QUOTE(lengzhai @ Dec 11 2016, 12:26 AM)

It's quite complicated and long winded. This is awaiting reply/consideration from my adviser/or and the manager before I proceed further.

Long story short, the adviser should get my acknowledgement to top-up on top of my first contribution to make up the minimum requirement for opening OnePRS account.

I have some top-up via KIB bank account but somehow my adviser reluctant to top-up on my PRS, and asked me to open another account, which is Kenanga Growth Fund.

then I guess, it is not the person who managed the fund.....for usually, layman like me have not direct contact with the fund manager (person who managed the fund)Long story short, the adviser should get my acknowledgement to top-up on top of my first contribution to make up the minimum requirement for opening OnePRS account.

I have some top-up via KIB bank account but somehow my adviser reluctant to top-up on my PRS, and asked me to open another account, which is Kenanga Growth Fund.

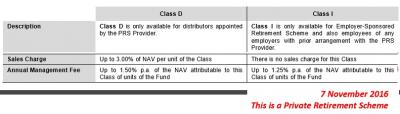

then I guess again, because your "adviser" would have a bigger commission (5.5%) from your purchase of Kenanga Growth fund.....if you buy that instead of 0% commission if you buy One PRS funds.

Dec 11 2016, 12:32 AM

Dec 11 2016, 12:32 AM

Quote

Quote

0.0287sec

0.0287sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled