs/Home but do remember to check out the T&C on your invested money.... many people mentioned that your money (most of it) would be locked till retirement age......the other % of it can be taken out subjected to taxes..... OOPS....sorry, i think i have add a note: ....PRS funds is not to save money.........for you may lose part of it too.... Understanding Saving and Investing http://www.moneysense.gov.sg/Understanding...-Investing.aspx This post has been edited by T231H: Sep 28 2018, 07:24 PM |

|

|

|

|

|

Oct 5 2018, 05:32 PM Oct 5 2018, 05:32 PM

Return to original view | Post

#194

|

Senior Member

5,143 posts Joined: Jan 2015 |

What should I consider when choosing a PRS?

When making your PRS contribution, you need to take into account various factors such as your age, personal and household income, risk tolerance, retirement objectives as well as the suitability of the different funds under the various schemes to meet your retirement needs. Where can I obtain information about the funds available? How would I know which option would suit me best? You can decide to choose a PRS fund or not to choose a PRS fund and invest based on the default option where contributions are allocated to the core PRS funds based on your age. For further details on fund options, please refer to Structure of PRS page. Meanwhile for the list of available funds and PRS Providers, please refer to the PRS Providers & Schemes section. https://www.ppa.my/prs-and-you/prs-faq/ can try look into this ...... AFFIN HWANG PRS MODERATE FUND https://www.fundsupermart.com.my/main/admin...eetMYHPRSMF.pdf This post has been edited by T231H: Oct 5 2018, 05:35 PM |

|

|

Nov 25 2018, 06:59 PM Nov 25 2018, 06:59 PM

Return to original view | Post

#195

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(saintmikal @ Nov 25 2018, 06:21 PM) Time to move everything into the most conservative funds. Can anyone here advise which one is the most ultra conservative in which the exposure to equity is limited? Best is a fund that is 100% based on government guaranteed bonds. If i were to believes to your forecast....i would have gone into fixed deposit...at a 4.x% confirmed return....+ pidm protected.....Weather forecast - rainy season with a chance of typhoon... No need take the risk attached to the most conservative funds or even look for it. Just go to lyn fd threads.... |

|

|

Dec 2 2018, 06:17 AM Dec 2 2018, 06:17 AM

Return to original view | Post

#196

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(terrysoh @ Dec 2 2018, 01:48 AM) 1st time buyer here... I havent proceed yet cos still looking for information. just a note:Thankfully, low yat forumers as always are very helpful and willing to share information =) 1st time buyer needed longer processing time...for it needs addition time to cater for the opening of a PPA a/c first...before you can buy PRS funds. |

|

|

Dec 24 2018, 08:36 PM Dec 24 2018, 08:36 PM

Return to original view | Post

#197

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(wenqing @ Dec 24 2018, 08:16 PM) if I am not mistake....the PRS fund house would sent you a statement, the PPA will also sent you one too....in those statements,...your PPA a/c number would be displayed too Alternatively, you can download the statement as well as check your balance online via FSMOne. (under Update EPF/PRS information) the PPA number would be PPA(NRIC number) |

|

|

Jul 23 2019, 10:55 AM Jul 23 2019, 10:55 AM

Return to original view | Post

#198

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Jul 23 2019, 11:26 AM Jul 23 2019, 11:26 AM

Return to original view | Post

#199

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(-CoupeFanatic- @ Jul 23 2019, 11:01 AM) At the time of registering for an account, the sales person assured me that the quota has not been fully filled yet, still a bunch of quota left... Pethaps more constructive n effective is to check back with the sales person or ppa itself?Also, there is no announcement from PPA to let us know if it is fully subscribed. |

|

|

Nov 29 2019, 04:03 PM Nov 29 2019, 04:03 PM

Return to original view | IPv6 | Post

#200

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(gvr @ Nov 26 2019, 10:00 PM) Hi, I would like to understand more about this promo. Since you already has a PPA number, RM8 will be deducted by the fund House when you buy in.... FSM My has 0%sales chargeSo for existing PRS member, I would need to open an account in FSM assuming I do not have a account with them, and a RM8 fees will be deducted when I top up? |

| Change to: |  0.0280sec 0.0280sec

0.23 0.23

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 07:27 AM |